Team-BHP

(

https://www.team-bhp.com/forum/)

How are battery manufacturers expected to perform given that, in 10 years of so the EV scene would be very different. Would Amararaja or Exide be a good investment now?

Quote:

Originally Posted by DudeWithaFiat

(Post 4303512)

How are battery manufacturers expected to perform given that, in 10 years of so the EV scene would be very different. Would Amararaja or Exide be a good investment now?

|

Short term (3 years) very positive because of growth in all automotive sectors plus developments in e-rickshaw scene. Also, a significant percentage of their revenues come from exports, Home UPS and telecom tower backup power supply. Amara Raja says they will double their revenue in 3 to 4 years

Amara Raja Batteries aims to be Rs 10,000-crore firm in 3 yrs http://www.moneycontrol.com/news/bus...s-2436355.html

Not sure about 10 or 20 year scene. Both Exide and Amara Raja talk about lithium ion / other EV battery storage technology in their annual reports. But they will not invest in manufacturing such batteries, unless asked by car manufacturers.

Come to think of it - I don't think Amara Raja or Exide has any advantage in manufacturing of Lithium ion batteries, over a new well funded startup. Or moneybags like Reliance Industries. Because lead acid battery tech and lithium ion battery tech is so different.

At lower prices, I will buy Exide & Amara Raja. No point worrying about 10 or 20 year future of companies. Stock markets look ahead, but not THAT ahead. :)

An exceptional thread, smartcat! I had zero information about stocks until a fortnight back and I'm quite a layman here. I've already started a practice account with Investopedia for some know-hows on the investing game. This thread has a vast amount of wisdom to take in from other fellow members too.

Since I'm a newbie to the whole game, someone might discern how dumb am I pertaining to the question I'm about to ask. But owing to the fact that I'm still in the learning phase, I deserve a pardon stupid:

During the process of share trading (either buying or selling), do we need to care more about the dividend that we get payed or the total return (profit/loss) when selling the share at a particular time.?

Hi Smartcat, can you evaluate this company? They are into automotive components, casting and established as an ancillary of Eicher and Volvo.

http://www.porwalauto.com/

Quote:

Originally Posted by E = mc˛

(Post 4305242)

During the process of share trading (either buying or selling), do we need to care more about the dividend that we get payed or the total return (profit/loss) when selling the share at a particular time.?

|

Preferably both - high dividend yield and good long term profit growth prospects (which will result in higher capital gains). Since I'm a conservative investor, of the two, I would prefer higher dividend yield. Aggressive investors prefer capital gains and do not care much about dividends.

So if there is a company that is growing at 30% per annum but not paying any dividend, I will NOT buy such a stock. As a corollary, if there is a company that is not growing much but available at a price that gives 4 or 5% dividend yield, I would rather buy that.

Primarily because I don't trust managements after Satyam, Worldcom, Enron scams. If there is company that says they have made Rs. 100 cr profit, how do you know it is true? All numbers can be faked. But if there is a company that says they have made Rs. 100 cr profit and is paying out Rs. 50 cr to shareholders as dividends, then yeah, you know those profit numbers are real.

Remember - profits can be faked, dividends cannot.

Quote:

Originally Posted by hrman

(Post 4305264)

Hi Smartcat, can you evaluate this company? They are into automotive components, casting and established as an ancillary of Eicher and Volvo. http://www.porwalauto.com/

|

I'm not sure what "established as an ancilliary of Eicher & Volvo" (as mentioned on the website) means. The promoters are different, so its likely that Eicher is just their client.

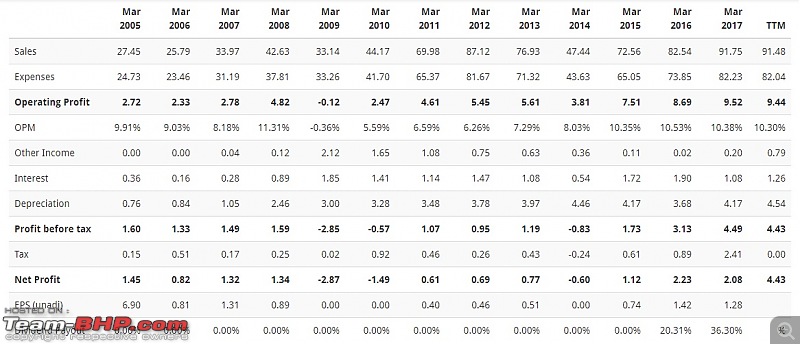

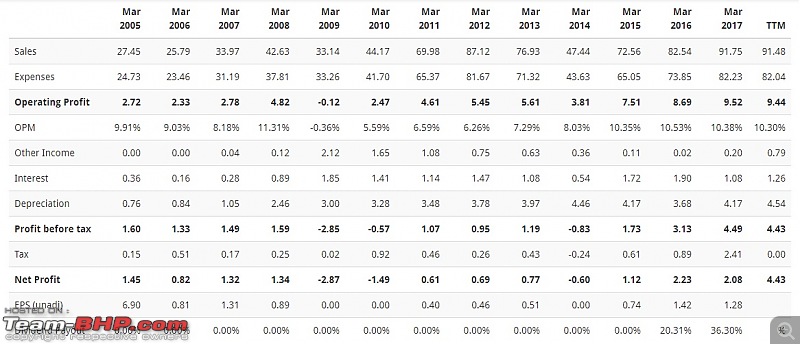

Let's look at their financial performance:

1) Sales & operating profit growing at 10% CAGR. Good!

2) FY09, FY10 & FY14 - they suffered losses. Red flag! Means the probability of Porwal Auto suffering badly during the next downturn is higher

3) They never paid any dividends till FY15. But in FY16 and FY17, they paid out 30% of their profits as dividends (look at the "dividend payout" row). This is an extremely good sign. That means the management is confident about the future of the company.

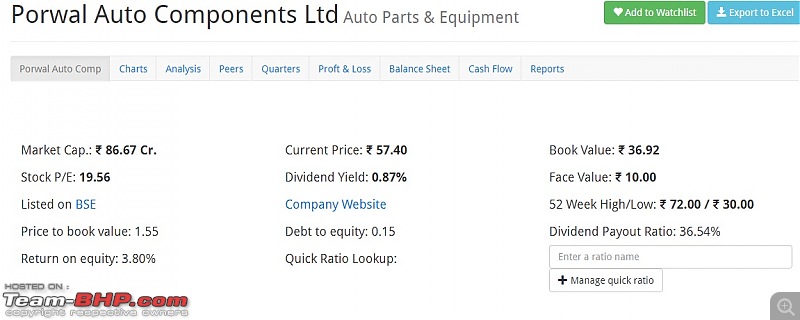

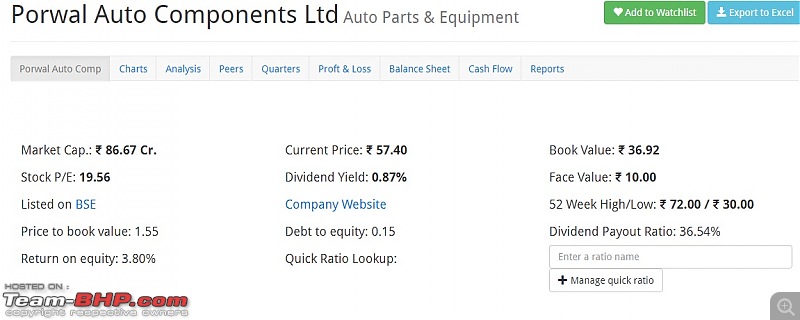

Let's now look at the stock's valuations:

1) Market cap of Porwal Auto Components is Rs. 86 cr. Such stocks are called MICROCAP STOCKS and can go up 10x times in 3 years or lose 90% of its value in one year.

2) PE of 19 and dividend yield of 0.9% means valuations are high. However, if profits double (and with micro caps, it is a possibility), then looking at current PE ratio/ dividend yield does not make sense. Use P/BV ratio for further analysis.

3) RoE is poor.

4) Debt to equity ratio of 0.15. Very good sign for a micro cap stock

5) Price to book value of 1.5 is Okay.

If you like this stock for some reason, buy at a price to book value of 1. That is, at 33% lower price. That will leave enough margin of safety. If you don't like to wait, buy 50% of what you originally wanted to - and buy more in bits if the stock falls.

Quote:

Originally Posted by smartcat

(Post 4305510)

I'm not sure what "established as an ancilliary of Eicher & Volvo" (as mentioned on the website) means. The promoters are different, so its likely that

|

Thanks smartcat for the thorough analysis. Will look at a small amount then and take a call as it grows

Quote:

Originally Posted by anandpadhye

(Post 4290585)

|

Quick update:

The Q2 results were good (as per expert opinions). The real GST benefits should start showing up Q3 onwards I think. Today Goodyear has suddenly jumped to 880.

Whoa - have you been watching Maruti? I think it's a great long-term stock.

Quote:

Originally Posted by GTO

(Post 4325769)

Whoa - have you been watching Maruti? I think it's a great long-term stock. Attachment 1708013

|

I am also watching Maruti from quiet a long time and it seems to be fantastic investment from long term perspective.Last 2 years it has grown from 4k to 10k --2.5 times. I cannot find any other stock with the same credentials.

Also Stock is overdue for a split and if it splits then price will grow exponentially.

Smartcat --your opinion please.:)

Hmm! 40 times earnings means Maruti stock is expensive now. But as I mentioned many times before, the right way to invest in such stocks is to 'accumulate' them over a period of time. That is - take some exposure now, and buy more if it falls.

Quote:

Originally Posted by vishal9999

(Post 4325790)

Also Stock is overdue for a split and if it splits then price will grow exponentially. Smartcat --your opinion please.

|

Um, no. Stocks splits and bonuses have a neutral effect on its future prices. Examples:

1) INFY is not doing much these days. Even if the stock is split or the management declares a bonus, the stock price won't move much in the future either - because INFY's business has slowed down

2) Let's say MARUTI does not split or offer bonus shares. But if it continues to show consistent growth and maintains 50% plus marketshare, the stock price will continue to go up.

Explaining visually, MARUTI stock before stock split:

MARUTI stock after stock split:

You won't get more pizza just because it has been cut into 4 pieces :)

^The consequence though, more people could "eat" a single slice, rather than a whole pizza. Isn't the point of a split to make the stock accessible to more buyers, which in turn could drive prices due to increased accessibility and demand?

Quote:

Originally Posted by ach1lles

(Post 4325848)

^The consequence though, more people could "eat" a single slice, rather than a whole pizza. Isn't the point of a split to make the stock accessible to more buyers, which in turn could drive prices due to increased accessibility and demand?

|

People who cannot afford to pay Rs. 10,000 to buy a stock do not have the ABILITY to influence prices. Remember this is a Rs. 300,000 crore value company. Average daily trading value of Maruti is Rs. 2,000 crores.

Small investors can influence micro-cap stocks (less than Rs. 100 cr market cap) though, but never NIFTY constituents.

I have Maruti shares bought way back at 800. I plan to sell off some shares now. I will keep some for future as I feel it will perform better.

Strange comparison between Maruti and Ferrari stock! :)

https://economictimes.indiatimes.com...w/62186244.cms

Key takeaways:

1) Maruti has the highest margins (11.6%) among global car makers

2) Maruti has the highest Return on Equity (22.2%) among global car makers

3) Maruti's PEG ratio of 1.52 (lower the better) means the stock is expensive. Ideally, PEG ratio should be 1 or lower. But global automotive stocks (except Chinese BYD/SAIC) have an even higher PEG ratio.

4) For some reason, Audi's margins (5.6%) are almost half that of BMW (9.9%) & Mercedes (8.2%)

PEG ratio is PE ratio (40 for Maruti) divided by Growth rate. Maruti having a PEG ratio of 1.6 means analysts expect Maruti to grow at 25% next year.

| All times are GMT +5.5. The time now is 04:34. | |