| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  37,576 views |

| | #46 | |||

| Distinguished - BHPian  Join Date: Aug 2014 Location: Delhi-NCR

Posts: 4,071

Thanked: 64,325 Times

| Re: My thoughts on the Budget 2018 Quote:

Quote:

Quote:

| |||

| |  ()

Thanks ()

Thanks

|

| |

| | #47 | |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,786 Times

| Re: My thoughts on the Budget 2018 Quote:

Or to restate as a percent of total income tax collected, 50% is from corporations, 37% from just 19 million salaried individuals employed by these corporations, and just 13% from a much higher population of businessmen/professionals - with the latter on an average arguably paying just about a tenth of the tax that their salaried counterparts pay per head. This would suggest that the crib is as much from TDS, as it is from seeing many more people that live among them and around them getting away with not paying their fair share of income tax. And there is the double whammy of seeing that what taxes they do pay, are not seen coming back to them as well built and reliable soft or hard infrastructure, or even where it does not come back to them but goes to the poor, knowing that even politicians admit that for every Rs 100 spent on support/poverty alleviation projects, only Rs 13 reaches the target population because of leakages. With other minor irritants about MPs and pay commissions voting ever higher salaries to these "servants" with no visible increase in their accountability, also in the mix. And if 17% is total of all taxes to GDP, it is certainly low. The question is - how is that to be increased? By even more sticks/stones? Via more direct taxes, to which although they may not be the targets, the salaried in the organised sector are the most vulnerable via TDS? Another demonetisation to bring business transactions that are hidden to light? GST? Or is it time to examine something more radical? And in parallel, what needs to be done to ensure that the higher ensuing collections are spent in a much more accountable, transparent and responsible way? I hope I will still be alive to see the day when this issue along with the other pressing issue of job creation in a way that the environment will sustain become the main subjects of a national dialogue instead of all else that dominates the various channels of dialogue today - that is the most I dare to hope for. Outcomes that follow will probably not come in my lifetime. The present young are the ones that need to drive the demand for this kind of dialogue to extract the desired outcomes from it. Discussions about the annual budget on the other hand are popular, but a distraction from what should be the main event. PS: I also suspect that even if it can be considered as one unified one, 19 million is small as national level vote banks go. Last edited by Sawyer : 4th February 2018 at 16:53. | |

| |  ()

Thanks ()

Thanks

|

| | #48 |

| BHPian Join Date: Mar 2007 Location: Hyderabad

Posts: 414

Thanked: 526 Times

| Re: My thoughts on the Budget 2018 As a salaried middle class person, i agree to a large extend to the points raised by Sawyer. Did I like this Budget? No, mainly as i did not see much benefit/relief for me. But I would not crib against the taxes I am paying. As a citizen of India, I am duty-bound to contribute toward the nation, and taxes is one important part. What I do crib about is the fact that a relatively small percentage of the people are contributing back to the nation via taxes. Every time I read news of corruption and money laundering, I feel betrayed. Why should the money i am paying from my hard work be lining the pockets of other people who may/may not be paying taxes. Even if i leave that aside, the basic fact that the govt cannot give sops/breaks to the income tax structure due to the small taxable base, should indicate that the tax base should be widened. How it needs to be done, i dont know. All I know is that as a law-abiding tax-paying citizen of India, frustration would creep in if there is only payment and more payment asked from us with not much visible/tangible improvement to the lives of us and our families. |

| |  ()

Thanks ()

Thanks

|

| | #49 | |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,786 Times

| Re: My thoughts on the Budget 2018 Quote:

As a salaryman for many years, I felt exactly the same as you do, without good data to back up my grudge. To be honest, even I had no idea till yesterday, when I was able to pull together the hard data that I have presented, about how much the data supports this grudge. I am shocked to myself realise that leaving aside corporations that aren't people as such, just 19 million salaried people in a country of 1400 million pay 75% of the income tax that the government collects from citizens. Working backwards using crude approximations from this population size of 1400 million, 19 million, out of a total number in excess of 200 million that must be having income that is taxable, are paying this 75%; the remaining 90% together are paying just about 25% of the income tax paid by all individuals. Very rough calculation, but anything more accurate isn't going to drastically change this picture of blatant inequity. Your situation looks more grim if you take political realities in the country into account. With the 19 million salaried fragmented as they are, as a vote bank in the elections to parliament, every political party can safely ignore this class, and - no surprises there - they have always done so. All that is done is paying lip service, as to a milk cow. Which is why my advice to the young would be to look for every possible opportunity to start their own business or profession and escape the jail that is TDS on salaries. As one automotive example, think of luxury car ownership, and how much easier it is to afford to buy one if it can be kept on the books of a business, as compared to buying one on a salary. And this, using only legitimate means of expensing out the costs in the calculation of taxable income. Last edited by Sawyer : 5th February 2018 at 16:10. | |

| |  ()

Thanks ()

Thanks

|

| | #50 | |

| BHPian Join Date: Feb 2010 Location: Blore

Posts: 265

Thanked: 639 Times

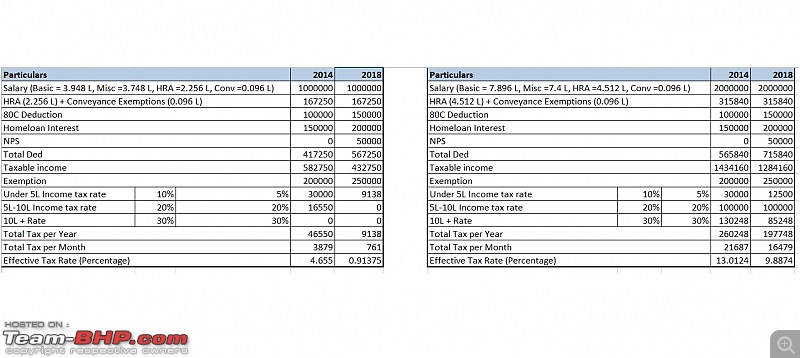

| Re: My thoughts on the Budget 2018 Quote:

Having worked in 6 countries across the globe, the lowest tax rates I have experienced is India and Singapore with paying 50% in Belgium the highest!: We would really be surprised as to how much we pay as income tax. Given below is an illustration of two salaried individuals at 10L and 20L annual salary (staying in a no-metro) and how much the tax has come down over the last 4 years. The effective tax rate is 1% for 10L and 10% for 20L!!  Last edited by JayKis : 6th February 2018 at 00:46. | |

| |  ()

Thanks ()

Thanks

|

| | #51 |

| BHPian Join Date: Sep 2010 Location: Chennai

Posts: 325

Thanked: 794 Times

| Re: My thoughts on the Budget 2018

Its like comparing apples to oranges. The Countries you are referring to have World Class Infrastructure , universal healthcare payed by Government and unemployment benefits. Most of Budget money goes into buying fancy cars for our Lutyens officials, paying for Judges holidays , Salary for Government officials and other mindless spending such as buying electric cars for Government officials. At end of the day I get zero benefits so why shouldn't I crib about it? I would be happy if our Government spends money on satisfying requirement of Armed Forces. Instead I see year after year Armed Forces are shortchanged whereas Politicians get automatic Salary raise. |

| |  ()

Thanks ()

Thanks

|

| | #52 |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,786 Times

| Re: My thoughts on the Budget 2018 The words "Paradigm Shift" come to mind, though these are now often used very casually for superficial changes. Here is one paradigm, that no one even realises these days, we are that used to it. If politics is public service, and politicians are servants - or to use the more popular word these days, sevaks - why are there over the top celebrations by the winner of every election in the country, with zero exceptions? Both by the winner who flashes victory signs vigorously and his followers who garland him profusely, distribute sweets, and re enact a Diwali with fire crackers. What exactly are they celebrating - being elected to being a servant?! Does no one see the blatant hypocrisy on show when they then claim to be sevaks? The shift of the paradigm from being as powerful a ruler as any rajah and maharajah in the past to being a genuine sevak will be easy to test in just the reactions to the result of an election. Doing things like removing beacons from cars is just superficial lip service; it does not fool anybody. Actually, our leaders have it even better than maharajas - when the latter were overthrown, they never got continuing Z category security or life long pensions. The lucky ones escaped with their lives. Related to this is why there is little hope for anything to change in India except at the speed of evolutionary change. Fixing India will take a slew of radical measures whose results will not happen in a visible way over the term of elected office and in many cases, things may even first get worse before the turnaround. With getting re-elected the prime motivator of every politician in the land, how can any relevant paradigm ever shift? Where is the motive for driving the shift? Even if elections are held as widely forecasted now by end 2018, regardless of the outcome, expect therefore the same ice cream in the budget that follows them. As the Americans say pithily - SSDD. Same *&^%, Different Day. |

| |  ()

Thanks ()

Thanks

|

| | #53 | |

| Senior - BHPian | Re: My thoughts on the Budget 2018 Quote:

The main grouse of the tax system, for me, is the lack of transparency and any visible changes. Its like modding your car to get a sub 10-second time, but despite pouring lakhs on the mods, you still see no improvement, on the other hand the reliability of the car has gone down. Its not like you are not willing to put in any money on the car, but just that it hasn't worked out. I had great faith in GST, but then, provided there would be relief on the income tax. A salaried person ends up paying double tax (Not cribbing here, just an observation) - just like the road tax we pay on ex-showroom. Technically, the road tax amount should be collected on the ex-factory price. | |

| |  ()

Thanks ()

Thanks

|

| | #54 | |

| BHPian Join Date: Aug 2017 Location: Bengaluru

Posts: 832

Thanked: 4,131 Times

| Re: My thoughts on the Budget 2018 Long term capital gain tax is worse than it looks It appears as 10% but in reality one may end up losing 30 or 40% Quote:

Last edited by Thermodynamics : 6th February 2018 at 10:19. Reason: add info | |

| |  ()

Thanks ()

Thanks

|

| | #55 | |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,786 Times

| Re: My thoughts on the Budget 2018 Quote:

This is similar to what the FM said today about reducing the corporate tax rate from 30% to 25%: he said he will do it once the exemptions in place today expire. He claims that this is what he said in 2015 as well, and if so, credit to him for consistency. But at both times, this is just playing around with numbers leaving corporates in the aggregate in the same place with respect to the total after tax income available in that sector to drive growth. Similarly, if the salaried are not to pay the tax they do just now, double or whatever, something else has to make up for it. Or the deficit has to increase. Last edited by Sawyer : 6th February 2018 at 10:47. | |

| |  ()

Thanks ()

Thanks

|

| | #56 | |

| BHPian Join Date: Feb 2010 Location: Pune, Bhopal, Indore

Posts: 350

Thanked: 685 Times

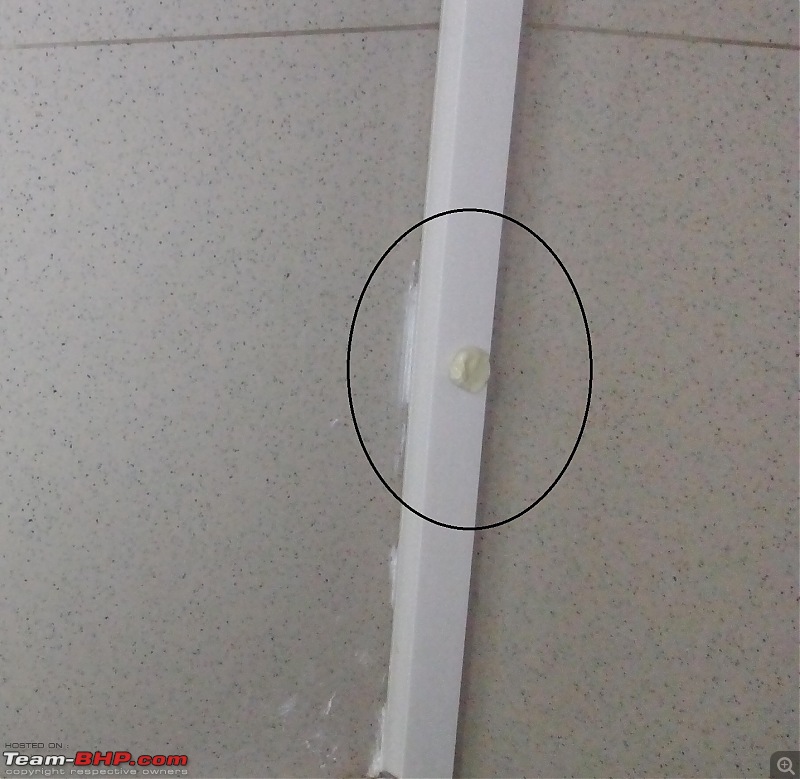

| Re: My thoughts on the Budget 2018 Quote:

Absolutely no offence meant to anyone who raised question on infrastructure, just wanted to quote someone who addressed infrastructure, hence the quoted post.  When we talk about world class infrastructure, the following pick is from a washroom of an office of a world class Software company in Pune; washroom is more than 99.9% used by so called educated class who are responsible for a significant share of the taxes that Government collects. This is the same group (not all) which crib for not having access to world class infrastructure even after promptly paying taxes. When we talk about world class infrastructure, the following pick is from a washroom of an office of a world class Software company in Pune; washroom is more than 99.9% used by so called educated class who are responsible for a significant share of the taxes that Government collects. This is the same group (not all) which crib for not having access to world class infrastructure even after promptly paying taxes.In the Pic the notice requests the user not to spit Gutkha or Chewing gum in the urinal. What my educated tax paying colleague did : stuck the remaining unwanted, leftover chewing gum on to the casing. He did not even have moral education throw this leftover, in a dust bin hardly 6-10 feet away. Even after notice planted right in front of the face, seeing Gutkha & Chewing gum in the urinal is a daily sight & probably after every cleaning that takes place at an interval of 2-3 Hours. Do we really thinks such class deserves a World class infrastructure? this is not applicable to all. We have probably compromised how any government handles us & have a belief that situation will not improve & have to live away with it. Had this not been the case, De-mon Drive would have been a super hit (almost everyone found a way to earn even during this) & so would have been the awareness drive for clean India. India is famous to find loop-holes in every policy or rules well before it is implemented. We will probably have to earn it, as few of us don't deserve it. Hence others suffer.   Last edited by saurabh2711 : 6th February 2018 at 16:14. | |

| |  ()

Thanks ()

Thanks

|

| |

| | #57 | |

| Senior - BHPian | Re: My thoughts on the Budget 2018 Quote:

1. For HRA exemption of that amount the person needs to rent a place for 40k per month at least (since you would need to deduct 10% of basic for HRA exemption). Hardly anyone having a 20L salary would do that. 2. You have shown Home Loan Interest as well. That means a person needs to buy a house in a different city to get that benefit else he wont. Also that would require a loan of 25-28L to take that benefit of 2L for the initial years. 3. For other areas also he needs to invest the money, like NPS, Remaining 80C etc. So at the end a person earning 20L, which I am sure you would agree is quite a lot in India, a person will be left with less than 60k in hand as disposable income. Add to this the amount for daily expenses, investments, etc. 20L doesn't seem that much then. I won't even go into the taxes imposed on them as well. The issue is not paying taxes. It's the return on them. I pay taxes to get service, service from the government. Do I get it, is the question. It's like Maruti doing a horrible service or no service and giving you back your car. When you complain, someone in a BMW tells you, "Oh come on, they have the lowest service cost, why are you cribbing? '  I don't understand why certain professions should be given exemptions. If they are earning they pay tax. If they are not doing well they will anyway be under the minimum threshold. Just because the politicians want to woo the larger chunk, we salaried taxpaying folks have to pay the brunt of it, since anyways we are the minorities at less than 3%. So don't think that the salaried folks are trying to jump on the free bus. It's just that it hurts seeing our hard earned money literally now going down the drain of 8 crore toilets. Last edited by Altocumulus : 6th February 2018 at 17:55. | |

| |  ()

Thanks ()

Thanks

|

| | #58 |

| Distinguished - BHPian  Join Date: Sep 2008 Location: --

Posts: 3,552

Thanked: 7,262 Times

| Re: My thoughts on the Budget 2018 Just a random hypothetical (impossible.. add more adjectives) thought, what if all tax paying citizens take a month's leave without pay? Will it make a difference enough for the Govt to seriously think about widening the tax base?  |

| |  ()

Thanks ()

Thanks

|

| | #59 | |

| BHPian Join Date: Aug 2009 Location: Bangalore

Posts: 169

Thanked: 797 Times

| Re: My thoughts on the Budget 2018 Quote:

That kind of stuff would shut down the economic activity to a stand still. | |

| |  ()

Thanks ()

Thanks

|

| | #60 |

| BHPian Join Date: Jun 2012 Location: Traveller

Posts: 149

Thanked: 285 Times

| Re: My thoughts on the Budget 2018 There are two different set of salaried taxpayers. One is pvt sector and the other are State and Center government employees. From my experience the HR at Pvt companies leave no stone unturned to avoid taxation to their employees. Heck the HR maze to avoid PF is a starting stone for any Pvt companies employees. So State and Center government employees do also form a huge chunk of direct tax base. |

| |  ()

Thanks ()

Thanks

|

|