| Re: My thoughts on the Budget 2018

Quote:

Originally Posted by JayKis

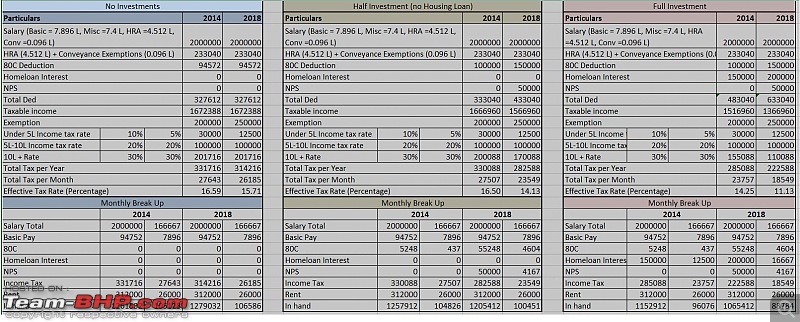

Please note the tax rates in all the scenarios,a light 10-16%

|

The numbers 10 and 16 may look like small numbers but they amount to a lot of money. What is the return that you get for paying for it ? What is the infrastructure, utilities, justice system, law and order, public transportation, safety, education etc you get for paying that ? Also the base here is 20L. The more salary, the percentage keeps on increasing because the investment deductions are limited to the amounts you mentioned.

Your location shows US and you mentioned you have been in different countries. I have had the opportunity to be in different countries as well. Can you see no difference in that or are government in these countries not human. Why does 3% people have to take the burden of 97% compared to 55% paying taxes in the US ?

Speaking of Belgium, you mentioned 50%, but you forgot to mention that is 50% after 48% (35+13) of you income goes into social security contributions for yourself. So that automatically brings down the tax percentage to 26% of your income based on your kind of calculations. Also upto 38080 Euros average tax is 37.5% of the amount which will bring the 26% down even further. Even if that brings down by 5% more, you will be paying 20-22% as tax. So are you saying by paying just 5-7% more I will get the same facilities as a Belgian Citizen would get in his country. I wish that was the situation, and I would have happy paid it.

In my opinion, I am paying 8-10 times more than what I should. After demonetization it was promised honest taxpayers to receive benefits. 2 budgets later effectively I will be paying even more thanks to the increase in cess. And as an automobile enthusiast, keep paying more for petrol. I pay huge amounts as roadtax. I pay toll, I pay GST, I pay necessary fees and then multiply the fees a few times more as bribe. So whatever I pay is anything but light.

Another way of looking at it is, average salary hike in India is 9% which is optimistic for quite a few. Inflation is at around 5%. If 30% plus cess of my 9% hike goes in Tax, effectively I am left with a hike of a little more than 1% in my earnings value. Very crude calculation, but it's the truth. Afterall companies do factor in inflation as a major component for hikes.

Last edited by Altocumulus : 7th February 2018 at 00:03.

|