Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by AWD

(Post 3074949)

Property Tax has been levied in some States, could the members from respective States state what's the quantum of tax imposed & what calculations are used ? How much Tax on residential properties & has it been imposed on vacant plots too ?

Also a larger question, what fundamentals is the Govt. using to impose such taxes, doesn't it make the residents a tenant in their own freehold properties ?

|

Property tax rules varies from state to state. You may need to

Google it or stay tuned to the media to get the latest updates.

Infact, the term tenant doesn't go well with freehold properties since it is usually used with leasehold properties. But as you may know every Indian citizen's real property belongs to Govt, in that case a resident is a tenant of Govt.

Quote:

Originally Posted by mithun

(Post 3075073)

Property tax rules varies from state to state.

But as you may know every Indian citizen's real property belongs to Govt, in that case a resident is a tenant of Govt.

|

I wanted to have an idea as to what criteria are followed while calculating Property Tax in various States. Like do they calculate on Plot size or Built up area, so on...

This Tax looks so much akin to what Muslim Invaders used to impose - "Jizya". How much of a right does the State have to impose such a Tax, can this be challenged in the Courts successfully ?

IMO atleast one Residential/self occupied Property should not be taxed. We make such a hue & cry when Fuel price rises < 1Re, but this tax over here would destabilize the budgets of many households.

Just now, I completed paying online the BBMP property tax for 2013-14 for my home and my daughters' vacant residential sites at Bangalore. Now, BBMP is asking for RR numbers of BESCOM and BWSSB and availability of borewell for the property. One cannot go to the payment page without providing these details. Additional cess is also levied for solid waste management based on area and category of the property.

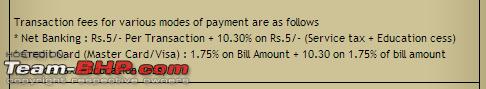

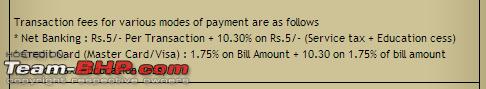

A few days back, I did the same for my Chennai home. Chennai Corporation levies additional charges for online payments!:Frustrati Everywhere, I get discount for online payments, but in Chennai, one has to pay more for online payments.

Quote:

Originally Posted by J.Ravi

(Post 3091662)

Just now, I completed paying online the BBMP property tax for 2013-14 for my home and my daughters' vacant residential sites at Bangalore. Now, BBMP is asking for RR numbers of BESCOM and BWSSB and availability of borewell for the property. One cannot go to the payment page without providing these details. Additional cess is also levied for solid waste management based on area and category of the property.

A few days back, I did the same for my Chennai home. Chennai Corporation levies additional charges for online payments!:Frustrati Everywhere, I get discount for online payments, but in Chennai, one has to pay more for online payments. Attachment 1072137

|

Same here. I am holding my decision to pay it online for chennai. :Frustrati

Btw, the RR number for BESCOM is onymandatory, BWSSB can be left null in case you do not have it.

Quote:

Originally Posted by J.Ravi

(Post 3091662)

Just now, I completed paying online the BBMP property tax for 2013-14

|

Hello J.Ravi, is there a 5 % rebate for payment before 30th April this year as well ? Otherwise I might pay up after enjoying my Goa vacation in May :)

Quote:

Originally Posted by mooza

(Post 3101523)

Hello J.Ravi, is there a 5 % rebate for payment before 30th April this year as well ?

|

Yes. Please pay the annual tax on or before 30 April 2013 to avail 5% rebate.

Quote:

Otherwise I might pay up after enjoying my Goa vacation in May :)

|

Since the election is round the corner, they may extend the last date for availing rebate to May end! But, don't take chance. :D

I bought a new apartment (direct from the builder) last year. I am confused about the khata transfer and property tax payments.

Which of these has to be done first? I have been running after an agent for months without results.

Team,

We don't have Completion certificate from PMC for our building. Builder still has not handed over the building to the soceity.

We are not receiving property tax receipts from PMC.

What should be the course of action ?

PUNE, MAHRASHTRA

Quote:

Originally Posted by F150

(Post 3101619)

We don't have Completion certificate from PMC for our building. Builder still has not handed over the building to the soceity.

We are not receiving property tax receipts from PMC.

|

By Completion certificate did you mean the Occupation Certificate (OC)? If so then its the builder who has to apply to PMC and obtain the OC and hand it over to you. Till the time OC is not generated for the building PMC would not start imposing the property tax. Till the time OC is not recd the builder is responsible for the paying any property related taxes.

As of now you cant do anything. You can try sourcing the info from the PMC town planning dept (if you have the right contacts) and get to know the status of the OC. BTW how old is the building and whether the building is already occupied?

Quote:

Originally Posted by ghodlur

(Post 3101902)

By Completion certificate did you mean the Occupation Certificate (OC)? If so then its the builder who has to apply to PMC and obtain the OC and hand it over to you. Till the time OC is not generated for the building PMC would not start imposing the property tax. Till the time OC is not recd the builder is responsible for the paying any property related taxes.

As of now you cant do anything. You can try sourcing the info from the PMC town planning dept (if you have the right contacts) and get to know the status of the OC. BTW how old is the building and whether the building is already occupied?

|

Completion certificate means PMC will certify that the building has been built as per the blue print and verify the stand norms have been adhered to and issues a certificate.

Builder issued us a OC but not from PMC.

The building is occupied since 2009.

Guess there's a way out if one does not possess the Completion certificate, I've heard that one can use the Electricity or Sewerage Bills. Find your old Elec, Sewerage Bills, Sewerage connections are usually given once construction is completed.

Quote:

Originally Posted by F150

(Post 3103917)

Completion certificate means PMC will certify that the building has been built as per the blue print and verify the stand norms have been adhered to and issues a certificate.

Builder issued us a OC but not from PMC.

|

Beg to differ here. Completion certificate is issued by Municipal authorities subject to matter you mentioned which is absolutely correct. Occupation certificate is not issued by the builder but by the Municipal authorities only subject to many criteria being fulfilled by the builder such as drainage provision, approach roads, regulatory reqmts such as solar system, rain water harvesting etc. I have attached the list of NOC which the builder is supposed to provide to the town development department who will finally issue the OC. If the builder is saying that he will provide the OC, it means that he will get it from municipal authorities and provide. Are you confusing the OC with the possession letter which is provided by the builder.

http://www.commonfloor.com/news/pmc-...tificates-6492 http://www.punecorporation.org/pmcwe...ERTIFICATE.pdf

I have been visiting local BBMP office from the past 5 days to pay the tax.

Yesterday only one person was available in the office and was busy with voter's list. Got an update from him that he will not accept the tax as the people concerned are busy with "Election duty" and maybe I should try the next day.

I went today and found all the rooms closed. Upon inquiring a person in BangaloreOne, which is located in same premises , told that all are on "Election duty"...:Frustrati

Quote:

Originally Posted by AltoLXI

(Post 3104862)

I have been visiting local BBMP office from the past 5 days to pay the tax.

|

Why are you visiting them, any problem with your khata?

Today I was reminded of the property tax. Just went to BBMP website, paid the tax in 10 minutes using credit card. Done.:thumbs up

PS: This is the 5th year I am paying online.

Quote:

Originally Posted by Samurai

(Post 3104922)

Why are you visiting them, any problem with your khata?

Today I was reminded of the property tax. Just went to BBMP website, paid the tax in 10 minutes using credit card. Done.:thumbs up

PS: This is the 5th year I am paying online.

|

+1. The most simple and hassle-free method of payment. You only require your 2008-2009 application number or PID number if already issued. No problems at all. I have been making my payment online for 3 years.

| All times are GMT +5.5. The time now is 19:46. | |