| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  23,463 views |

| | #1 |

| Newbie Join Date: Mar 2021 Location: lucknow

Posts: 14

Thanked: 36 Times

| Tyre add-on in car insurance, and putting claims for damaged tyres Hi everyone. I am not sure if this is the right section to post this query and mods can move it to the appropriate section. I have an ECOSPORT Titanium+ Edition. Brought it in 2017 December. They had 17 inch Ecopia (Bridgestone) tyres and I got them changed at the dealership after reading that those tyres were having burst problems. When the bulge started happening again in the tyre (s), I visited the dealership (service center)and I was told that the bulge is happening because of the way I drive and they would not replace the tyres. I told them, its under warranty, and they have to change. The service center then told me that they will replace the tyres but they will apply some forumula to arrive at the cost of the tyres and will charge me according to that formula when they replace the tyres. I said, please go ahead, and give me the invoices as well as the copy of that formula that you guys will be using to arrive at the price of the tyres. I will pursue this in consumer court. Well, the service center guys then called me inside and then changed all the tyres, free of cost. A month back, my car got into a minor accident and there was a large sized stone that did the damage to the Right side alloy+tyre as well as RTB. I have Zero Dep Insurance with Reliance, since Reliance has the garage of the dealership, listed as a cashless garage. I got the damage covered (its another long story, I had to complain to IRDA to get it done.). Now, the service center people are telling me that the tyre was damaged because of the accident. it has a bulge. Insurance does not covers it. So, it seems, I will have to pay for it out of my own pocket. Its okay. I have driven almost 50k Kms. The last time the tyres were changed when the ODO read around 42k. Since I got the tyres changed under warranty, i am seeing it as an expense that I would have had otherwise incurred too, once the tyres have had completed 50k. I see that the insurnace companies have a tyre add on too. Which covers the scenarios such as bulge in tyre, bursting of tyre and damage/cut to the tyre. I need advice on this. If anyone of you can shed some light on this, it will be quite helpful. I mean, the next time, I renew the insurance, should I also opt for this add on? Will Insurnace companies find a way to deny claims under this add on too ? |

| |  (8)

Thanks (8)

Thanks

|

| The following 8 BHPians Thank foadbear for this useful post: | chinmaypillay, hmansari, InControl, lemedico, Nitish B Shetty, Researcher, SuhairZain, whitewing |

| | #2 |

| Distinguished - BHPian  | re: Tyre add-on in car insurance, and putting claims for damaged tyres Rather than the insurance company, do check which brands are giving 5 year replacement warranty. I think there are a couple of tyre companies that are offering this, but I dont remember which ones. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank condor for this useful post: | chinmaypillay, foadbear, Researcher |

| | #3 |

| BHPian Join Date: Aug 2020 Location: Ranchi

Posts: 97

Thanked: 329 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres It is hard to understand the companies policies with regards to claiming under insurance or warranty. Having worked in both general insurance (motor vehicle claims) and dealership (after-sales), bulges on the sidewall of tires are usually declined due to many factors and among most commonly pronounced is due to improper inflation the damage has occurred. If there are any pictures of the damages on the vehicle which are claimed under the insurance will be helpful to determine why are they declining the tire. Attaching along are both the insurance and tire manufacturer policy wordings that specify any mishandling of the part is not covered. Only if there is any damage on the tire relevant to the accident we can pressurize the insurance company by escalating to top bosses may assist for at least contributing a portion of the cost. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank sameerpatel90 for this useful post: | foadbear, ike, ruzbehxyz |

| | #4 |

| BHPian Join Date: Jul 2012 Location: KL-08/Chennai

Posts: 879

Thanked: 2,086 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres

Is this true for cases where one has opted for a tyre protect add on at an additional cost? |

| |  ()

Thanks ()

Thanks

|

| | #5 |

| BHPian Join Date: May 2020 Location: Navsari-AMD

Posts: 94

Thanked: 523 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Dealerships normally charge higher for tires compared to getting them from outside (especially true for Germans), plus, there is always this risk of them not accepting the fault and blaming it onto the consumer. Tire damage is a once in while thing that does not get repeated often. Do check the cost of add-on tire cover and the difference in cost of getting it fitted at dealership. I will list my personal experience here. At an odo of 8k on my BMW X1, the rear left tire gave way on a regular pothole at 80 kph. Since it was covered by both BMW and insurance, asked them to replace it. BMW said it will bear 50% of the cost of tire (35k) and the labour charge of a "nominal" 20k would have to be borne by us. The same tire was procured from outside at 17k. Since decided to get them fitted outside at a reliable workshop, I do not know what happens to the NCB if insurance is claimed. I got 2 tires for a lesser sum, without the hassle. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank hridaygandhi for this useful post: | chinmaypillay, hmansari, Researcher, sgm |

| | #6 | ||||

| Newbie Join Date: Mar 2021 Location: lucknow

Posts: 14

Thanked: 36 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

Quote:

As for the insurance add on for the tyre part, I am thinking to take one. Accordong to Digit's policy wordings, "Accidental loss or damage to tyre and tubes which would in turn make the tyre unfit for use. This includes scenarios such as bulge in tyre, bursting of tyre and damage/cut to the tyre." exclusions , "Damage arising due to a manufacturing defect or service provided by an unauthorized service centre." https://www.godigit.com/motor-insura...-protect-cover Quote:

Quote:

I will keep your suggestion in mind. | ||||

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank foadbear for this useful post: | hmansari, hridaygandhi, Researcher |

| | #7 | |||

| BHPian Join Date: Aug 2020 Location: Ranchi

Posts: 97

Thanked: 329 Times

| Quote:

There are many factors which give an upper hand to the insurer. As a market practice it is understandable to delay the claim intimation post minor accidents occur. This is well known by all but at time certain cases as such or multiple damage or scratches it is definitely a hair scratching situation to both the claimant and loss assessor. In conclusion, insurance claims absolutely vary case to case and as a responsible insured we must be vigilant with our vehicles, it's documents and even previous history Both mechanical and body repair/replacements. Quote:

I would like to see some pictures (if you've taken) of the damage on the tire and wheel rim to better understand the scenario which you're undergoing. Quote:

Premium vehicles cannot be compared with mass segment vehicles as it is well said "we get, for what we pay". Big brands charge heftily and clients never question back with just an assumption of that the company will take care of them when an issue occurs. Having my ex-colleagues working in India as well as abroad in the same sector. There is a huge gap in the process of investigating an accidental claim in our country and abroad and it's the same with dealership operations and services too. In my opinion, we are still lacking a lot more from our automotive industry which is still far from reach. Last edited by Sheel : 16th April 2021 at 16:32. Reason: Please edit or multi quote your replies instead of back to back posts on the same page. Thanks. | |||

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank sameerpatel90 for this useful post: | GTO, hridaygandhi, neerajdan, Researcher |

| | #8 | |

| Newbie Join Date: Mar 2021 Location: lucknow

Posts: 14

Thanked: 36 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

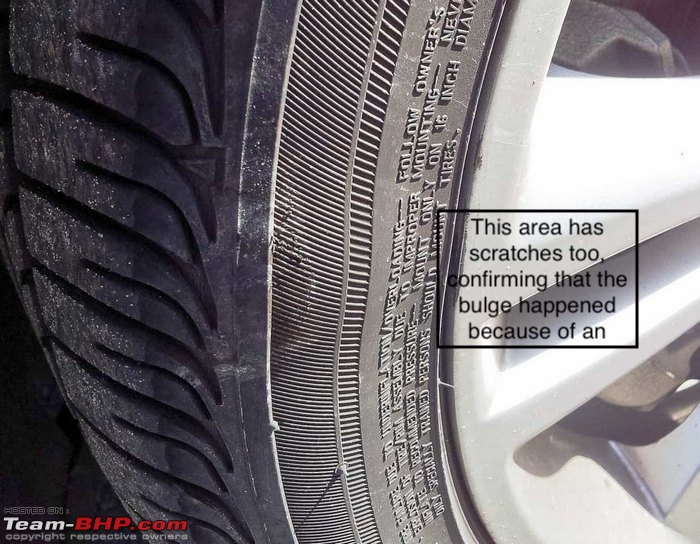

When I was talking about the damage to the tyre, the service center manager and the Insurance guy, were arguing among themselves. The Insurance guy said that its a manufacturing defect and the service guy said, it is not. It is a bulge that happened because of the accident. I left them both arguing. The body shop person told me that he will put the tyre under claim process too, but he was not too hopeful if he would get a claim for that. If I may, let me narrate the whole scenario. How I dealt with reliance on this. I was called by a surveyor when I took the car to the body shop and filed a claim. Now, the policy states that we have to file an intimation within 7 days of loss. however, in my case, it was around 21 days. I told the surveyor the reason for the delay is that the service center people took 4 days to assess the damage to the RTB. After that it was Holi and I was told by body shop manage to come after Holi. I felt I was being interrogated again and again by the surveyor for the reason of delay. I then filed a complaint with IRDAI about this. IRDAI has three circulars which state that no insurer can deny the claim if the reason is just delay in intimation. The surveyor assigned an investigator and when the person came to collect documents and I asked his ID card, he couldnt produce one. I had to let him go. With stern words, I asked him to leave and filed a complaint with IRDAI again. Also forwarded all the correspondence to Reliance General Insurance's top mangement. Well, the head of the team of investigation called me and told me to trust him and give my documents. I am telling all this because I had to go to some distance to get my work done in this case. Got a call from the CSM of Reliance and he assured me that approval has been sent. Now, I call the body shop, I am being told that the approval for tyre was not sent. Except that, approval for everything has been sent. Now, I have a query and it would be quite helpful if you can give me some pointers. You told me not to accept the insurer's approval and that I should escalate it to the management. I am attaching a picture, its not mine, i took it from the internet. But the bulge and the scratch , both are visible and in a straight line, confirming that the bulge happened because of the accident. I have the receipt of the tyre that was changed. My question is, can i pursue this after I have got my car back? I have two cars but I like the Ecosport better. (I have an i20 too). Or should I email them now and ask for the clarification? Thanks again for taking your time, I apreciate this.  | |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank foadbear for this useful post: | Nitish B Shetty, Researcher, sameerpatel90 |

| | #9 | |

| BHPian Join Date: Aug 2020 Location: Ranchi

Posts: 97

Thanked: 329 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

To be frank, in my experience as well as the general market practice such damage is not appreciated/admissible under an accidental claim. As the root cause of a bubble in a tire is due to under inflation and when it comes in contact with a pothole or a sharp/blunt edge object at good amount of speed the force exerted causes fracture in the inner lining structure of the tire. But, still I will try my best in assisting with your concern. Shall update ASAP. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks sameerpatel90 for this useful post: | GTO |

| | #10 | |

| Distinguished - BHPian  Join Date: Oct 2018 Location: COK\BLR\MYS

Posts: 3,900

Thanked: 11,327 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

There was this exasperated Mercedes owner who brought his car into the tire dealer and asking for a solution (will a different make of tire will help etc), it was not the money , the fellow was just fed up of having to replace tires so many times. I think it's bad design as well as customer negligence leading to such issues. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank Kosfactor for this useful post: | GTO, sameerpatel90 |

| | #11 | |

| BHPian Join Date: Aug 2020 Location: Ranchi

Posts: 97

Thanked: 329 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

1. Get an inspection report from the A.S.S and their feedback to the same. 2. Register a claim with tire manufacturer and post their inspection and feedback report. If, they say it is due to accidental damage (or) it is not a manufacturing defect. 3. Submit these evidences to the insurer and they'll be forced to be liable in approving the damaged part. 4. As mentioned by some staff of insurance co. ask them to prove that it is manufacturing defect and same came be claimed from manufacturer. 5. Last but not the least will be proceeding for legal battle against both of them (tire manufacturer & ins co.). 6. In my humble opinion, some sort of negotiation can be initiated under benefit of doubt and this depends on customers representation and surveyors interest of providing his/her bests services on behalf of the company. These are the only resorts available, which may eat up a lot of your time but, hope to see the results for sure. My sincere apologies if I had disappointed with my response. | |

| |  (14)

Thanks (14)

Thanks

|

| The following 14 BHPians Thank sameerpatel90 for this useful post: | Almoral, aniketvu, AZT, bugatti, foadbear, GTO, Holyghost, Kosfactor, neerajdan, Nitish B Shetty, One, TorqueAddict007, v1p3r, whitewing |

| |

| | #12 | |

| Newbie Join Date: Mar 2021 Location: lucknow

Posts: 14

Thanked: 36 Times

| re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

This is quite helpful. I have trouble with people who bully me and the insurance people were doing it so many times. You have been quite helpful, I am speechless. I will take it up with the persons involved. I just dont want these people to get away with it. Thanks again.  | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks foadbear for this useful post: | sameerpatel90 |

| | #13 | |

| BHPian Join Date: Nov 2020 Location: Hyderabad

Posts: 36

Thanked: 25 Times

| Re: Tyre add-on in car insurance, and putting claims for damaged tyres Quote:

| |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank Almoral for this useful post: | foadbear, sameerpatel90, v1p3r |

| | #14 |

| BHPian Join Date: Nov 2019 Location: Toronto

Posts: 693

Thanked: 2,662 Times

| Re: Tyre add-on in car insurance, and putting claims for damaged tyres |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank AZT for this useful post: | foadbear, sameerpatel90 |

| | #15 |

| Newbie Join Date: Mar 2021 Location: lucknow

Posts: 14

Thanked: 36 Times

| Re: Tyre add-on in car insurance, and putting claims for damaged tyres First of all, thanks a lot for giving your inputs. I am amazed at the level of participation. I asked insurance people the same thing, why was the tyre not compensated. I have, however, also complained to IRDA regarding this and sent Reliance Insurance a copy of this complaint, tagging the people higher up in their hierarchy. I received calls from the claim survey expert, and the same person, who was once rude to me, had his tone completely changed. He asked me if I had a problem with the settlement, and I told him about the tyre issue. He pleaded me, yes, pleaded is the word, to close the complaint. He told me that he is just an employee and I should think about him too. I wanted to pursue this further and told him that I would write an email that I am accepting the settlement under protest to Reliance General Insurance and then will file a complaint with IRDA again. However, he called me again a day later and pleaded again to close the case. He repeatedly told me to think about him and his job. I could not pursue it further. I closed the complaint and called it a day. If it were any other time, I would have pursued this. However, something inside me told me that If I kept following this, the claim survey expert might have to bear the backlash. Usually, it is a good thing. It didn't felt right in this case, though. I told the insurance company that it seems a case of not doing the survey correctly since a licensed surveyor has to be appointed if the damages are above Rs 50,000. The bill that was made in my case was around 49,700. I wrote to the insurance company that they should check it at their end. Failing to do this, I will complain to IRDA about a possible case of manipulating the cost of damages to my car to avoid getting it inspected by a licensed surveyor. It turns out, the person assigned to handle my claim was a claim survey expert and not a licensed surveyor. I decided not to pursue this since even if I were compensated, it would have been around 3-4k since tyres are paid for only 50% of the amount. I do think about this, if I did the right thing or not. I like to think I did the right thing. P.S. Received an infarction about poor grammar/spelling mistakes. Double checked this time. I hope all is well this time. |

| |  ()

Thanks ()

Thanks

|

|