News

Financing a car with residual value: How it works, pros & cons

Cars financed with straight amortization can be sold directly to a dealer or private person, where you take care of transfer of hypothecation. This isn't possible with residual value

BHPian supermax recently shared this with other enthusiasts.

Car financing works differently in different countries, and sometimes, one comes across less common terms while looking for deals. The concept of residual value is not uncommon in the world of car leasing, but I got to know that this is also applicable in some cases, with new car purchases.

When I was looking up the cost of purchasing a brand new Skoda, with financing, I realized that Skoda Sverige (Skoda Sweden) doesn't do straight amortization with their loans, but offers the ability to finance with residual value. I'm sure there are plenty of members on TBHP with a very good grasp about financial matters and they'd know everything about it already, but I thought that it might still be an interesting post for those who might not know about it.

Conventional hypothecation vs financing with residual value:

When one finances the purchase of a car under more conventional terms (also known as straight amortization), one puts down a certain percentage as the down-payment, and enters into a contract to pay off the full remaining value of the car in a series of installments, with additional clauses describing penalties if any, if the buyer wants to finish off the payments before the originally contracted end-date. A key point about this kind of financing is that even though the car is still under hypothecation, it's possible to sell the car to a new owner, as long as the new owner takes on the hypothecation, so it makes flipping a car easier; keep this in mind for now.

When one finances the purchase of a car with the residual value option (restvärde, in Swedish), one pays a down-payment exactly as in the case of a conventional hypothecation, but the remaining payments are not made to the full remaining value of the car, but a smaller sum, leaving behind a certain sum, known as restvärde or residual value.

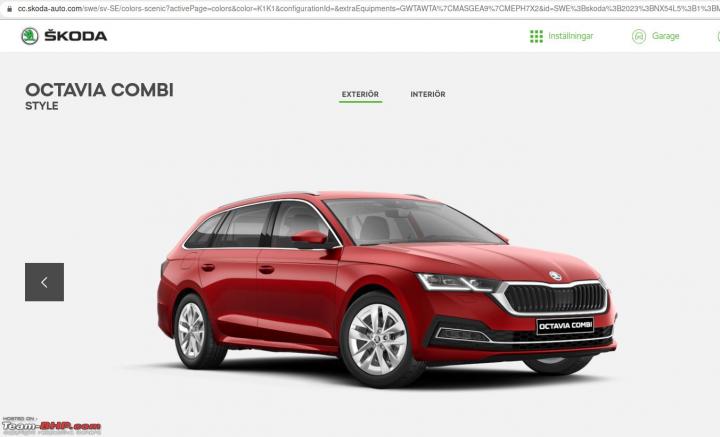

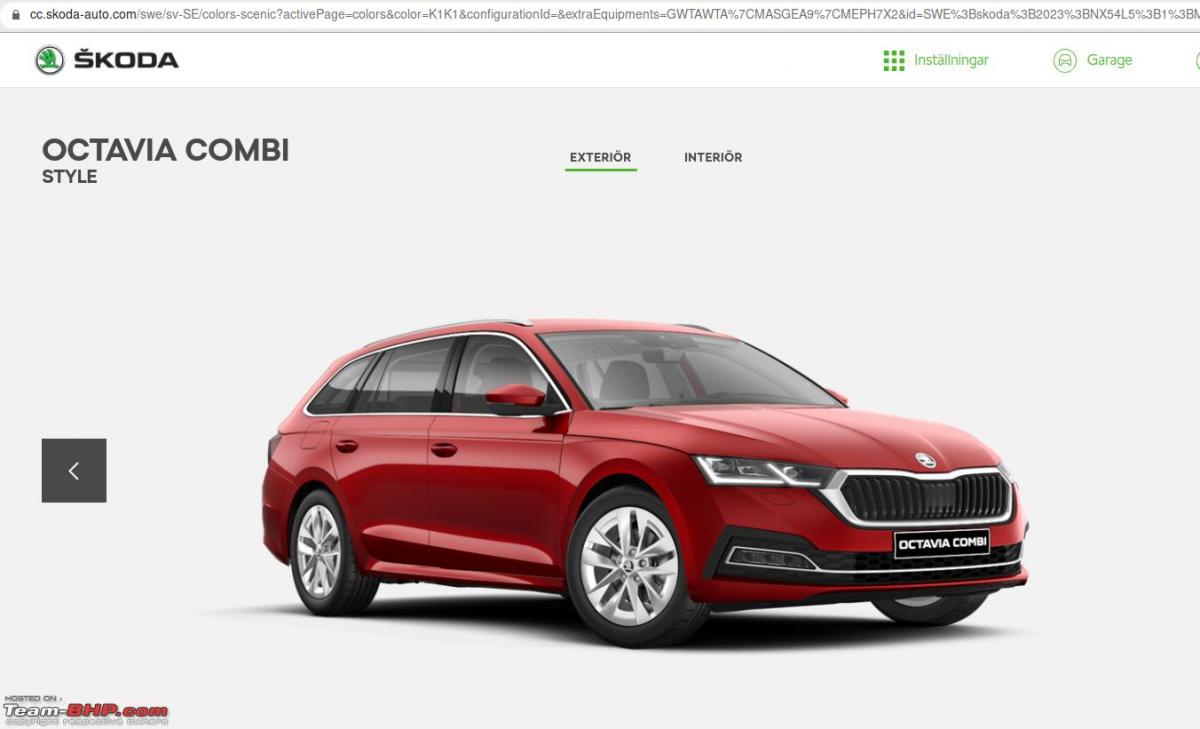

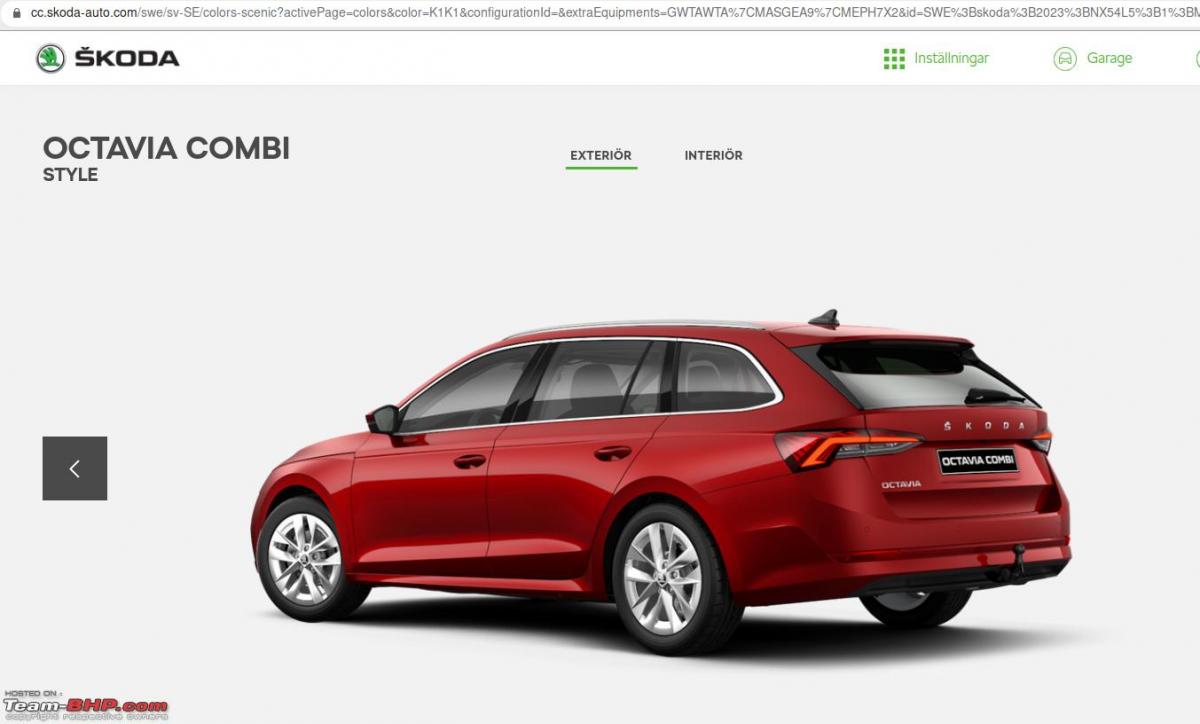

For instance, here's what it looks like, if I'd like to buy a brand new Skoda Octavia Combi, with a one liter turbo petrol engine and a manual transmission, with tow-hook, petrol-driven coupe-heater, velvet red metallic finish paint, and parking sensors front and back:

The full value of the car comes up to 358700 SEK (~28L INR), and when I agree to pay 20% as the down-payment (71740 SEK/5.6L INR), I'd only need to make 36 monthly payments of 3976 SEK (~31K INR), leaving a residual value of 50%.

What it means to have residual value:

Apart from the down-payment of 5.6L, I would have paid 36 installments of 36K INR, for a total sum paid of around 16.7 L INR. What are my options now?

There are three.

- Return the car to the dealership; a valuation of the car is made, and that value is compared with that of the remaining 50% value at time of contract start. If the current value is higher, i.e. your car was in a good condition, you can actually get the difference paid to you, or use it for part or full down-payment of your next car from Skoda; this latter option is the one Skoda would like, and the very reason behind them extending this option to you. If the car valuation came out poorly, you would have to make up the difference to the 50% sum.

- Pay the remaining sum, and own the car outright.

- Switch to a regular loan with straight amortization, to pay off the remaining (residual) value of the car.

Advantages of financing with residual value:

- First and probably the biggest advantage is that the monthly outflow is much lower than it would be, if you'd been paying for the full value of the car.

- The scheme works much like a lease, but is in principle closer to owning a car under hypothecation, as there are no strong clauses about mileage a car can do or the state it should be in, when the lease period expires.

- Works well if you'd like to be able to change cars within shorter intervals.

Disadvantages of financing with residual value:

- Cars financed with straight amortization can be sold directly to a dealer or private person, where you take care of transfer of hypothecation. This isn't possible with residual value, where you have to first close the contract and own the car outright, if you'd like to subsequently sell it. In other words, you cannot use the car itself to raise the money needed to pay off the loan.

- The remaining value which is calculated at the time of signing the contract may or may not correspond to the actual value of the car when the contract time ends; in a condition like now, where there's a huge demand for used cars, you might even fetch a premium, but if not, you'll have to make up for the difference yourself. This is basically to discourage the practice of flipping cars quickly for a profit in the used car market.

In conclusion:

Financing with residual value option provides greater flexibility than a lease, with respect to the condition of the car and the mileage it can do without attracting stiff penalties, but the onus is on the buyer to find the money for the down-payment, which is not needed for a lease. When compared with a regular hypothecation, this results in a much lower EMI, so people with limited spare cash at the end of each month would have it a lot easier, and still get to enjoy the use of a brand new car.