News

How I got Reliance Insurance to pay for engine seizures on my Volvo S60

Unfortunately, the insurance game in India is such that people feel lucky when their insurance claim is approved.

BHPian kmalhotra1901 recently shared this with other enthusiasts.

I am a practising Corporate lawyer in Delhi. I own a Volvo S60, D4 Kinetic. I bought my car second-hand in late 2021 with a running of 38,000 km and in well-maintained condition. I simply love the car.

I have been meaning to write this blog for long; like really long. Why you ask? Well, firstly, I am grateful to all fellow BHPians for their informative posts. I followed various posts here on car repairs and insurance-related grievances, and they were helpful in resolving mine. I hope by sharing my experience here, I might be helpful in solving someone else. Especially, the insurance-related issues I faced in my case were unique. My case essentially touched upon aspects of reopening accidental insurance claims with insurers, and insurer liability in case of aggravated loss post an accidental repair. Please bear with me for a long post coming up.

Chapter 1 – The innocuous accident of my S60

My story begins almost a year ago; on 08-July 2022. While on my way to work, my car met with an innocuous accident. If you live in Delhi, you will relate to omnipresent heaps of construction materials waylaid on the side-lines of roads. I went over a similar heap of construction debris.

Nevertheless, when I stopped and inspected, I noticed no major damage to the exteriors but noticed that some iron bars got lodged in the undercarriage of my car. However, unsuspecting of any major damage, I got into the car, and moved it slightly forward, to loosen the debris. The time was running against me as I had to make it to the office, so I chose to drive away without any further inspections.

My horror thereafter started. After driving for another 10-15 minutes, I noticed a “low oil pressure” indication on my car’s dashboard. The indication quickly escalated into a much more urgent “no oil pressure” warning.

The indication asked me to immediately pull over and stop the engine. Now here is something which is important to note in my story. At this moment, I did not know for how long the warning light was flashing. I just saw a “low oil pressure” warning quickly develop into a “no oil pressure” warning within a few seconds. Anyways, since my office was hardly a few hundred metres ahead, I decided to carry on and stop at my office, where I thought I will have more help and resources available.

Chapter 2 – What the hell happened?

The usual process, as with anyone, in such a situation is to look up the error messages on the internet. So did I. Immediately, to my layman's understanding, it was evident that something is amiss. I could understand that the warning indicates that the engine oil level is low. So, I called the authorized service centre of Volvo; Swede Auto, Gurugram. The service centre customer care informed me that the message is critical in nature and that I should leave my car as is where is. They recommended towing the car to the workshop for further inspection.

Since I had some important work to attend to during the day in my office, I did not tow the car right away. I resumed my office; but as it was late evening to get over with work, I came back the next day, which was a non-working Saturday. I called a towing truck to my office location, and while on my way to the office, I got hold of a local mechanic. I took him to my car and asked him to diagnose the problem. At first instance, he saw a pool of engine oil under the carriage, and on-going under the carriage pointed me towards a gaping hole in my undercarriage. By that time, it was clear that I had damaged the undercarriage. Nevertheless, as the towing vehicle was already at my office, with a heavy heart I towed my car to Swede Auto.

Chapter 3 – The first set of repairs

The workshop mechanics mounted my car for inspection. Upon hoisting onto a ramp, my initial fear was backed up with evidence of a major chamber burst.

Thereafter, the authorized service centre raised an insurance claim with the insurer, Reliance General Insurance, the same very day. The diagnosis was followed by a visit from the surveyor. The process of approval was smoother than expected, without any surprises. The repair estimate of around Rs. 1,00,000/- was sent to the insurer, and the claim was approved to initiate the repairs.

On the following day post approval, I called the Volvo technician handling my case, to understand the process of repair. He informed me that the damaged chamber will be replaced with a new one, some hot oil will be filled in the chamber, and the engine will be fired. On the same evening, I got a call from him, saying that the oil sump has been changed, and the engine has started successfully. He also told me that the car was driven for around 5 kilometres or so without any noticeable issues in the engine. However, by that time, I had read a few blogs on Team-BHP about engine seizure problems due to dry oil chamber run. Since my insurance policy had an additional engine protection cover, I suggested the technician test run as much as he could to be certain of no engine damage due to running the car without engine oil.

On the next day itself, I got a call from the technician saying that the car was test run for 30 kilometres with no issues. I was satisfied by their explanation; went over to the workshop and took delivery of the repaired car. The total bill settled was Rs. 97,796/- and I had to pay Rs. 5988/- only in salvage and file charges.

Chapter 4- The curious case of a humming engine

My story took a dramatic turn. On 24-Aug-22, after driving approx. 700 KM from taking delivery after repairs, all of a sudden, I noticed a humming noise emanating from the engine. On consulting the same Volvo technician who handled my case, I was explained that the noise could be due to fresh engine oil in the engine. Nevertheless, he also mentioned that since the car was performing normally, I can bring over the car whenever I am around their workshop. However, after running a few Kilometres only, the humming noise turned into high pitch rattles, which echo in my conscience to this very day. More than the trauma of your beloved car developing a major snag, the heavier part was to call the same towing company and dispatch my car again within a month.

Upon inspection, the Service manager at Swede Auto diagnosed some engine damage. The probable cause was the dry chamber run in the previous accident. The insurance company was immediately informed along with a request for reopening of the insurance claim for repairing the engine damage.

The insurance company was completely dismissive of the request. They did not get back to the request for 10 days or so. On inquiring with them, they started blaming some natural wear and tear as the source of the noise of the engine rattling. However, both the service centre and I spoke to them and insisted that they should at least agree to open the engine to identify the problem. I insisted that diagnosis is better than speculation. After some pursuance of another 5-10 days, they agreed to my request to undertake a diagnosis of the problem, provided that I bore the cost of the diagnosis, to which I complied.

This led to a careful job of dismantling the engine. As the engine cylinders were opened, the technicians diagnosed a failure of the main bearing in cylinder no. 4 as a cause of engine seizure. The reason was concluded to be a failure of the part due to a high level of friction developed due to loss of lubrication in the bearing, leading to a compromise of its integrity and later failure.

The service centre's opinion was shared with the insurance company along with expensive approx. cost of repairs of Rs. 6,50,000/-. As expected, it was followed by total silence from them for more than 30 days. Meanwhile, it was disheartening to see my car lying wide open. Like a patient on a ventilator.

Chapter 5- Insurance Companies and their notorious modus operandi

Till this point, I had neither informed the insurer nor the service centre about my legal background. I chose to be a silent observer between their dealings to figure out the right way out of the problem. I read many stories on Team-BHP and otherwise about the murky insurance business. On one hand, the insurers always try to cut corners by rejecting claims with the slightest suspicion; even big companies are into the modus operandi. The “benefit of any doubt” goes against the “insured”. On the other hand, there are numerous stories about fake insurance claims and insurance rackets.

Meanwhile, I had also made inquiries with many insurance brokers and lawyers in my circle, who had advised me about the slim chances that my insurer will re-open the claim. The technical reason is that once I took the delivery of the car after the first set of repairs, I signed a “discharge of liability” form. The conventional industry view is that the endorsement relieves the insurer of any further liability arising for the same cause of action (accident). Although, some lawyer friends also pointed out a few case laws in India which dispute the practice of discharge of liability. These cases point out that discharge of liability is considered to be waived if the insured can prove that the discharge was given under false representation. Those who want to delve deeper into this topic can refer to the decision of the Supreme Court in the cases of United India Insurance v Ajmer Singh Cotton and General Mills and Others and United India Insurance Co. Ltd. v ASA Singh Cotton Factory and Others [(1999) 6 SCC 400.

Therefore, the question remained whether the insurer will re-open the claim despite getting a discharge of liability and considering that 4 weeks and 700 KM had passed before the aggravated loss got detected from the same incident. The odds were in favour of the rejection of the claim. Therefore, I started preparing for the worse.

But, somehow I knew that the insurer cannot take my claim lightly, as I had timely and accurately informed them, furnished all towing bills establishing my turn of events, and acted bonafide by bearing the cost of engine diagnosis. Importantly, I had the opinion of Volvo’s authorized service centre backing my claim.

Nonetheless, after a few more weeks of patiently waiting and sending some chase-up emails, the insurer finally got back to me. This time I was surprised as they advised me to provide some kind of “third party opinion” from the manufacturer, Volvo Cars India [VCI], ratifying the opinion of their authorized workshop. I asked them about the reason for their request, to which they indicated that I am acting in connivance with the workshop for the insurance claim. This allegation really hurt me.

Despite the burdensome and illogical demands, I decided to meet their demand. There were again a couple of reasons. First, by that time, my patience was running out. I resolved that this would be the last demand I am meeting to amicably resolve the issue from my side. The second reason was by agreeing to meet their demand, I can further my claim of putting an unreasonable burden on the insured if the matter ended up in court.

I escalated the matter to Volvo India. Here I would like to thank the General manager of the authorized service centre, Swede Auto, Gurugram, Mr Vishal Munjal, who was extremely helpful in handling the problem and providing a resolution. Although Volvo India declined to send their technical engineers to evaluate the condition of the car, they wrote to the insurance company stating that Volvo provides a lifetime guarantee against the failure of the damaged part (main bearing), and the extent of damage to the part in question, could only possibly result by some external influence such as loss of lubrication in the engine. This was good backing for my case, and I was heartened to see a manufacturer actually standing by their product. No wonder why Volvo cars frequently create 1 million miles records.

Chapter 6 – Let’s play a bargaining game

Armed with the opinion of Volvo India, the insurer realized that their options are cut out. They agreed to pass my claim, but on the contrary, they chose to negotiate on the repair cost. Reliance termed my claim as substandard, meaning that the insurer believed that there was some pre-existing problem in the car which had resulted in the insurance claim and that I had not acted bonafide. Initially, they offered me to pay only 25 % of the repair cost, which was then raised to 50 %. This was also the time I lost my patience, and I escalated the matter to the insurers' grievance cell. Finally, the insurer offered to pass my claim on a substandard basis with 75 % of the repair cost to be borne by them.

It was almost mid-November 2022, 3 months since the dismantling of the engine. I agreed to their offer to undergo the repairs by paying the remaining 25 % of the costs. By now, my car had been lying with its engine dismantled for more than 60 days, and I thought it was technically prudent to go ahead with repairs than wait any longer in order to avoid issues in other parts of the car.

I approved repairs, and the replacement parts [main bearing, crankshaft etc.] were ordered. The turnaround of parts from Sweden was quick. Finally, the car was repaired, and I took delivery of the car on 24-Jan-23, after 6 months of reporting it for repairs the first time. The car was repaired with a final bill of Rs. 5,25,068/- out of which, I paid Rs. 1,11,598/- out of my pocket.

Chapter 7 – Let me sue you!

Unfortunately, the insurance game in India is such that people feel lucky when their insurance claim is approved. On the contrary, paying up your insurance claim is not charity, it’s a legal obligation of the insurer. That somehow gives an upper hand to the insurers. For example, what put me off in my claim was their take-it-or-leave-it approach.

Nevertheless, at this moment, there were 2 choices. The first one was to approach Insurance Ombudsman. The second one is the consumer court. I found out from my professional circle, that although Ombudsman as a forum usually favoured the insurers, appealing to them was simpler. The most important point in appealing to the Ombudsman is that its decision is non-binding on the insured. This means that if the Ombudsman decides against the insured, he/ she can simply choose to ignore the decision. I actually thought that the Ombudsman adjudication will be a prelude to the proceedings in the consumer court. So, I appealed the insurer's claim at the Insurance Ombudsman, New Delhi without any delay post taking up the delivery.

To my surprise, the procedure for appeal was simpler than expected. Any person, who is aggrieved by the decision of an insurance company, can register a complaint with the Insurance Ombudsman within one year from the cause of action. The only requisite is that the complainant should have first escalated their complaint with the Grievance cell of the insurer.

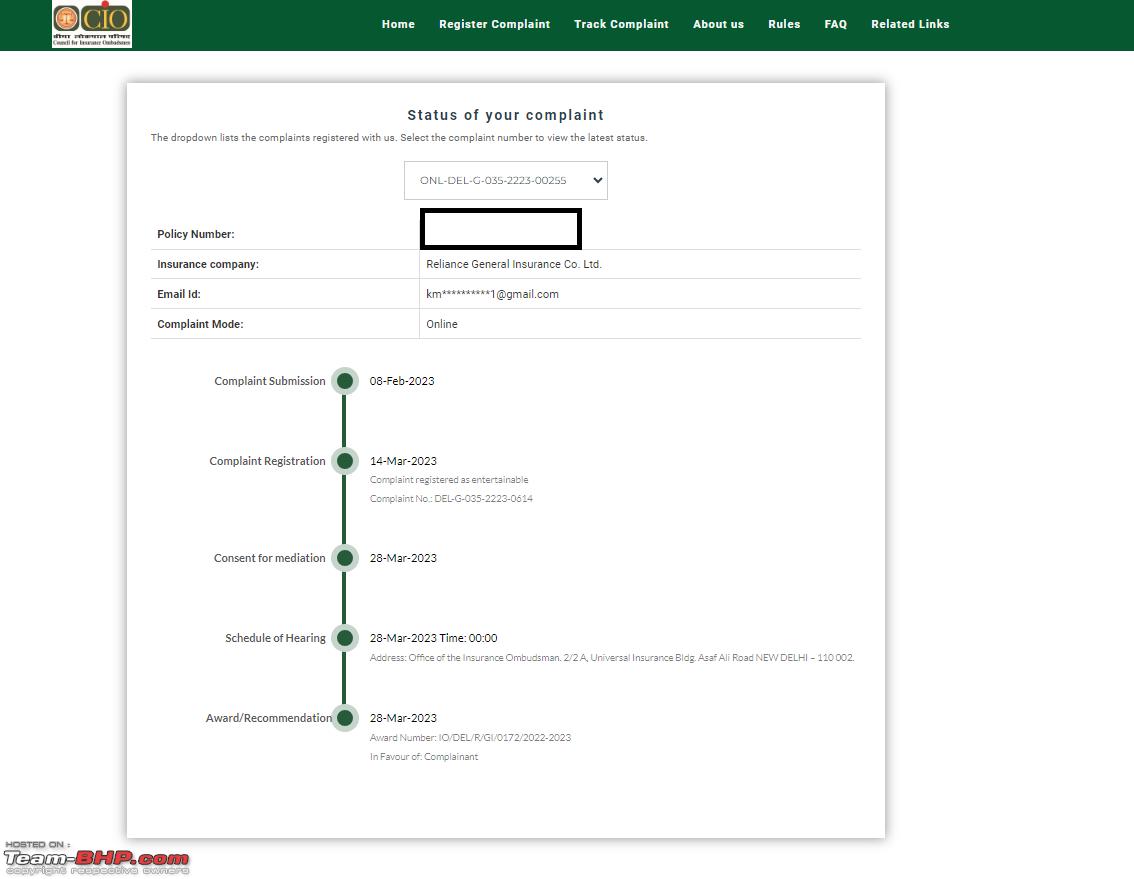

For filing the complaint, I had to file an online complaint at their online portal, www.cioins.co.in. The portal is user-friendly, the complaint is tied to your mobile number, and all updates are shared with you in real time.

For the complaint that I filed on 08-Feb-23, I was first called for a hearing on 16-Mar-23. Since the insurer did not come to the proceeding to their detriment, I was given a second date on 28-Mar-23, with a final notice given to the insurer.

On the date of the hearing, I went to the Insurance Ombudsman's office on Asif Ali Road in New Delhi. The office was very well managed. The staff guided me to the hearing chambers, where my matter was called. The matter was listed in front of the Ombudsman chairman with a couple of technical members supporting her.

The hearing went smoothly. The chairman asked me to summarize my grievance in summary, and after that, she took over the show. I was a mute spectator thereafter. To my surprise and joy, the Ombudsman was reprimanding the insurance company. I also found that she was well-informed about my case. I think this was because I had drafted the complaint meticulously and filed all evidence (towing bills, repair bills, emails exchanged, and opinion of technicians) in an orderly manner. One additional factor that weighed in my favour was that my policy had an engine protection cover. Within 15 minutes of the hearing, the Ombudsman awarded my claim, asking the insurer to pay up the cost within 30 days.

After approaching the insurer with the decision, and following up with a few documents, by the end of the first week of May 2023, I received the out-of-pocket payment for repairs in my bank account. I feel that one downside of appealing to the Ombudsman is that they award claims only to the extent of the loss. Compensation for mental agony, deficiency of service etc, is not part of their award. It should be.

Nevertheless, since the award is non-binding, I still have the option to go to consumer court and claim these damages. However, I chose not to, as the time investment in consumer court proceedings is more than the expected compensation.

Chapter 8 – Learnings?

Well in my professional career, I have had learnings of few legal disputes, but living through one gives you a different perspective. I am trying to list my learnings by wearing both hats; the one of a lawyer and the other one of an insurance claimant.

- Faking up the accidental claim: During the first few days of my problem, I was advised by many to fake up an accident rather than file a claim of re-opening. Even some insurance brokers in my circle advised in favour of earlier rather than later. I will strongly advise others to refrain from the option. There are a few reasons. Firstly, a fake insurance claim is a systemic problem plaguing the insurance industry. More so, it is also a bane for the genuine parties. I found it the hard way when the insurer doubted my integrity by blaming my connivance with the service centre. As a bonafide insurance claimant, an allegation like this hits your conscience. Moreover, the insurance companies are most of the time smart enough to recognize the chaff from the grain.

- Always check up on your vehicle after accidental repairs: As a rule, the liability of insurers usually extinguishes as soon as you take delivery of your vehicle after repairs. That is why be thoroughly sure of the repair. You can work with your workshop to give you extra time to test drive your vehicle. The usual benchmark is that the authorized workshops will give you a 30 KM test drive window. But I found that is negotiable. In case of critical repairs, you can buy more time. I test-drove my vehicle for around 100 KM after the engine repairs. You can keep your foot down and make the test drive non-negotiable in case of critical repairs to your vehicle. Remember reopening insurance claims is very cumbersome.

- Always assume the worse outcome: Insurance claims are taken very lightly by us. The general feeling is that they are passed by default. It is not the case. Cheaper claims might be passed easily, but the expensive ones certainly aren’t. Even a week’s delay in reporting of claim to the insurer might lead to the rejection of the claim. Many of us rely on the workshop or service centre to pursue the claim. That is ok, but please also go through your insurance process simultaneously. It is always advisable to read the insurance policy word for word. Every policy comes up with a summary of the terms right at the beginning; read it if not the entire blueprint.

- Choose your insurance plan wisely: My advice for everyone is to go with a zero depreciation policy. Also, opt for engine protection which covers engine failure due to hydrostatic lock (water ingestion) and oil leak. Especially, for premium/ luxury cars. The general word is that the engines of modern-day cars don’t fail just like that, but the reality in India is a little different. Our road conditions are harsher and waterlogging on roads is a common sight. Yes, the engines of the cars don’t fail just like that, but when they do the cost of repairs could be exhaustive. Engine protection covers give the trade-off to paying an extra premium to be recovered in any such eventuality.

- Don’t fear taking the legal course of action: I feel that the general sense prevailing in courts favours the insured rather than the insurance company. The courts most of the time align with the insured. For insurance disputes, do think about complaining to Ombudsman as the right way. The process is easy, and not agonizingly hard. And you always have the option to appeal to consumer forums if you fail to convince the Ombudsman.

I hope the post was useful. Apologies for the wordiness thereof. Thank you for reading, please feel free to leave comments below.

Check out BHPian comments for more insights and information.

.png)