This statement emanating from the ICRA says that the pandemic has rolled the clock back for our automobile industry by ten years. The situation is gloomy according to the report. ICRA was established in 1991, is headquartered in Gurgaon and was originally named Investment Information and Credit Rating Agency of India Limited (IICRA India). It is affiliated to Moody's Investor's Services.

This report says:-

Quote:

"It is estimated that the volumes in FY21 would be down for LCVs by 17%-20%, MHCVs by 35%-40%, PVs by 22%-25%, and 2Ws by 16%-18% along with a fall in GDP by 11%. The sales volume of the Indian automotive industry, globally the fourth largest, which is battling tough economic conditions and COVID-19-induced lockdowns, is on a free fall. However, there has been a sequential recovery month over month in segments like passenger vehicles, two-wheelers and tractors, according to the analysts of the credit rating agency ICRA. About the expected PV trend, Ashish Modani, vice president, ICRA, said, “There is an increased risk aversion in retail as well as wholesale financing, which is a deterrent. The rural market will be the key driver of volume in FY21 which will benefit entry-level cars and UVs. Buyers may opt for 2Ws or used cars to avoid public transport."

" Demand growth in the commercial vehicle industry fell by 85% in Q1 FY21, severely impacted by extended lockdowns across the country which curtailed the movement of goods. Other than this, the segment continues to face several challenges from overcapacity, global meltdown, financing issues, lower GDP growth, subdued freight availability, mining ban, infra issues, increased vehicle prices (by 10%-15%) with the implementation of BS VI, and revised axle norms, the rating agency said in a presentation."

|

The link to the full report:-

https://auto.economictimes.indiatime...-icra/78663272

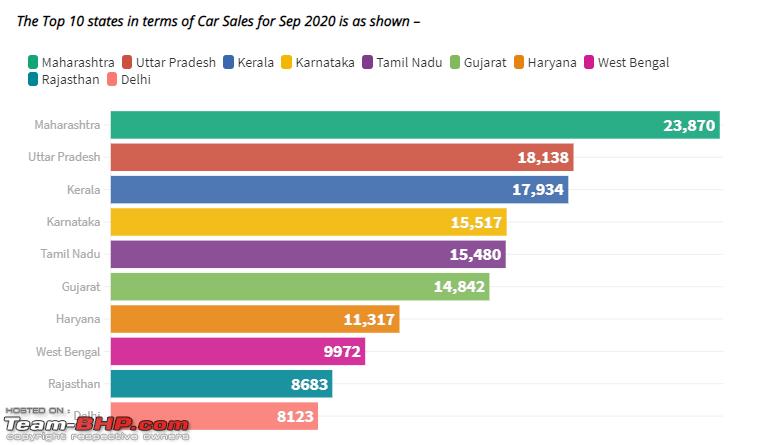

September 2020 brought in cheers though for the automobile industry, but the overall contraction for FY 20-21 would be in the region of 21%. But even two years before the pandemic struck, headwinds had hit the industry, plagued and crippled by the low demand.

There are no very tangible and result oriented steps being taken by the policy makers despite the negative indicators, to save the world's fourth largest automobile industry. The steps being announced at present will emerge as dampeners sooner or later and are all results of very bad planning, foresight and shallow understanding at the top level.

Among the two supposed booster doses announced are:-

-They feel the new scrappage policy will make India emerge as the #1 automobile maker. It is destined to be a cropper as the GST discounts have been rejected in toto and the burden is now on manufacturers and dealers to give rebates for scrapped cars. This relates to the new scrappage policy and is news from about a week ago, though the policy is yet to be notified.

-Next, the financial stimulus package for government employees in lieu of LTC announced a few days ago is another hare-brained decision. They expect someone to forego LTC fares worth Rs 100,000 and spend three times the amount to buy white goods (>12%GST) incl a car. Unless some employee has already decided to replace a car during 2020-21 or buy a new one, is he off his head to spend that amount just to prop up the automobile industry as its saviour?

The government should become more pragmatic and think of 'out of the box' measures by announcing more dynamic steps like:-

-Offer GST rebates to swap scrapped cars.

-Offer income tax rebates to all new automobile buyers to the extent of even 10-20% of the cost.

-Very aggressively incentivise exports by automakers and offer tax holidays on their earned revenue in foreign exchange.

-The three year compulsory insurance for new automobiles vide a Supreme Court order could be given a holiday for a few years till the auto industry recovers. This will decrease the ex-showroom prices. They can either approach the Supreme Court again for such an amended order, calling for relaxation of this norm for the present or as is the trend, go for a Presidential promulagation to this effect.

As the automobile industry is a huge employment generator, revenue earner and a good contributor to the GDP these matters need to be dealt with, in all seriousness.

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(3)

Thanks

(3)

Thanks

(4)

Thanks

(4)

Thanks

(2)

Thanks

(2)

Thanks

(3)

Thanks

(3)

Thanks

) even after losing the diesel engine. The reason could be Maruti introducing Factory fitted S-CNG on many of their models like Ertiga, Wagon-R etc. This is probably why Maruti has been able to maintain its market share ~50%

) even after losing the diesel engine. The reason could be Maruti introducing Factory fitted S-CNG on many of their models like Ertiga, Wagon-R etc. This is probably why Maruti has been able to maintain its market share ~50%  despite ditching diesel. Or is there any other reason? I am curious.

despite ditching diesel. Or is there any other reason? I am curious.