Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by hothatchaway Did the dealer warn you that you would be charged extra for using debit/credit card

|

I was told by both the dealers (Spares and Tyre) about the extra charges. But I think these charges should be waived by GOI to promote Cashless Transactions.

Quote:

Originally Posted by IndigoXLGrandDi

(Post 4139571)

I was told by both the dealers (Spares and Tyre) about the extra charges. But I think these charges should be waived by GOI to promote Cashless Transactions.

|

In such cases, it is not the gubbermint but these unscrupulous dealers who are loathe to absorb the charges which come with having an infrastructure to offer digital payment options to customers; they should not be passing this on to the customer. For some others, they pay lip service to digital payment while encouraging cash transactions to fly under the tax radar. I know that many service and spare dealers perpetuate this practice, whenever possible its best to take your business elsewhere.

Quote:

Originally Posted by LonelyPlanet

(Post 4124260)

The banks are just being greedy charging % based on amount of transaction.

Its not that the cost of the transaction changes for the bank if you transfer Rs 1 or Rs 100.

Get it to a flat fee of Rs ~1 / swipe and all will be happy (minus the bankers).

|

Sorry mate, this is the universal practice. What does happen is that bulk customers, like OMCs negotiate a discounted rate. Typically the charge is something like 1% each for the two banks, and the Card Co., though now I hear that the card co is only 0.5%.

Quote:

Originally Posted by hothatchaway

(Post 4139937)

In such cases, it is not the gubbermint but these unscrupulous dealers who are loathe to absorb the charges which come with having an infrastructure to offer digital payment options to customers; they should not be passing this on to the customer. For some others, they pay lip service to digital payment while encouraging cash transactions to fly under the tax radar. I know that many service and spare dealers perpetuate this practice, whenever possible its best to take your business elsewhere.

|

Was there everywhere, but abroad the merchant charges vanished, as competition took over. remember, the merchant also saves in cash handling, and bill management. Of course over here he probably curses the buyer since it ceases to be 'black'.

Another initiative from the government in its drive towards improving electronic payments systems. Government has launched BharatQr Code a payment system using QR codes. The best part or uniqueness of the App is that it is inter-operable i.e., you can pay a merchant who has PayTM even if you have some other payment system. In essence a merchant can have just a single payment QR code displayed and get payments from multiple other systems.

http://www.thehindu.com/business/Eco...le17339300.ece

With all the reports of fake 2K notes coming in , it's better to stay cashless. I heard somebody got a bogus 2K note from an ATM.

Here's another bizarre report of fake 2K notes with "Churan Patti" embossed on the notes. rl:

http://www.indiatimes.com/news/india...ia-272048.html

I wonder how robust and well tested the new payment methods like UPI are. I paid for a railway ticket using UPI and later cancelled it - haven't received the refund in a month. IRCTC says they've refunded the amount and my bank says they haven't got anything. I regularly face technical errors while using UPI on PhonePe.

Any software system needs to be well designed , coded and tested , needs to be maintained and that certainly doesn't appear to be the case with UPI. All this costs money . The end users end up being the guinea pigs.

Debit and credit cards have been around longer , and their usage costs more - but they are probably more robust than the new gen payment methods.

Quote:

Originally Posted by sdp1975

(Post 4395843)

I wonder how robust and well tested the new payment methods like UPI are. I paid for a railway ticket using UPI and later cancelled it - haven't received the refund in a month. IRCTC says they've refunded the amount and my bank says they haven't got anything..

|

I am sorry to hear such incidence. But I'd be curious whether the fault lies on IRCTC side, bank side or with UPI protocol. I have been using UPI protocol very regularly in most of my personal and professional payments and haven't faced a single problem till date.

UPI allowed me to write my own software to automate payments. I find it to be a very innovative platform.

While debit and credit cards have been around for long, and are fairly robust, even they occasionally run into problems. I for one closed my ICICI Bank credit card over one such disputed transaction. I was shown as having ordered Rs 500 worth of chocolates which I neither did (not even in my wildest of dreams!) nor received. But that apart.

Quote:

Originally Posted by mayuresh

(Post 4396321)

I am sorry to hear such incidence. But I'd be curious whether the fault lies on IRCTC side, bank side or with UPI protocol. I have been using UPI protocol very regularly in most of my personal and professional payments and haven't faced a single problem till date.

UPI allowed me to write my own software to automate payments. I find it to be a very innovative platform.

While debit and credit cards have been around for long, and are fairly robust, even they occasionally run into problems. I for one closed my ICICI Bank credit card over one such disputed transaction. I was shown as having ordered Rs 500 worth of chocolates which I neither did (not even in my wildest of dreams!) nor received. But that apart.

|

I don't think the UPI reconciliation process is robust. I see circulars for banks from NPCI introducing additional error codes , asking banks to do reconciliation on a daily basis etc. Some banks apparently don't even follow these well intended circulars ! I also see numerous complaints specifically with IRCTC UPI refunds/transaction failures on twitter. Also , I guess the reconcialiation process is outsourced by banks to the cheapest IT vendor , consequently software quality takes a hit.

A friend once told me of a delayed NEFT transaction story. It was a diwali weekend , and there was a backlog of transactions and a file got truncated during transfer due to it's large size leading to delayed payments. The point here is the quality of software that gets deployed. NEFT is supposedly a very robust platform.

In the end it's not just a single but a combination of several factors - fundamentally economic and social - that leads to these problems .

I have never used UPI before. Today I installed the BHIM app & chose one of my banks as the bank. It automatically identified my account with the bank & created my UPI id which was phonenumber@upi. I setup a second id which was more anonymous (Without my phone number or name) & made that the primary ID.

Now a few questions - how anonymous is UPI?

- Are both my UPI ids now linked to the same bank account?

- When I send money to someone what will he see? Will he see my primary ID or other id or all ids?

- Will he see my name or bank's name? Will see any account number?

Google Pay refuses to recognise my ICICI Bank account tied to my phone number, though it's been the registered contact on that account for a decade+.

Reported to Google but no response. So much for technology and convenience.

Quote:

Originally Posted by Chetan_Rao

(Post 4601630)

Google Pay refuses to recognise my ICICI Bank account tied to my phone number, though it's been the registered contact on that account for a decade+.

Reported to Google but no response. So much for technology and convenience.

|

If you have ICICI Bank imobile app did you ever try generating and using you handle from there? If this is working then it's indeed gpay problem.

If you have a joint account gpay may not work.

I have two bank accounts, one with Allahabad Bank and the other with Post Office Savings Bank. While I can understand the latter not being available on Google Pay (heck, even online and offline merchant payments can't be done with my POSB RuPay debit card), I was surprised when my other account didn't get linked either. Left it at that and went back to PayTM.

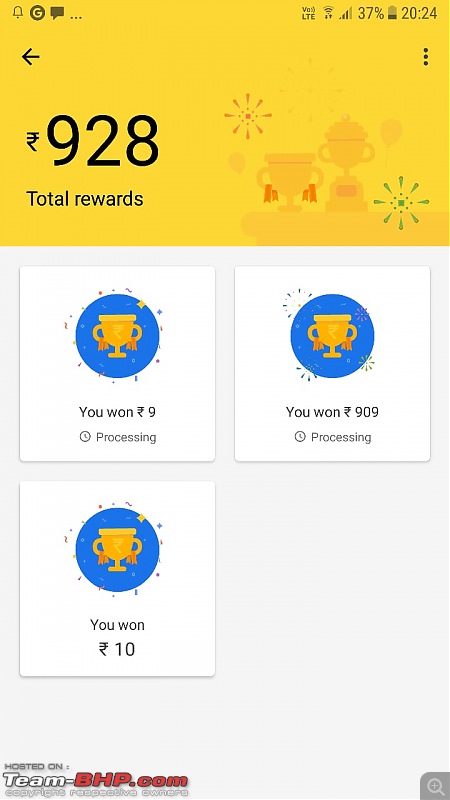

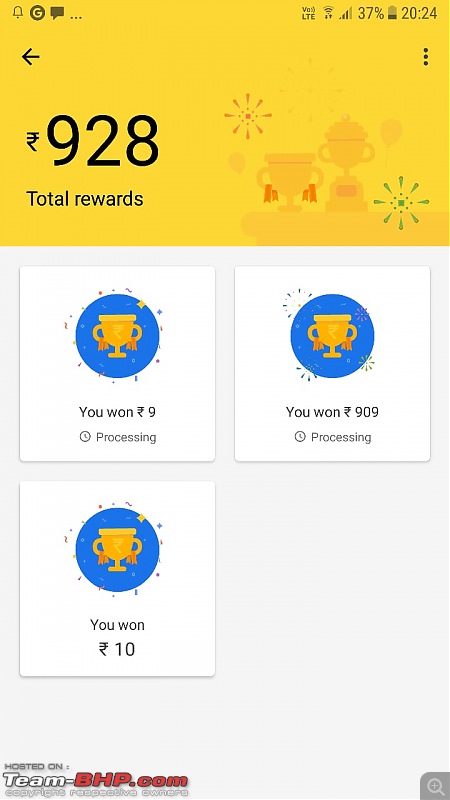

:OT, but I had decided to try out Google Pay after a friend sent me the following screenshot:

I've used UPI so very often thanks to its instantaneous transfers + I get to avoid convenience charges (for cards) by restaurants / sellers.

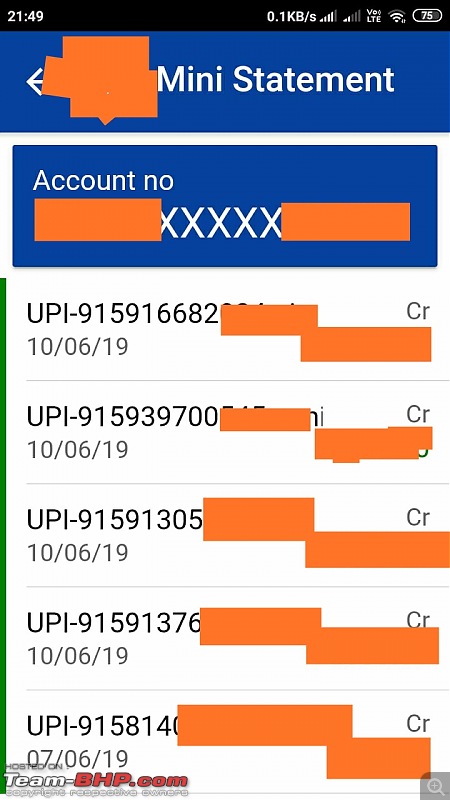

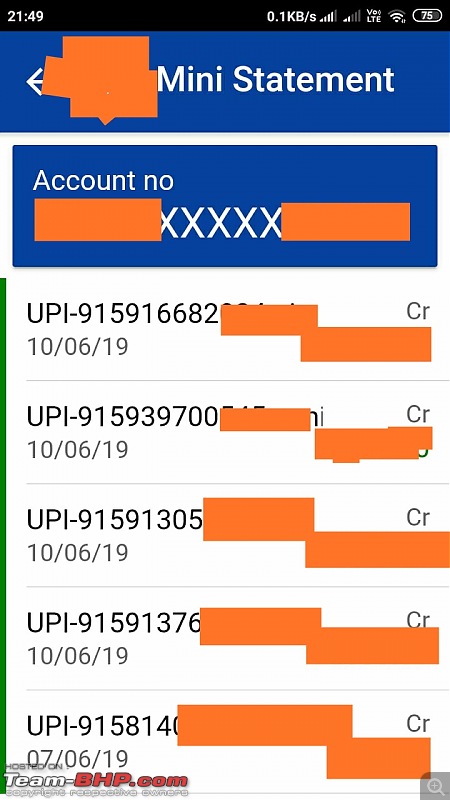

Tracking transactions is mostly simple, except for a one-off quirk. Like Yesterday I received payments thru UPI for a dinner-bill-split. Confirmation SMS has come from NCPI as well as the bank. However the bank statement shows 10th as the transaction date.

Was wondering if it could be because yesterday was a bank holiday (2nd Saturday)?

Quote:

Originally Posted by haisaikat

(Post 4601649)

If you have ICICI Bank imobile app did you ever try generating and using you handle from there? If this is working then it's indeed gpay problem.

If you have a joint account gpay may not work.

|

I have a UPI ID on my ICICI account, and it works fine.

Ironically, my SBI account, held jointly with the better half, is recognised fine on Google Pay.

Oh well, I guess I can live without handing more info to Google:).

Quote:

Originally Posted by GrammarNazi

(Post 4601673)

|

Which upi app is this? Seems it is also showing account balance, seems like a very useful feature

| All times are GMT +5.5. The time now is 23:48. | |