| | #751 |

| BHPian Join Date: Jun 2011 Location: Gurgaon

Posts: 149

Thanked: 64 Times

| |

| |

| |

| | #752 |

| Senior - BHPian | |

| |

| | #753 |

| Senior - BHPian Join Date: Dec 2007 Location: Gurugram

Posts: 7,971

Thanked: 4,809 Times

| |

| |

| | #754 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,077

Thanked: 9,334 Times

| |

| |

| | #755 |

| Senior - BHPian Join Date: Jan 2008 Location: Bombay

Posts: 1,481

Thanked: 1,130 Times

| |

| |

| | #756 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,816

Thanked: 418 Times

| |

| |

| | #757 |

| Senior - BHPian Join Date: Dec 2008 Location: Bangalore

Posts: 3,834

Thanked: 6,136 Times

| |

| |

| | #758 |

| Senior - BHPian Join Date: Jan 2008 Location: Bombay

Posts: 1,481

Thanked: 1,130 Times

| |

| |

| | #759 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,816

Thanked: 418 Times

| |

| |

| | #760 |

| Senior - BHPian Join Date: Dec 2008 Location: Bangalore

Posts: 3,834

Thanked: 6,136 Times

| |

| |

| | #761 |

|

Posts: n/a

| |

| |

| | #762 |

| Senior - BHPian Join Date: Jul 2007 Location: Gurgaon

Posts: 5,975

Thanked: 4,675 Times

| |

| |

| | #763 |

| Distinguished - BHPian  | |

| |

| | #764 |

|

Posts: n/a

| |

| | #765 |

| BHPian Join Date: Aug 2007 Location: Paradise (wish it was)

Posts: 456

Thanked: 371 Times

| |

| |

|

Most Viewed

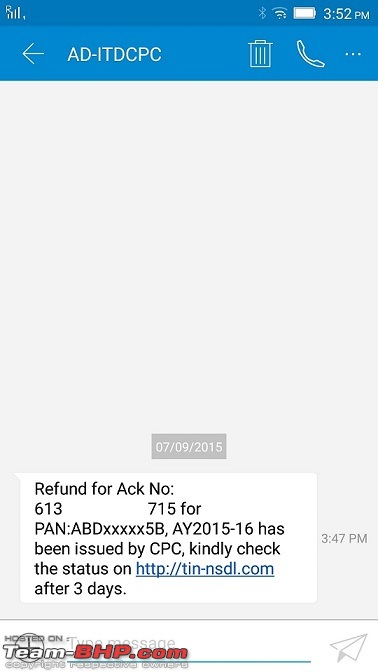

This time, they have credited more than what I had asked for. Earlier, I received the detailed assessment order too. Fantastic job.

This time, they have credited more than what I had asked for. Earlier, I received the detailed assessment order too. Fantastic job.