| | #901 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,809

Thanked: 417 Times

| |

| |

| |

| | #902 |

| BHPian | |

| |

| | #903 |

| Senior - BHPian Join Date: Dec 2008 Location: Bangalore

Posts: 3,552

Thanked: 5,527 Times

| |

| |

| | #904 |

| BHPian Join Date: May 2016 Location: New Delhi

Posts: 137

Thanked: 92 Times

| |

| |

| | #905 |

| BANNED Join Date: Dec 2007 Location: Gurugram

Posts: 7,969

Thanked: 4,788 Times

| |

| |

| | #906 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,809

Thanked: 417 Times

| |

| |

| | #907 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,809

Thanked: 417 Times

| |

| |

| | #908 |

| BHPian Join Date: Sep 2009 Location: Chennai

Posts: 605

Thanked: 261 Times

| |

| |

| | #909 |

| Senior - BHPian Join Date: Jan 2010 Location: Bangalore

Posts: 1,041

Thanked: 1,161 Times

| |

| |

| | #910 |

| Senior - BHPian Join Date: Mar 2007 Location: Bangalore

Posts: 1,584

Thanked: 259 Times

| |

| |

| | #911 |

| Distinguished - BHPian  | |

| |

| |

| | #912 |

| Senior - BHPian Join Date: Mar 2007 Location: Bangalore

Posts: 1,584

Thanked: 259 Times

| |

| |

| | #913 |

| Distinguished - BHPian  Join Date: Dec 2012 Location: Ranchi

Posts: 4,396

Thanked: 12,051 Times

| |

| |

| | #914 |

| BHPian Join Date: Oct 2015 Location: Hosur

Posts: 641

Thanked: 937 Times

| |

| |

| | #915 |

| BANNED Join Date: Dec 2007 Location: Gurugram

Posts: 7,969

Thanked: 4,788 Times

| |

| |

|

Most Viewed

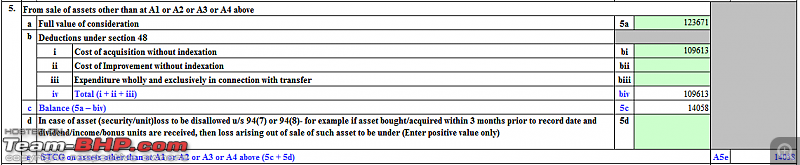

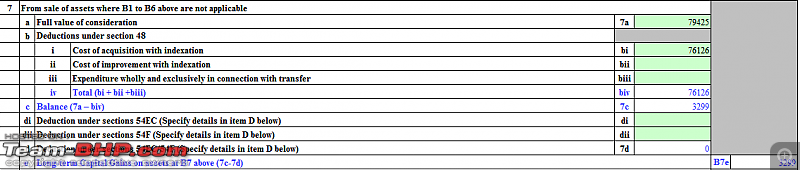

). So the person is suffering by having to pay that additional 15k work of tax.

). So the person is suffering by having to pay that additional 15k work of tax.