|

@RVMohankumar

Your long post will definitely be helpful to people who read it to realise the importance of a balanced outlook in life with regards to money and the necessity of saving money.

Like you I too have burnt my hands at the stock market. I started working in 2003 & in 2007 I had all my saving in stock market which included savings from 2 year onsite stint. In early 2008 the market crashed and I lost a huge huge huge amount of money (in 7 figures). I was shattered. My family, friends & colleagues were shocked to see my state. I used to sit like a zoombie in office just looking at my investments go south. My family helped me a lot to recover from that loss.

The good part was that a major portion of the money I lost was what I had earned as profits over the 4 years. So I consoled myself by thinking that the money was easy come and easy go. Though it was not easy to earn that money and my hardwork of 4 years had gone down the drain.

In late 2007 I was also looking to purchase a house and with the crash my budget also crashed. I was left with lesser money and had to now look at houses which were smaller than what I had initially planned. In mid 2008 I purchased a house in NCR with a Home loan & some monetary help from my parents. Home Loan is the only EMI pay. I have also LIC & have a PPF account since 2004. These are all the liabilities I have. Though I still play the stock market I dont invest more than 2L. After all that deductions I am not left with much to save but whatever is left I have been accumalating for some impending expenses.

I would admit here that I am scared of EMIs. My home loan takes a huge chunk out of my salary (almost 40%). I had a bad experience with Manhattan credit card in 2005 after which I don't use credit cards. I have only 1 credit card which I carry with me only when I tavel abroad. There too I try not to use it. Its more of a safety device to carry around. Rest of the times it lies at my home unused. Till date I've not bought a new car as I fear that the EMI will tighten the deduction noose on my neck.

Always keep some liquid cash with you for emergencies. God forbid, but if you need it for some health issues, casualty or any other kind of emergency then it would be helpful.

Coming from a very humble background I have always valued money in life. Looking back I think it was very naive of me to put all the eggs in one basket. With the crash in markets I also crashed. This is the single most important piece of advice I can give to you. Dont invest in only one domain. Be it Stock market, Real Estate, Mutual funds or anything else. Distribute your money. It is more headache but it will be beneficial in the long run.

@ampere

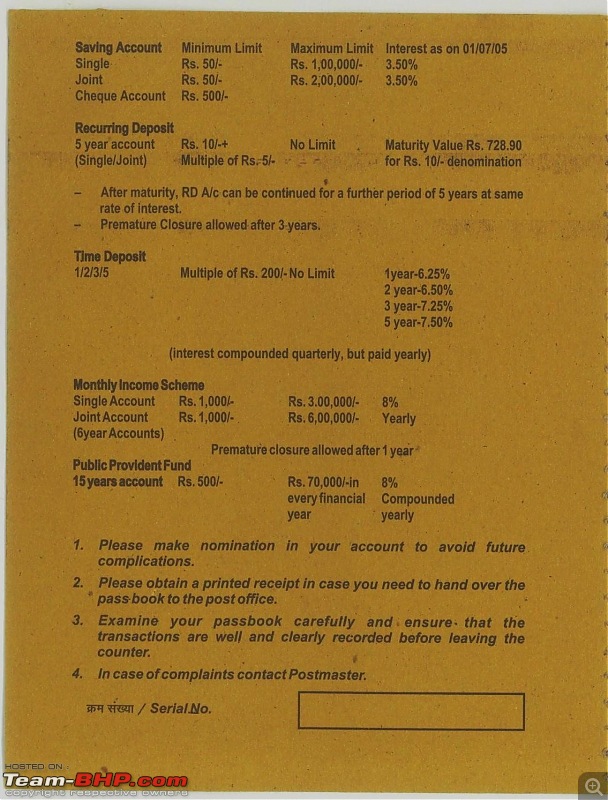

"Black-Hole account" - thats a good term. Instead of having this account in a nationalized back I would suggest we open a PPF account. It provides 8% compund interest which cannot be matched by any bank. And it is a real black hole account. Plus tax savings. What a coincidence, that just this noon I deposited 10K in my PPF account and I came across this thread.

I think it is a great way to save money with a minimum pay in Rs 500/- per year. Most of us are in private sector jobs. It makes sense to make investments in PF accounts cos when retirement comes there will be no steady source of income. However, don't put all your savings in a PPF account, as you cannot withdraw money from it freely until it is 15 years old. My plan is to invest a small amount of money every year in the PPF account and once it is 15 years old it is as good as a savings account, when I can move most of my money to this account.

I urge each and everyone to be careful with money. Not to the extent where it becomes the sole purpose of your life but be very careful with it. Most of us earn it the hard way and we should respect it. It is a means of living a good life, makes you able to help others, fulfill your dreams and aspirations and may bring hapiness and joy in your or someone else's life.

My dad often says one statement "Jo paise ki kadr nahi karta, paisa uski kadr nahi karta"

["If you do not value money, money will not value you"] |