Quote:

Originally Posted by aargee  This comes as a good advice especially when I'm looking out to buy one; I was actually considering (read it finalized) endowment plan from LIC; I knew about not getting the money, but didn't know it was called as "term" insurance.

What I would be needing is the whole life plan & I'm thinking of LIC's Endowment plus for 15 years. What's your opinion? |

Endowment plans aren't pure insurance. It isn't a term insurance.

So my advice is don't waste money on it.

Instead first figure out if you need life insurance & for what term.

Factors to consider

- If you die in the next 'X' years, is someone going to be seriously affected because they are dependent on your salary.

This may be your parents who are dependent on you & their pension & investment income isn't enough to meet their expenditure & their health issues.

This may be your children who if you die may not be able to afford to complete their education because your monthly salary or savings when savings corpus isn't there to pay their fees, books etc.

This may be your spouse who is fully dependent on your income & your savings if you die tommorow will not be enough to pay her bills.

You may have a home loan for the next 5 years. If you die, your spouse may not be able to pay the monthly EMI from your savings & still have money left over for daily expenditure.

If the above is true, that means your death in the next 'X' years will affect this person seriously. In that case, take a term insurance for 'X' years for 'Y' amount of money. The 'Y' amount of money would be such that, if you die, then the dependent(s) will get the 'Y' amount & would be

able to live off it (by investing it in FDs, Monthly Income Schemes, etc)

For eg. let's say your children are 15 years old & you expect them to be self sufficient by age 25 years. Your current savings or the savings you expect to have next 10 years isn't enough to get them through to age 25 if you die before they are 25. Then calculate what money they would need in addition to whatever savings you have(which they will inherit when if you die) to provide a cushion for them upto age 25. Then buy a term life insurance for this amount for a term of 10 years. If you die in between, your savings which they inherit + the money they get from your policy should be able to get them through comfortably upto age 25 after when they may be self sufficient.

Again, even this may not be needed by everyone. Suppose you have enough savings & investment to take care of your dependents needs (adjusted for inflation) even if you die, you may not need any insurance at all.

Quote:

Originally Posted by aargee  Read it 40%!!! If we also play little harder, they'll agree to pay the first premium for us  |

It will still be costlier than Term Insurance + Regular Investment.

Quote:

Originally Posted by aargee  It makes no sense to mix insurance & investment, but at some point of life, one would need an insurance. |

I don't understand your point here?

Quote:

Originally Posted by aargee  Haven't got it completely; any elaboration will help as I'm looking to take one immediately. Tks. |

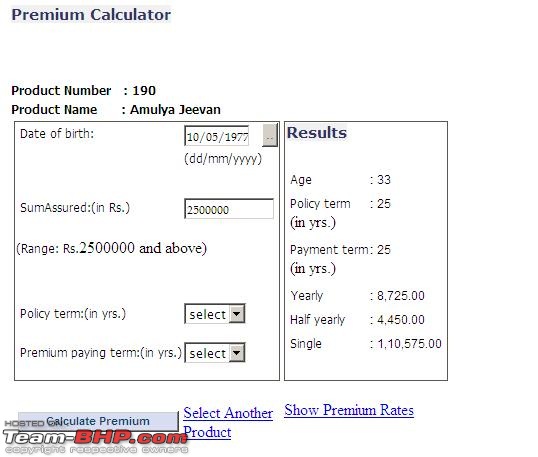

Say you get Term insurance for 'X' Lakhs cover by paying 10K per year.

And you can get a Money Back, Endowment, Whole Life, ULIP for 'X' Lakhs by paying 40K per year.

Then take Term Insurance instead of the other policies. Put the remaining 30 K per year into some other pure investment(FD, PPF, MF whatever). Investing 30K per into this invesment vehicle would at a minimum give you more at the end of your term (if you die or don't die) than what you would get from your money back, endowment, ULIP, whole life policy.

As an example, 30K per year compounded annually for 20 years at 8% would give you 13 lakhs at the end of 20 years.

So don't expect money back from insurance. Instead invest the difference in premiums between term & money back policies

to get money back.