News

Bad experience with Royal Sundaram's customer service

I needed an NCB copy for my recently sold Volkswagen Jetta.

BHPian ajmat recently shared this with other enthusiasts.

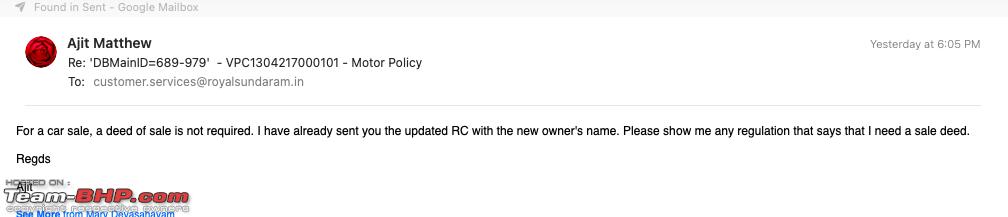

I recently sold my VW Jetta and needed my NCB Copy. So I politely wrote as follows:

After the usual acknowledgement - I get the reply as follows:

Sale Deed? That's only required for something like a house. I had enclosed the updated RC Copy

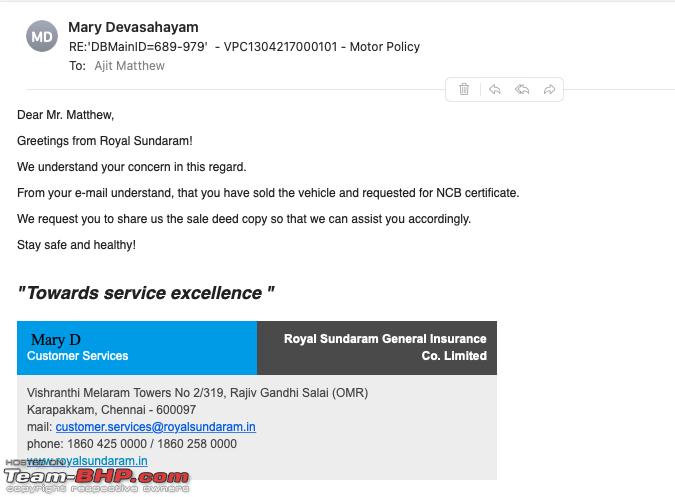

So I replied

and I get the reply

Brilliant way of stalling a customer by making us go in circles. I better be careful in making any claim. We will need a written permit to crash

Anyway - my options are:

- Wait for the insurance to run out on that car mid-March, get my next insurance renewal to verify with Royal Sundram

- Report this to Royal Sundram Grievance - which I will do

- Storm into their office

My replacement car is also with Sundram - am awaiting the updated RC card due any time. The insurance is due end-April.

Here's what BHPian GrammarNazi had to say on the matter:

They made me wait in a similar way and eventually didn't give me the NCB Certificate for 50% NCB.

This was after having insured my car with them for 7 years between 2010-2017, with 0 claims.

Unfortunately, I didn't have time to vehemently follow up beyond a few phone calls every month. So, if possible, PLEASE do report them to the ombudsman if they play around.

I discussed it here

Here's what BHPian EV NXT had to say on the matter:

With the current dog-eat-dog scenario between insurance companies, my understanding is that all you need to do is renew your policy with another company and you would get your 50% NCB.

They don’t bother to obtain the NCB certificate like they did earlier - all they want is the premium by any means.

So I guess you can tell Sundaram to take a hike after the policy is over, renew with another company, and be none the worse for the wear.

Here's what BHPian thanixravindran had to say on the matter:

To get an NCB certificate, as per the Royal Sundaram website, the required document is Form 29/30 which is nothing but Intimation of Transfer of Ownership to RTO. This is to prove the car is indeed sold.

By Default, the TP insurance (tied to the vehicle) is transferred to a new owner but without NCB in OD cover. The catch is once the buyer gets the new RC or applies for RC transfer, he has to apply for Insurance name transfer endorsement and pay the NCB price difference on OD cover.

However now many are selling the car to used car dealers or online aggregators by signing blank Form 29/30 (without a buyer) and want to get the NCB certificate and hence they are providing the NCB certificate with delivery note as proof. This is easy when both your old and new car insurance is with the same service provider. Else, Insurance companies need to send the hard copy certificate acknowledging the sale and send it to you or another insurance copy which they are not willing (losing their business).

On the cancellation, the agent you talked to is partially correct. The car has to be insured THIRD PARTY ONLY as per law. Unfortunately, since we have a comprehensive package policy, they cannot cancel only the Own Damage portion.

So when you sell the car, I was advised to get a Third Party Only policy (from anyone as rates are the same by law) and then cancel the comprehensive package with RS and get an NCB certificate with a partial refund based on the duration remaining.

My guess in ajmat's case is, the new RC itself has come but the buyer may not have applied for insurance name transfer and hence for an Insurance company at least OD is still in ajmat's name with applicable NCB. Without insurance name transfer, the Insurance company will lose the NCB discount money as it cannot recover it from the buyer.

I got to know this from an RS agent when I was exploring selling my old car and buying a new car. Eventually, I decided against selling the car and did not pursue it.

Check out BHPian comments for more insights and information.

- Tags:

- Indian

- Member Content

- Insurance

.jpg)