News

Passenger vehicle sales analysis & trends for FY2021-22

The volume-wise ranking continues to remain unchanged with Maruti leading the pack followed by Hyundai, Tata, Mahindra and Kia in the top 5.

BHPian volkman10 recently shared this with other enthusiasts.

The story-so-far from April - Oct-21 of the performance of Passenger Vehicle segment for the FY 21-22.

With a Year-to-date volume of about 16,44,909 units, the Indian PV industry is on a rapid growth track.

The growth rate has crossed the 35% mark and continues to soar higher with new launches around the corner.

- The volume-wise ranking continues to remain unchanged with Maruti leading the pack followed by Hyundai and then Tata, Mahindra, and Kia in the top 5 PV manufacturers ranking.

- The growth in terms of volume-wise came from Maruti as rank 1, however, the next biggest gains came from TATA Motors, with a growth of about 89,277 units. The third highest gain in volume was from Hyundai with 60,385 units. In total, the industry grew by about 4,33,110 units.

- On a percentage basis, the highest growth came from Nissan, Skoda, Fiat, Tata Motors, and Toyota. The Industry grew by 35.74% for the 7 months period.

- The Market share gainers were Tata Motors with a high of 3.41%. The next in growth came from Mahindra with a 1.12% growth in market share. Nissan grew by 0.99% in market share.

- The top losers in market share came from Maruti Suzuki with -5.79%. Hyundai also lost a market share of about -1.09%. Renault and Honda lose a market share of -0.13% and -0.03% respectively.

Only 5 Car Manufacturers cross 1lakh this FY 21-22 YTD. Maruti, Hyundai, Tata, Mahindra & Kia.

This was a strong performance despite the lockdowns and other challenges, the volume growth stood at 4,33,110 units when compared to the last year till date volume of 12,11,799.

- The total share of these 5 OEMs stood at about 83.93% and continues to remain stable around this volume.

- Cumulatively both Maruti and Hyundai control over 59% of the Indian PV Industry.

- The trio of Tata, Mahindra, and Kia continue to either hold or add volume and cross the 1,00,000+, within a period of 7 months. These 3 OEMs together contribute to about 24% of the Indian PV Industry.

With more new launches along with the rapid network expansion that is under progress, it is but obvious that the contribution from these OEMs is bound to grow from here on.

This also is a reason to ponder for other OEMs who may be global leaders, but fail to make a significant mark in the Indian market.

Top 10 Growing Hatch Back in India for FY 21-22.

The hatchback segment still contributes to about 36.52% of the PV industry with a volume of about 6,00,000+ this year to date.

- The top 10 selling Hatchbacks contribute to over 5,54,123 units. This is as high as 92% of the entire hatchback segment. The strong contributions from the top 10 models have also ensured the dominance of their share in the overall top 10 selling cars.

- The Hatchback segment is dominated by Maruti Suzuki. Out of the top 5, there are 4 models from Maruti Suzuki ( In terms of growth ). Wagon R Hyundai Manages to get 3 in the top 10 and Tata Motors Manges to get 2 in the top 10 selling Hatchbacks.

- Wagon R is not only the highest-selling model but has also managed to have the highest growth of 20,880 units. From a percentage perspective, this stood at about 29.11%.

- Next in line was Baleno, with a volume of about 89,913 units. It stood rank2 in terms of growth with 29.17% growth.

With all OEMs having at least 1 launch in this segment by the end of the next financial year, this hatchback segment is sure to draw some attention again and the volume trajectory is surely looking at an upward trend.

Number 1 UV OEM this FY 21-22 YTD.

- Maruti beats Hyundai, to become Number 1 UV OEM

- With a volume of about 1,62,160 units and about 21.18% Market Share in the SUV segment, MSIL was able to outplace Hyundai from the Rank 1 position. The growth percentage stood at 58%.

- On the volume front, it has crossed the 7.6 Lakhs mark YTD with 69% growth. More than 85% of the recent new car launches have been dedicated to the UV segment.

- Hyundai came second with a market share of 18.44%.

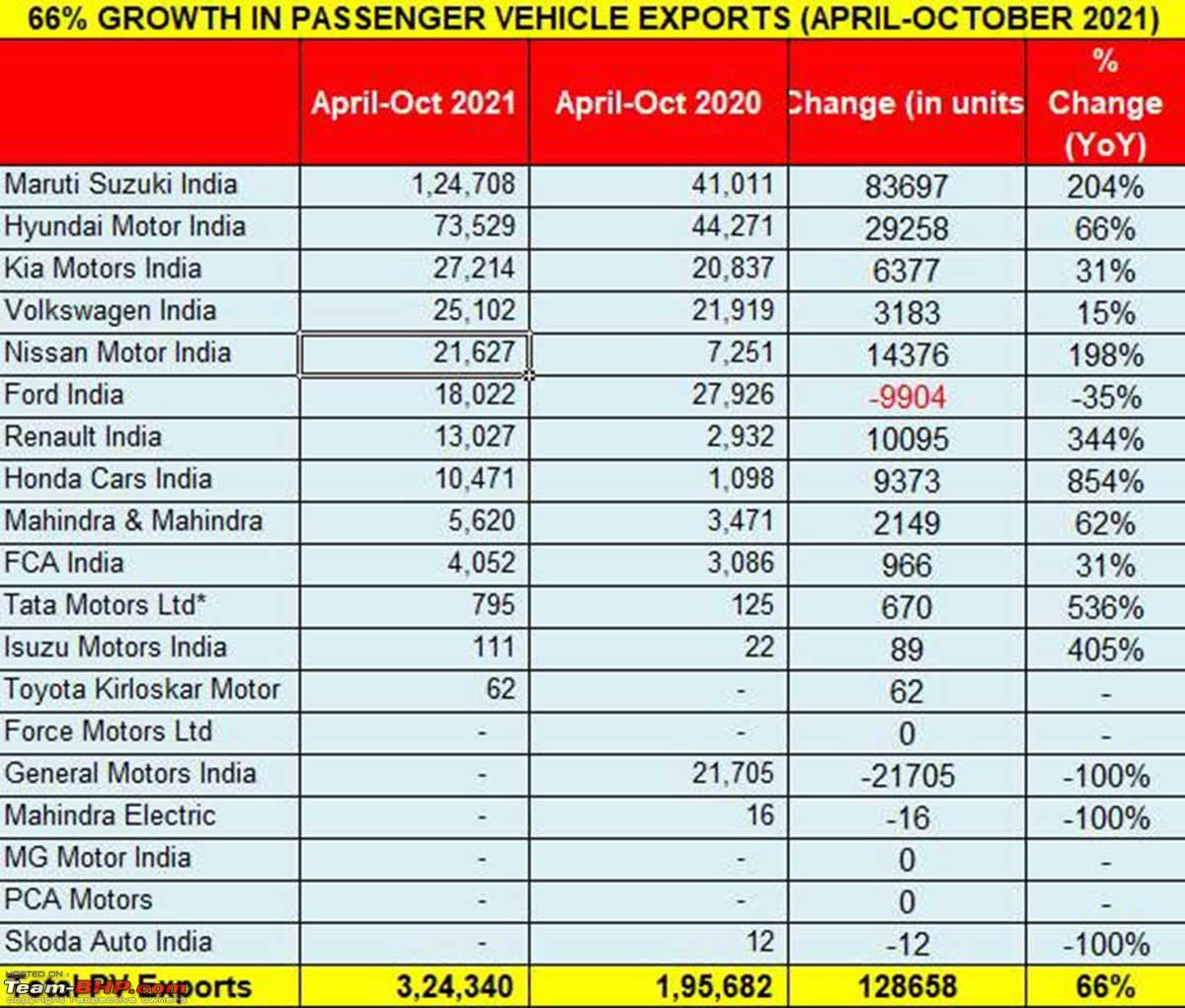

Export Trend: Apri- Oct'21

- Maruti Suzuki leads passenger vehicle exports in FY2022. With 1,24,708 units, which marks solid 204 per cent YoY growth and accounts for 38 per cent of total made-in-India car exports. Expect the Baleno, S-Presso, Dzire, Swift, Vitara Brezza and Jimny to be the top six models for the carmaker on the export demand front.

- Hyundai Motor India, which wrested the No. 1 made-in-India passenger vehicle (PV) exporter title from Ford India in FY2020 and also took the title in FY2021, is at second position in the PV export rankings.

Check out BHPian comments for more insights and information.

- Tags:

- Indian

- Member Content

- Sales