| Re: Automobile Insurance Queries? Ask me

Quote:

Originally Posted by Jaggu  1- Everything is proportional and ever increasing in India

2- IDV or Market price whichever is LESSER! will be paid in case of total loss.

I wouldn't recommend a higher IDV after the first 2-3 years when your bumper to bumper no dip covers end. |

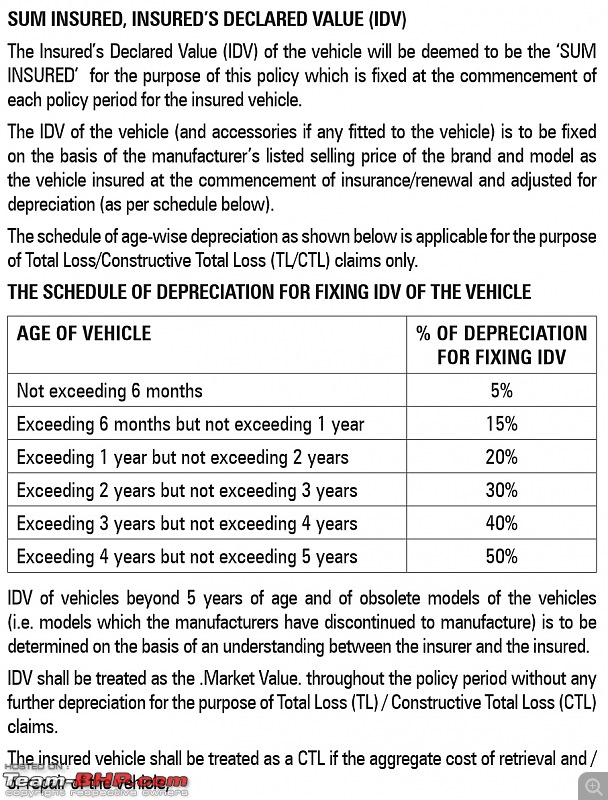

Hello Jaggu, can you reconfirm the point number two? IDV or Market price whichever is lesser will be paid in case of total loss.

I had been supporting a colleague in this matter. What I learnt that there is nothing like 'whichever is lesser' clause. It's just a ploy to reduce the payout by the insurer.

- when the premium is calculated and collected basis IDV, why should the insured at the time of TL claim be settled by paying off the 'whichever is lesser' amount? It's not even 12M that the premium was calculated mutually

- another thing to point is TL claim is applicable when AGGREGATE cost of repair (including towing, storage and customer payable components ) exceeds 75% of IDV. What the insured is actually fed at the time of claim is that TL will only be entertained if insurance company's payout is >75%. Escaping from commitments?

- lastly, when we approached the actual Total loss settlement stage we were informed that the claim is settled 'net of salvage' and with RC.

Meaning that my friend has chosen to retain the salvage (car was in tatters) and will sell it off along with the registration documents as used car and the insurer will only pay the difference!!! This was being forced upon by the insurer who posing to be customer centric said "we will arrange a buyer for you". What it meant was we had to go through the hassle of paperwork involving the RC transfer. Note, RC transfer wouldn't happen till the car which was in shambles was roadworthy to a be reregistered. We were to own the responsibility of any parts missing a till such time the wreck was lifted by the dealer. Be available to have different scrap buyers inspect the car! Moreover the arranging of buyer meant that they will fish around the market for weeks till such time a sweet deal is struck and the insurance liability is reduced.

On reading regulatory guidelines, we realized that my colleague hadn't signed any full and final document/indemnity. Basis the guidelines and with a copy to IRDA we sent a note asking the car to be scrapped since it was not safe to be repaired and put back in the road. Demanded copy of survey report which actually hinted towards the same. Insurer paid full amount IDV as well as parking and estimation charges and agreed to sell the wreck on their own.

What the claims manager informed that owing to GST, they will have to pay 18% out of the proceeds which they could have saved if they could make the deal look as if my colleague was selling the wreck as individual...

Pretty complicated topic but there is a lot in IRDA fine print that actually guards the interest of customers.

Your comments? Experiences? |  (2)

Thanks

(2)

Thanks

(3)

Thanks

(3)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks