| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  93,831 views |

| | #76 |

| Distinguished - BHPian  Join Date: Jan 2015 Location: Chennai

Posts: 1,915

Thanked: 9,179 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Ola and Uber are indeed taking a hammering themselves from what I can see in my office commutes. Office Ride and Shuttl are providing cheap vans for office comnuters and QuickRide and Sride are whittling away at this market at the other end. A friend of mine just wanted an Ola and was scolded by a driver before getting rejected - "all of you office-goers have migrated to Quickride. Don't expect us to come to you" |

| |  ()

Thanks ()

Thanks

|

| | #77 | |

| BANNED Join Date: Jul 2019 Location: Earth

Posts: 1,750

Thanked: 8,899 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Quote: Yes. Regarding Ola/Uber and the likes and their growth in India, I think we are at one of the red dots in zone-1 in the rough graph shown below:

They came, they changed the way we travel, but to initially onboard drivers and users without the chicken & egg problem, they showered huge discounts on both riders & drivers while burning vaults and vaults of investor money. Now since the bases are set, they started concentrating on profits, this fall of Ola/Uber in India is because of their pruning and consolidation operations to shift their focus towards profit. If you notice, whenever they enter any city newly, they offer huge discounts to the users & huge incentives/rewards to the drivers. But over time after acquiring sizeable userbase & driverbase and after the stabilization of their operations in that city they will start cutting(or stop being aggressive) on discounts & incentives and start concentrating on profit making. So their operations are profitable in few cities, while they are making losses at other newly entered cities. During the initial years their sole focus was establishing themselves, once that was done they shifted their focus towards the next required thing. This fall in growth, userbase, and driverbase is because they are shifting their focus towards profit making and so they are increasing prices while cutting on discounts & rewards. Despite the reduced growth, they started their journey towards profit making which is what matters to the investor. One may bring up the accounting stats and say they are not yet making profits, but one should understand that they just started and they are yet to go there. Stats are sourced from Wikipedia and Ola India website. Mentioned stats are as on today. Last edited by wheelguy : 14th September 2019 at 16:03. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank wheelguy for this useful post: | N33raj, SpideyBoy |

| | #78 | |||||||||

| BHPian Join Date: Nov 2017 Location: Yantar

Posts: 142

Thanked: 415 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

On a side note, if fossil fuels are so bad, give them to me so that i can burn it in my G Wagen and finish it off! Quote:

Quote:

Quote:

Yes, my locus standi is a rather pessimistic one but it has served me and my clients well over the years. I would love to be proven wrong though! | |||||||||

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks N33raj for this useful post: | imidnightmare |

| | #79 | |

| BHPian Join Date: May 2013 Location: Mumbai

Posts: 108

Thanked: 321 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Quote:

For the record, my segment has 0 import duties on finished goods. But, there are duties imposed on critical parts that I’m forced to import because of lack of any domestic expertise in those areas. Go figure. The mess has taken decades to create. It won’t go away easily. If at all. We plough on. We write and plead and have seen some positives in the last 4-5 years. But I don’t hold out hope for sweeping change that will alter everything. That would be anti-populist and so will never transpire... PS: I do have plans to expand. Shockingly though, all inputs right now are that it’ll be easier for us to expand overseas. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank imidnightmare for this useful post: | AZT, N33raj |

| | #80 | |

| BHPian Join Date: Nov 2017 Location: Yantar

Posts: 142

Thanked: 415 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Quote:

Yes sir i am in a similar boat. We make some machines which cater to an important segment of the country's population and we get nothing from the govt as support. While we make all the components in house, we still have a hard time convincing clients that our equipment is completely India made; they simply cannot believe that an Indian firm can make something so high quality with high accuracy and repeatability! The inputs you have received as regards expansion are correct. It IS easier for us to setup our bigger capacity plant in a neighbouring country than in India! While talking about these machines and their potential sale with an associate in the Africas, he did ask me if i was interested in setting up a bigger plant in his country! The govt there is interested and willing to provide me with a lot of facilities for setup and my production cost will come down a bit as well with no reduction in quality! | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks N33raj for this useful post: | imidnightmare |

| | #81 |

| Distinguished - BHPian  Join Date: May 2012 Location: BLR/PTR

Posts: 3,480

Thanked: 10,715 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Emission testing guys seem to be the only one's who are extremely happy in Automobile Industry. Their business has sky rocketed, thanks to new fines.I don't know what their margins are but they are easily making 15000 a day compared 1-2K earlier. Off-topic, I was at Koramangala probably after a year, me and my friend were the only customers for lunch at a popular place! Felt awkward and visited nearby place the situation was same. the bylanes which used to be packed with vehicles, wore a deserted look. Well this was the scene on Sunday, wonder what these restaurants do on a weekday. |

| |  ()

Thanks ()

Thanks

|

| | #82 | |||||

| BANNED Join Date: Jul 2019 Location: Earth

Posts: 1,750

Thanked: 8,899 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Quote:

Quote: Quote:

Quote:

Quote:

| |||||

| |  ()

Thanks ()

Thanks

|

| | #83 |

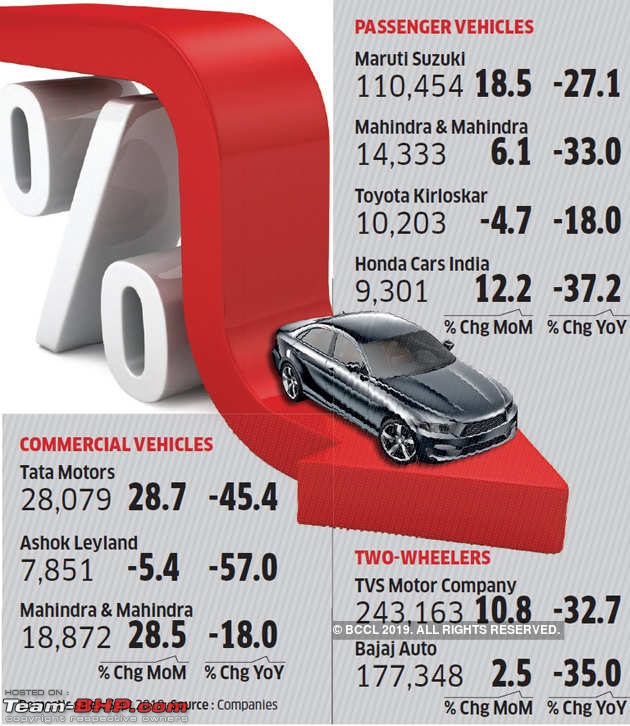

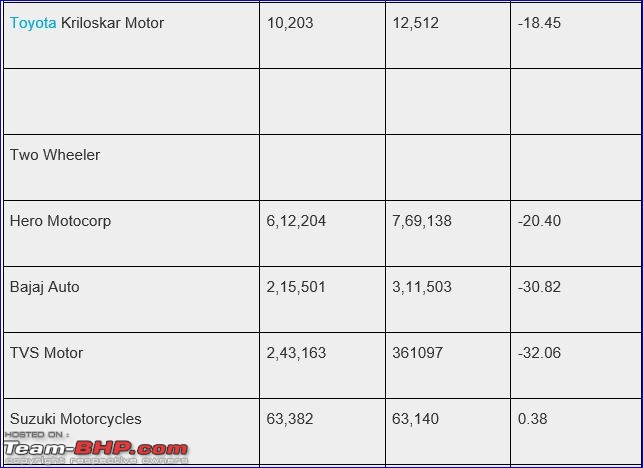

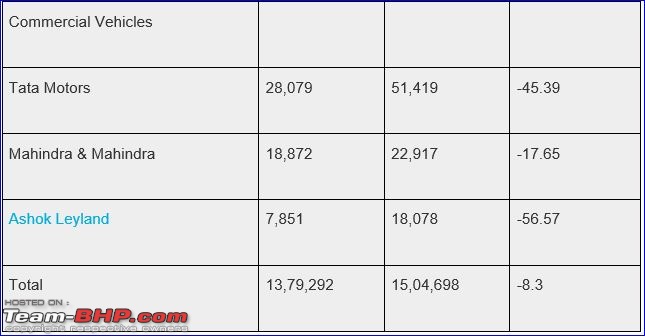

| Distinguished - BHPian  | Re: The great Indian automobile industry slowdown of 2018-19 Shows signs of recovery in September-19, but continues in the negative trend and woes are far from over!     ET Last edited by volkman10 : 2nd October 2019 at 08:13. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks volkman10 for this useful post: | varunswnt |

| | #84 |

| Senior - BHPian Join Date: Apr 2011 Location: Dubai/Bengaluru

Posts: 3,953

Thanked: 12,192 Times

Infractions: 0/1 (7) | Re: The great Indian automobile industry slowdown of 2018-19 I was making a purchase in the market and this slowdown has not changed dealer behaviour in any way. They continue to be unconcerned. It's 'business as usual' for staff. No promotions, price-offs or eagerness to sell. They still continue to fleece customers. For example, we picked up an NTORQ from Preetham Motors paying 88,850, cash. But when I cross-verified this with TVS, I was supposed to pay 88,100. That's Rs.750 overcharging. Now they say sorry and have given accessories and a scratch card. Has any tax benefit been passed down to buyers? Nothing! So in a way - there are no lessons learnt, and this slowdown could be artificially created, is my guess. By the way, they say there is slowdown in real estate, but builders still offer no discounts. Just few deals, here and there, that too regarding interest rates. Government has to note the ground realty, rather than just industry speak! Strictly my two bit. |

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank Sebring for this useful post: | Aditya_Bhp, Durango Dude, jailbird_fynix, pranjal1984, SideView, SpideyBoy, sri_tesla, Superleggera, suv100 |

| | #85 | |

| BANNED Join Date: Jul 2019 Location: Earth

Posts: 1,750

Thanked: 8,899 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Here starts the blame-game. Auto industry problems are essentially derived from SC order to upgrade to BS-VI, says Sitharaman. Quote:

| |

| |  ()

Thanks ()

Thanks

|

| | #86 | |

| Distinguished - BHPian  | Re: The great Indian automobile industry slowdown of 2018-19 Slowdown forces aggressive cost cuts at Tata Motors, co may offer VRS to 1,600 employees. The scheme will be offered to employees of different departments, across its businesses of passenger and commercial vehicles. Quote:

Link Last edited by volkman10 : 28th November 2019 at 16:15. | |

| |  ()

Thanks ()

Thanks

|

| |

| | #87 |

| Senior - BHPian Join Date: Sep 2019 Location: —-

Posts: 2,770

Thanked: 8,653 Times

| Re: The great Indian automobile industry slowdown of 2018-19

The lesser said about the government's role in the auto industry slow down, the better. And people in high posts who are unqualified to comment on specific industries, must refrain from doing so. They still haven't come out of the "Millennial buying mindset" reaction, now this. The government is clueless about demand stimulation, and has now squeezed out every percentage possible of the repo rate. Any further contraction will hurt the retail savings/investment process. The automotive industry too has played its part by not being bold and innovative in many aspects. For example, MSIL leadership have publicly sworn to 'bare minimum' compliance to safety standards, that too if push came to shove. They could have easily pushed the electric/hybrid tech in a big way, given their massive reach across the country. That would have spurred a new mindset towards cars. Instead of that, they provide us more tinpots like S-Presso. Last edited by fhdowntheline : 28th November 2019 at 16:44. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks fhdowntheline for this useful post: | AZT |

| | #88 | |

| BHPian Join Date: May 2013 Location: Mumbai

Posts: 108

Thanked: 321 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Quote:

1. There will likely be further rate cuts - I don't rule out rate cut by another 25 bps down to 4.9% levels - though any lower is tough 2. The issue isn't the government squeezing rates down; they're not being passed on! The fact is that most lending is still at a spread of 4% from the repo as loans in the retail segment and MSME segment aren't repo-linked at all. The TBLR, MCLR etc. are still very high with most banks 3. The issue isn't about the automotive sector alone - it's about the state of the economy and there are multiple key drivers A. Lack of new sunrise segments The previous decades have brought forward new sectors which have driven growth for the economy - software, outsourcing (BPO), pharma being the examples from the decade before this one. But nothing else has come up. A combination of atrocious skill-level from educational institutes, horrible contract enforcement laws (we remain Leftist to the core), horrid labour laws and high prices of resources have stunted growth in "sunrise" segments. Our Balance of Trade is collapsing - simply because we aren't creating world-class industries and exports therefore just aren't rising in tune with what's needed. It's all (at best) nominally inflation-linked here. Bottomline - when you don't innovate, you stagnate and then recede. B. The crisis caused by subsidy culture Very under-reported but the DisComs are in crisis. This could well lead to another financial / banking meltdown given the scale of the issue. DisComs owed 74,710 crores to Gencos in July 2019 - of which 55,091 crores was overdue. Where will the money come from? Given the scale of subsidies, recovery is highly unlikely without drastic and politically suicidal reform OR a very expensive bailout - which would then affect (at political cost) other schemes that need funding. This is a driver for low PLF (plant load factors) at most Gencos. This in turn leads to Genco losses as well as poor power supply quality (load-shedding) which in turn increases effective cost of electricity for industry and specially commercial establishments even further (switch on the DGs) when they're already paying higher prices to cover the cost of subsidies. Fantastic. C. Increased coverage of core infra Economics 101 tells you that government spending can dramatically aid the growth number and improve liquidity. Since about 1998-2000, government spending was massive (including PPPs, sanctioned projects and direct investment) in core infra - power plants, railways, roads and highways etc. But now, we've reached saturation in some areas. At the same time, government subsidies just kept expanding. From MGNREGA to housing to loan waivers and more, there is an increasing drain on the exchequer - all while the present dispensation increased tax rates and therefore led to a dramatic miss in collections against expectations. So, government spending in areas that aid liquidity has fallen - and revenues haven't increased. Savings etc. is another bomb. Most Indians want high deposit rates - and PSU banks set the floor here. Also, falling deposit rates would lead to a potential flight of FIIs as we stop offering the risk-return proposition that we present today. This too hurts the space the regulator has for maneuvering. Final point; if we are to see long-term gains, it's essential to have: 1. Drastic reform in power sector 2. Immediate relaxation in labour laws and land acquisition too 3. Overhaul of the system for ensuring contract enforcement and IP protection 4. Education system reform - till we start churning out better graduates, we are condemned to remain third world / "developing". | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank imidnightmare for this useful post: | AZT, TDCi'd |

| | #89 |

| Senior - BHPian Join Date: Oct 2008 Location: kolkata/bangalore,india

Posts: 2,907

Thanked: 4,237 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Some good news coming in. Maruti has reported domestic sales of 143686 for November 2019 which is just a percentage less than November 2018, but it is a higher than October 2019. October was big festive month, so it is heartening to see auto sales seemed to have held going into November, and looks like the industry has stabilized. https://economictimes.indiatimes.com...w/72315766.cms |

| |  ()

Thanks ()

Thanks

|

| | #90 |

| BHPian Join Date: Oct 2009 Location: Mumbai

Posts: 198

Thanked: 1,248 Times

| Re: The great Indian automobile industry slowdown of 2018-19 Wholesale numbers for Nov 2019. Some numbers are approximate. KIA has reached number 4 and is agonizingly close to the number 3 player. They have reached here with just one product and in just 4 months! I had predicted that they would become number three the moment they launch their second offering. However, it looks like they can become number 3 with just Seltos! |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank fazayal for this useful post: | jailbird_fynix, Turbanator |

|