News

Maruti Ertiga & XL6: How they cracked the Indian MPV segment

Only time will tell if the Kia Carens will be able to stand its ground in the segment, sandwiched between the Ertiga & the Toyota Innova Crysta.

BHPian pqr recently shared this with other enthusiasts.

How did Maruti crack the compact MUV code with Ertiga 2nd generation and its derivative XL6?

Key achievements of Ertiga 2nd generation in 2021:

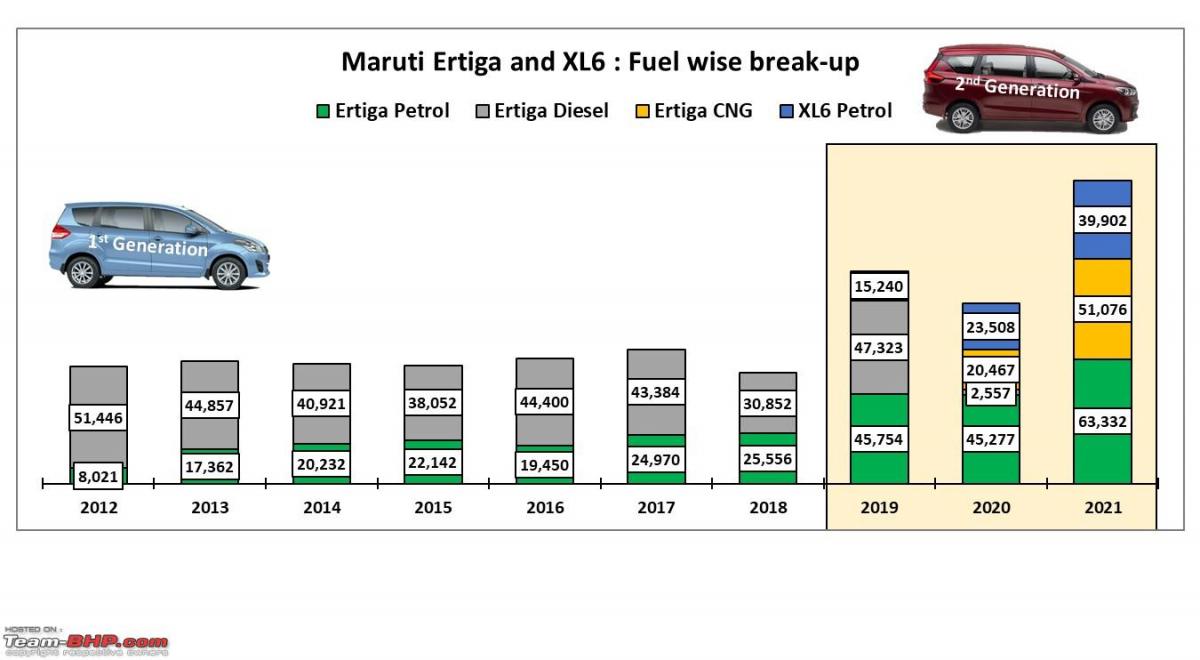

- Petrol (+CNG) only Ertiga and extended product line - XL6 - together sold 1,54,310, which is the highest in its lifetime

- 2nd generation extended Ertiga product line, in 2021, sold more than twice as many as the 1st generation, ever in any calendar year

- The extended Ertiga product line has joined the esteemed club of 1,50,000+ cars in a year (Other members - Maruti 800, Maruti Alto, Maruti Baleno, Maruti Wagon R, Maruti Dzire, Maruti Swift, Hyundai i10)

- 2021 CNG only Ertiga 2nd generation (51,076) nearly matched best-ever diesel Ertiga sales (51,446)

- XL6 (39,902) has been quite successful on a standalone basis, it is standing just behind Ertiga and Innova in sales tally, even ahead of (half of its price) Renault Triber (32,766)

Tracing timeline

Introduced in 2012, Ertiga 1st generation was a definitive product in the Indian market. It is a MUV with monocoque construction, front-wheel drive arrangement, with a compact footprint, offering comfortable ingress and egress, and the option of a 1.4L petrol or a 1.3L FCA sourced diesel engine (in a higher state of power tune), mated to a 5-speed manual transmission and was wearing a very attractive price tag, starting from ₹ 5,89,000 (lower than executive sedans). It was having 2nd generation Swift inspired, but differentiated design, which was nice on the eyes. Similar to Toyota Innova, Ertiga 1st generation imbibes kinetic motion in design quite well, shunning conventional van like the boxy image of MPV. Ertiga 1st generation was sharing platform with 2nd generation Swift means it was having back end cost synergy as well. Ertiga 1st generation was quite a city friendly due to its compact footprint and car-like driving behaviour, which made it an instant hit among customers with extended families or in need of a versatile car for daily drive. Fleet operators too were happy to have an MPV with a much lower price tag than that of Toyota Innova.

By mid-2013, Maruti also introduced a CNG kit with dual ECU and gas-port injection for Ertiga (Lxi and Vxi variant), however, the SIAM library does not have a separate sales breakup between petrol and CNG, for 1st generation Ertiga.

Ertiga 1st generation’s facelift was introduced in 2015, and in came 4-speed torque convertor transmission for 1.4L petrol engine and the addition of starter-generator based mild-hybrid technology for 1.3L diesel engine. Sales always remained in 60,000+ territory throughout the lifecycle, with diesel commanding 60% of the mix.

2nd Generation Ertiga

2nd generation Ertiga was launched towards the end of 2018. 2nd generation Ertiga was having a new design direction with more conventional-looking headlamps and larger tail lamps that covers a larger rear area, quite a departure from 3rd generation Swift with which it shares a platform. Dimension wise, 2nd generation Ertiga was longer (+130mm), wider (+40mm), slightly taller (+5mm), with the same old wheelbase. New structure and sheet metal have added generous bulk at the right places.

2nd generation Ertiga came with a new 1.5L petrol engine (+12 bhp power and +8Nm torque) and the same 1.3L FCA sourced diesel engine, this time both the engines were coupled with starter-generator based mild-hybrid technology, though transmission options remained the same.

The price increase was in the range of ₹ 50,000 - ₹ 72,000 for petrol variants. All the variants received projector headlamps, LED tail lamps, mild-hybrid technology, 3rd-row seat recline function and coloured TFT MID.

For lower diesel variants price optically remain unchanged, despite the addition of projector headlamps, LED tail lamps and 3rd-row seat recline function for all diesel variants. The top two diesel variants (Zdi and Zdi+) saw an increase in price by ₹ 44,000 and ₹20,000, respectively, for the Auto AC feature.

Later in 2019, Maruti replaced FCA sourced diesel engine with its first in-house developed 1.5L BS4 diesel engine mated to an all-new 6-speed manual transmission, prices were ₹ 29,000 higher than the equivalent 1.3L diesel engine. Maruti also introduced a factory-fitted CNG kit for a 1.5L petrol engine (without mild-hybrid technology), only on the VXi variant and Tour M (for fleet operators), for an additional sum of ₹ 71,000 over a petrol-only engine. All new sets of engines were refined and fuel-efficient, in a typical Maruti way. However, Maruti has to discontinue the 1.5L diesel engine from 1st April 2020 as the BS6 upgraded engine prototype failed to meet BS6 emission regulation in internal testing due to some thermodynamics issues.

In 2019, GNCAP subjected Ertiga 2nd generation to a 40% frontal offset crash test. It received a 9.25 score (on a scale of 0-17) for adult occupant protection which translates into a 3-star rating and the body shell was found to be UNSTABLE. Not very remarkable performance on safety parameters, though.

With the 2nd generation Ertiga launch - full-year sales nearly doubled in 2019 (vs 2018) in an already depressed market. The year 2020 saw sales plunge to 91,000 mark, owing to COVID-19 induced pandemic, still, Ertiga+XL6 became the 6th best-selling passenger vehicle in the Indian market. Come 2021, despite all odds Ertiga+XL6 became the 5th best-selling passenger vehicle in the Indian market, with a stellar sales figure (1,54,310). CNG Ertiga 2nd generation launch has proved to be a game-changer for Maruti, as it largely filled the void created by diesel engine discontinuation.

Why the 2nd generation Ertiga with a petrol-only engine (+CNG) is more successful than the 1st generation Ertiga with petrol as well as diesel engine option?

The answer lies in the additional increase in length of 2nd generation Ertiga. 2nd generation Ertiga is 130 mm longer than 1st Generation Ertiga, though the wheelbase remains the same. That additional increase in length has gone in the rear overhang extension.

As a result, the third row of seats now have more legroom to offer than before and there is additional usable boot space of +74L. Maruti has added recline function to the 3rd-row backrest, thus making it more practical.

Now if one looks at the basic definition of a MUV: It is a category of vehicle meant to carry more passengers or more luggage or both together. Ertiga 1st generation was having little compromised 3rd row and was a little less usable for carrying more passengers in comfort or more luggage at the same time. This never worked that well for the fleet operators - one of the major target segments. With 2nd generation Ertiga, the fleet operators can easily fit in adult passengers in reasonably acceptable comfort levels. Same way, family segment customers can have, adults too, seated in reasonable comfort for a given budget (those who cannot afford Innova). Value was unlocked by the 2nd generation Ertiga and that resulted in very good sales traction.

Introduction of XL6: A clever derivative

XL6 is Ertiga 2nd generation’s outdoorsy crossover version, with lots of cosmetic upgrades inside-out. In marketing terminology, this concept is known as product line extension.

XL6 gets captain seats in the second row replacing the bench seat of Ertiga, an all-black interior theme with a better quality roof liner, redesigned bumpers, revised bonnet line and roof rails. In terms of features, it gets new LED headlamps, DRL, tail lamp, cruise control, auto headlamps, and leatherette seat covers, over Ertiga’s usual features list. For XL6, Maruti just black painted 15” silver alloy wheels of Ertiga, a design change and size upgrade could have been a better differentiator, though. Mechanically it remained the same. Increased on paper dimensions (length and width) over regular Ertiga is all due to protruding body cladding and reprofiled bumper and there is no change in-cabin space. Sold through the Nexa network, Maruti is trying to build a premium brand identity for XL6 over regular Ertiga. It is mostly targeted towards the chauffeured driven segment, who seek the luxury of captain seats, somehow it works quite well in India. Maruti is charging a price premium of ₹ 48,000 to ₹ 68,000, for Delta and Alpha variants of XL6 over Zxi and Zxi+ variants of Ertiga 2nd generation, respectively. Maruti claims, that, they and their vendors have jointly invested ₹ 100 crores in the development of XL6.

XL6 actually picked up immediately and added incremental monthly sales of 3,000 units to the Ertiga product line. For relative reference, 1st generation Ertiga was selling around 5,000 units on a monthly average basis. Now that is quite a figure for highly synergized investments.

Competition

Many manufacturers tried to emulate Ertiga 1st generation recipe, in past, to gain volume and success. Forget about their success, rather, they failed miserably and had to discontinue their MUV product line completely, that too within 4 years span.

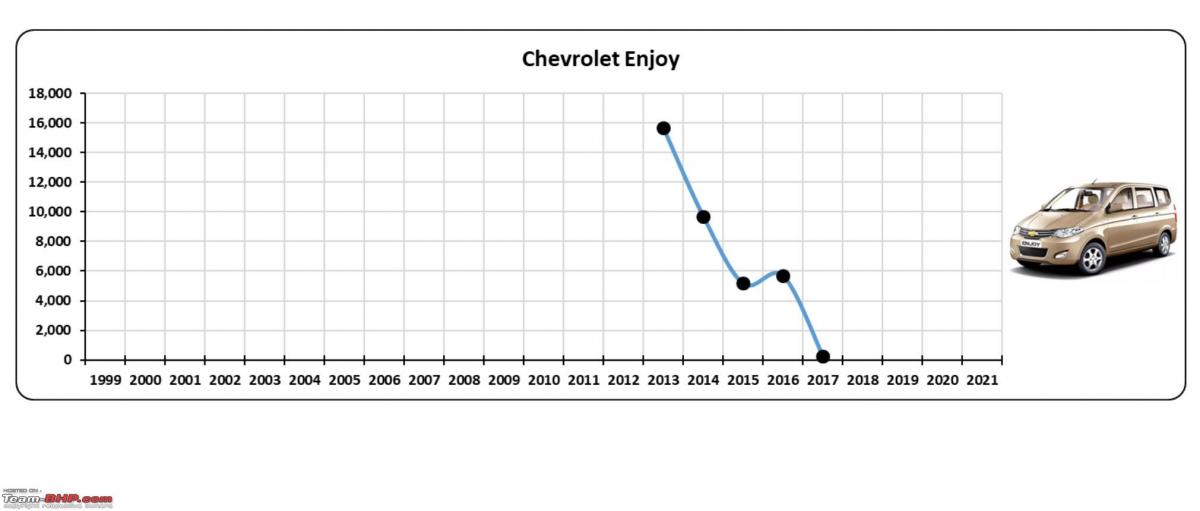

Chevrolet Enjoy (2013-2017)

SAIC has had slipped in the RHD version of its Chinese product - Wuling Hongguang S - as its third product in India, under the Chevrolet badge, and named it ‘Enjoy’. It was a rear-wheel-drive, monocoque construction with the boxy rear end and age-old interiors from the 90s. It did undercut Ertiga’s pricing at the time of introduction but later reached the same level. By setting contemporary Maruti Ertiga as a benchmark, the Indian target audience decided not to compromise on value by paying the same amount asked for Chevrolet Enjoy. So Enjoy turned out to be a flop.

Honda Mobilio (2014-2017)

Mobilio was having an edge over Ertiga in terms of engine performance, and space was nearly at par. But then Honda tried to command a hefty brand premium in price (₹ 80,000+), and the customer didn’t accept Mobilio at such a price point with a sub-par interior from Brio. Honda initially was quite lazy and didn’t even try to differentiate Mobilio from Brio and Amaze which were having the same front design. Honda Mobilio was a massive flop.

But somehow it didn’t deter Honda India, they brought in some sort of jacked-up crossover version of Mobilio, with Honda City inspired front, developed in Thailand primarily for the ASEAN market and called it BRV (Bold Runabout Vehicle), whatever that name means in Honda world. Honda was trying to build SUV the brand identity for BRV and pitted it against Hyundai Creta, but the brand image created in the mind of Indian customers was that of a crossover version of Mobilio (due to near-identical side profile), result - another big flop from Honda India.

Renault Lodgy (2015-2019)

Renault was aiming for Toyota Innova with rebadged European Dacia Lodgy for the Indian market. It was having K9K series diesel engine option in two states of tune, to target both fleet operators and family segment, buyers. But then target customers compared it with the Ertiga as a benchmark, not Toyota Innova as intended by Renault India, and Lodgy started looking expensive, without much value. The worst part – is it looks like an ambulance and nobody wants to buy an ambulance to ferry their family. Renault Lodgy was a big flop.

There were unconfirmed reports of Hyundai starting a compact MUV project way back in 2012 to rival Ertiga 1st generation but later abandoned it in due course of time, due to an unmet cost target.

The project was recently revived by KIA with Carens (a bigger vehicle than Ertiga 2nd generation), as there is a good chance of higher volume potential and cost synergy among both the brands. Positioning will be clear once prices are out in the coming months.

Has Maruti Ertiga 2nd generation nearly killed Mahindra Marazzo (2018-)?

Compared to Ertiga 2nd generation – Mahindra Marazzo is bigger on the external dimension, with a relatively more powerful diesel engine, and a GNCAP safety rating of 4 Star (Ertiga scored 3 Star), relatively premium interior feel, also it is priced in the sweet spot - between Ertiga and Innova, more so by maintaining a safe distance from Innova. Mahindra does have a network and pedigree of selling people movers across the length and breadth of the country, a large majority of hinterland relies on Mahindra or Force Motors for cheap small scale proper public or commercial transport vehicles.

Going by these on paper facts, it seems like Mahindra was having the right set of ingredients for a successful recipe. But it turned out otherwise. 2nd generation Ertiga was launched towards the end of 2018, just after the launch of Mahindra Marazzo, and Marazzo lost steam immediately afterwards. Sales could not even cross the 20,000 mark ever in any given calendar year, even ugly looking Mahindra Xylo crossed the 30,000 mark at the beginning of its lifecycle. What gives?

The answer lies in, the attributes, buyers keenly look for in an MPV. To start with, the third row of Mahindra Marazzo offers relatively less space and seating comfort in comparison to Maruti Ertiga 2nd generation, and it goes against the primary attribute buyers look for in an MPV. After taking a seat in the third row of Marazzo, right after Ertiga, space difference and seating comfort level become a little more apparent. With the reclining third row of the seat’s backrest, larger side glass panel, Ertiga 2nd generation feels more spacious, practical and airy, thus taking away the cake here.

Marazzo’s boot space figure is marginally less on papers but is significantly affected on practicality, due to loading lip and vertical orientation, whereas Ertiga’s boot floor is flat with respect to loading lip (due to false flooring) and offer a larger base for luggage storage, thus Ertiga being more accommodating and practical.

Mahindra has also gone for complex platform architecture for Marazzo. Whereas Ertiga has a simple monocoque FWD platform shared with other Maruti products for cost synergy, Marazzo has ladder frame underpinnings with FWD transverse engine architecture (thus no propeller shaft). It is quite unique as ladder frame chassis conventionally have RWD biased propulsion system. Seems like a hybrid architecture to have the goodness of both the world. But financially Mahindra has killed the cost synergy somewhere. Moreover, the dashboard intrudes too much inside the cabin and eats up in-cabin space. Also, the engine bay is too cramped for regular maintenance work. Seems like a case of misplaced packaging due to a lack of harmony between designers and engineers at Mahindra.

The overall value proposition offered by Marazzo for customers gets distorted, as the top-end Marazzo M6+ BS6 diesel variant is ₹4,78,000 and ₹ 4,10,000 (ex-showroom price level) more expensive than Maruti Ertiga Zxi+ and Maruti XL6 Alpha BS6 petrol manual variants, respectively, but offers less practical space in the third row. A high price gap of ₹ 4,78,000 at the ex-showroom level, offsets the diesel advantage of Mahindra Marazzo over BS6 petrol Ertiga. CNG Ertiga is priced at ₹ 9,87,500, here works as icing on the cake, as it is much cheaper to own and run, wherever CNG filling station network is good, and becomes a favourite choice among the fleet operators.

At the same time, Maruti is also keeping a strong check on prices, though virtually it has no direct competition right now, in the given price band. It seems, Maruti knows the price elasticity curve would not be favourable in its case, unlike for Toyota Innova, where price has gone up with time and so is the volume.

Does lack of automatic transmission or petrol engine reduce Marazzo’s potential further? Maybe yes, for family-oriented buyers, but may not be for fleet operators, later also being a big target segment.

Mahindra has benchmarked Marazzo against Toyota Innova (based on test mule images) and maintained a safe price gap, but never imagined in foresight that Maruti can take an incremental step for betterment, in the form of 2nd generation Ertiga and destroy the whole armour. For now, the presumed to be a sweet spot for Mahindra Marazzo in 2018, turns out, to be between a rock (Maruti Ertiga) and a hard place (Toyota Innova).

Only time will tell if KIA succeeds to make a place for Carens, sandwiched between Maruti Ertiga and Toyota Innova, with typical Hyundai/KIA’s traditional strength of long features list and diverse drivetrain option, or meet the fate of other not so successful challengers.

Conclusion

Market sizing

Market size for a new product always depends on the value proposition of the offering. Looking at 1st generation Ertiga’s sales number, anyone would assume 60,000+ market size, even for future product planning. However, an altered value proposition has unlocked higher market potential, even without a diesel engine. So market sizing exercise size should be very thoughtful.

Customer/Consumer Need analysis

- Customer/consumer’s unfulfilled needs to be explored in-depth and addressed before emulating ingredients and recipe of a successful competitor’s product, a basic tenet to success.

- Exterior Dimension and packaging – myth buster

- External dimension figures, may, may not be, the right proxy for real in-cabin or boot space. Real-world practicality needs to be always judged in person and validated during the product development phase. Hyundai Alcazar (2760mm) has a 10mm longer wheelbase than Toyota Innova (2750mm). Does that makes Alcazar offer more space in the second row or the third row, answer is, no! Dimension on paper can be deceptive.

- Harping on Creta’s success, Hyundai has gone for a product line extension in the form of a 6/7 seater Alcazar, to enter white space, with back end cost synergy. Hyundai Alcazar has already lost some of the market traction as of now, as Hyundai messed up with the 2nd and 3rd row of seating space, which rivals like Tata Safari do offer a better value at a justifiable price premium, except features though. In addition, Hyundai deliberately chose an underpowered, but more efficient 1.5L diesel engine, seems like an attempt to protect Tucson with a 2L diesel engine from complete cannibalization? The wrong choice again, as Tucson is not going to bring in volumes anyways, largely due to Hyundai’s brand elasticity limit, and Alcazar will suffer, as competitors do offer a more powerful diesel engine in that price band.

Price elasticity

- Price elasticity judgement is highly necessary, it is always safe to start at the lower price tag and gradually increase price based on the success of the product (like MG Astor and Mahindra XUV 700), rather than offering discounts in the early stage (like Skoda Kushaq). Not every product can have inelastic demand like - Toyota Innova, Fortuner and Hyundai Creta.

Check out BHPian comments for more insights and information.

.jpg)