Advice

The real cost of car ownership

Did you believe the smiling salesman when he said, “Sir, your equal monthly installment is just Rs.10,000 a month – surely, you can afford that!” I hope not.

Remember, the equal monthly installment (EMI) is just one small part of the total cost of car ownership; additional expenses can double the EMI. Because a car only depreciates in value, it should not be considered an investment at all. An asset, maybe; but never an investment.

Team-BHP explains all the costs you should budget and prepare for as a car owner.

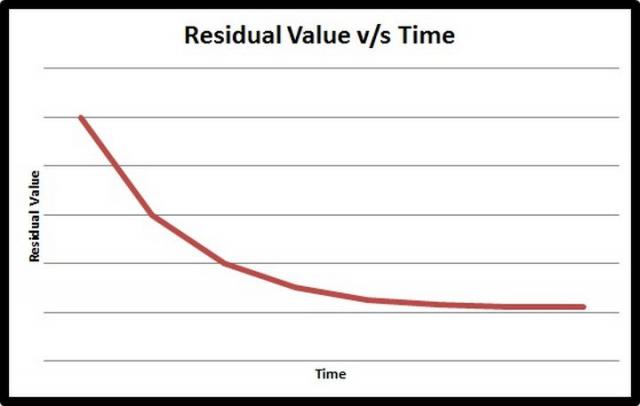

- Depreciation: Depreciation is far and away the biggest expense of motoring. Your shiny new car will lose almost 10% of its value as soon as you drive it off the showroom floor, and 30 to 40% in the first year of ownership alone.

- Fuel Costs: If there is one thing that has always increased with time, it’s the cost of fuel in India. Petrol and diesel are more expensive than ever before and fuel alone – especially petrol – can cost as much as your EMI payment, depending on how you use your car.

- Interest: Your EMI includes not only payments towards the original loan, but also the interest due on it. You will be charged interest rates between 6 and 14%.

- Taxes: Most car loans do not cover taxes like octroi and RTO tax. In Mumbai, the octroi alone adds 5.5% to the showroom price of a car.

- Scheduled maintenance: On average, Indian cars require scheduled service twice a year. Expect to pay from Rs.2 000 per visit, but this amount will increase as your cars ages and some luxury cars like Mercedes can cost Rs. 15,000 per visit. Very few cars sold in India are covered by service plans that include routine maintenance.

- Unscheduled maintenance: Though most modern cars are generally very reliable it is not uncommon for a Maruti Esteem’s air conditioner compressor – or a Honda’s fuel pump – to fail. Replacement parts can be very expensive.

- Insurance: Insurance is another unavoidable cost of car ownership. Current rates for comprehensive insurance are anywhere between 3 and 4% of a car’s book value.

- Repair costs: Consider yourself lucky if you don’t damage your car’s body or engine in the first three years of ownership. Modern cars are exceedingly efficient and reliable, but accidental damage can be exceedingly expensive to repair.

- Accessorizing: Most car buyers opt for optional extras such as upgraded music systems, anti-theft alarms, body kits, custom alloy wheels etc. Accessories also add to the overall ownership cost.

- Miscellany: Parking costs, tolls, and tickets are just some of the additional charges that you will need to be prepared to pay for as a car owner.