| | #1426 | ||

| Distinguished - BHPian  | Re: Understanding Economics Quote:

Quote:

https://www.telesurenglish.net/amp/n...0320-0015.html The current five members of BRICS already combined together equal to 42% of the world population and if they do actually release a common currency or basket of currencies which member countries can trade with via NDB then that would be a start and will attract more countries to join them. With China mediating ties between Saudi and Iran it could soon mean the Yemen conflict might stop and could eventually see a decline of arm imports made by Saudi from US? | ||

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank SnS_12 for this useful post: | am1m, gauravanekar |

| |

| | #1427 |

| Distinguished - BHPian  | Re: Understanding Economics

The point about the petro-dollar and this demand making the $, and hence the USofA becoming powerful is mentioned many a time. Can you please help me understand how ? Why I ask: there has been a demand for the $, and it has been the defacto standard. But isnt it more show than go ? More like a status symbol ? How can just a (simple) demand/de-facto standard give the US power with this demand ? |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank condor for this useful post: | am1m, gauravanekar |

| | #1428 | |

| Team-BHP Support  | Re: Understanding Economics Quote:

Read this post from 2011 about how currency is used in international transaction. Petro-dollars is a further twist on the example from the link. If India wants to buy oil from KSA or Russia, first India has to procure dollars. That is because the seller only accepts dollar. Therefore, USA can simply print and sell dollars just because India is buying oil from KSA. This is what made them the richest country in the history of the world. | |

| |  (12)

Thanks (12)

Thanks

|

| The following 12 BHPians Thank Samurai for this useful post: | aargee, aim120, am1m, condor, digitalnirvana, gauravanekar, koyomi_araragi, Lobogris, premsky, rajvardhanraje, SnS_12, V.Narayan |

| | #1429 | ||

| Team-BHP Support  | Re: Understanding Economics Quote:

Quote:

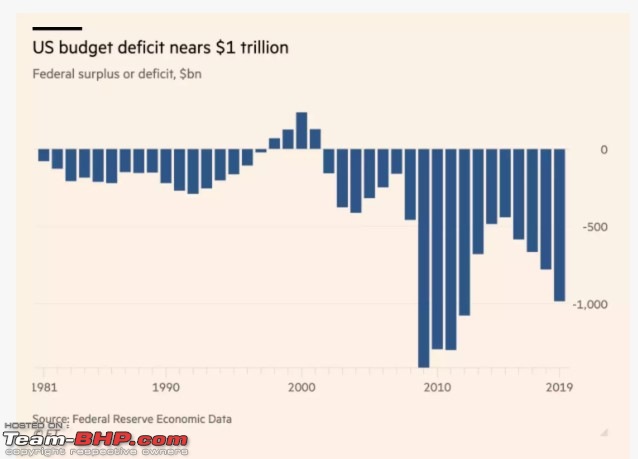

Now USA can afford this not because it is a "rich country" or has the largest economy. USA's tax revenues are significantly lower than their expenses - the difference is around $1.4 trillion now.  They can afford this simply because they can print whatever money they need to fund their geopolitical extra-curricular activities. Other countries cannot run large deficits like USA because their currencies are accepted only locally. They cannot use it for imports for example. But USA can. Because they can create dollars which is widely accepted by all countries, they literally have unlimited money. Last edited by SmartCat : 1st April 2023 at 13:21. | ||

| |  (17)

Thanks (17)

Thanks

|

| The following 17 BHPians Thank SmartCat for this useful post: | aargee, aim120, alphadog, am1m, amit_purohit20, condor, digitalnirvana, koyomi_araragi, Latheesh, Lobogris, quickdraw, rajvardhanraje, sainyamk95, SnS_12, srvm, thanixravindran, V.Narayan |

| | #1430 |

| BHPian Join Date: Sep 2008 Location: Hyderabad

Posts: 280

Thanked: 573 Times

| Re: Understanding Economics A lesser dollarised international trade would be better for all involved and given the experiences of what having 1 currency dominate the global trade can do, it is better if nations do not try to replace USD with something else. It is better if bilateral trade is done with the currencies of the nations involved. Creating a new currency directly as a competition to USD will push US to take steps, however drastic, to defend USD either overtly or covertly. From the reports I read, the wars on Iraq, Libya were a direct result of the rulers trying to trade oil in Euros rather than USD. At the same time, I hope the decline of USD is more gradual and not sudden or too fast. The impact of a major economy like USA collapsing, which it certainly would if USD were to stop being the dominant currency within short period given the debt levels it has, would be too drastic and destabilizing for global economy. Last edited by vamsi.kona : 1st April 2023 at 15:27. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank vamsi.kona for this useful post: | am1m, Lobogris, sainyamk95, Stolidus500 |

| | #1431 | |

| BHPian | Re: Understanding Economics Quote:

And the Yen is beloved by governments and institutions since it is considered safe haven, like the Swiss franc and gold. Last edited by no_fear : 1st April 2023 at 21:44. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank no_fear for this useful post: | amit_purohit20, SmartCat |

| | #1432 | ||

| Team-BHP Support  | Re: Understanding Economics Quote:

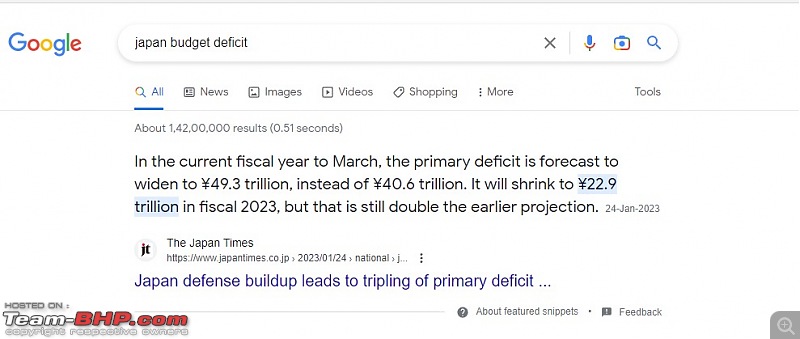

That comes to around $300 billion. India's budget deficit is around $180 billion. Quote:

| ||

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank SmartCat for this useful post: | am1m, digitalnirvana, no_fear |

| | #1433 | |

| BHPian | Re: Understanding Economics Quote:

The deficit is what you mentioned. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks no_fear for this useful post: | SmartCat |

| | #1434 |

| BHPian Join Date: Sep 2012 Location: YYZ

Posts: 55

Thanked: 451 Times

| Re: Understanding Economics And Saudi Arabia/OPEC+ just announced a production cut. Brent nearing $86 a barrel. This is going to make US-Saudi relations so much worse but the timing of it just makes more and more sense. Saudis just invested Billions in China's upstream oil refinery projects. Does not affect China much but boy will this make things worse for EU and other western nations. I think one key unofficial member of the OPEC+ is Texas (the private US oil companies.) Anybody agree/disagree? Not hopeful for peace lasting in the Middle East. Too many wild cards and self-interests in the game. But people are people and people are greedy. Especially dictators. In the end it would be quite comical if greed is what brought peace to Middle East.  All the GCC oil producing nations have their currencies pegged to the dollar and defend this peg viciously. It gives them stability. Saudi Arabia might devalue their currency a little bit in the future though as they want more companies to open shop in their country. But Dollar is still King. They can settle in Yuan and try everything they want under the sun, China knows it, the Saudis/GCC know it. There's a new nexus being created to completely stave off western countries from Asian and African Regions. This is old news now but post 2020, it has only accelerated. Between China and Asian/African/South American nations, they have all the resources that are the backbone of any economy; Energy, Agriculture, Manufacturing, Services and soon, Technology. Suddenly it appears clear that US needs the world more than the world needs the US. US/EU getting busy with domestic issues is also a good/bad sign of this pivot from not stopping any time soon. It is surprising it took the world this long to realize that China and Middle East/African countries complement each other much better than US and the rest. I have a feeling US will try to severely restrict China under the pretext of defending Taiwan or will strongly stretch its muscles in the Middle East through Israel. Peace in the MEA is US's nightmare. China is so much worse than the US though. What US does in secret, China does rather openly and without any checks or balances. If China displaces the US, we as citizens don't really gain much except maybe less foreign interference in domestic policies. Last edited by Imran.Syed : 3rd April 2023 at 09:13. |

| |  (15)

Thanks (15)

Thanks

|

| The following 15 BHPians Thank Imran.Syed for this useful post: | alphadog, am1m, anandtheleo, digitalnirvana, dragracer567, Everlearner, GForceEnjoyer, JoshuaM, Nitish B Shetty, premsky, R.G, rajvardhanraje, Sen, TheCatalyst, V.Narayan |

| | #1435 | |

| Senior - BHPian Join Date: Feb 2010 Location: -

Posts: 1,157

Thanked: 1,271 Times

| Re: Understanding Economics Quote:

This is one of the reason why Warren Buffet says "Never bet against America". | |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank download2live for this useful post: | am1m, digitalnirvana, InControl, rajvardhanraje, V.Narayan |

| | #1436 | ||||||||

| Distinguished - BHPian  Join Date: Aug 2014 Location: Delhi-NCR

Posts: 4,330

Thanked: 72,426 Times

| Re: Understanding Economics Dear @Imran.Syed, Thank you for expounding your perspective and making some very interesting observations. My take below on the key points you raise. My perspective is different while we fully understand that each of us including the world's leading diplomats and Foreign Ministers are like the blind men trying to describe an elephant. Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

Last edited by libranof1987 : 3rd April 2023 at 14:39. Reason: As requested | ||||||||

| |  (12)

Thanks (12)

Thanks

|

| The following 12 BHPians Thank V.Narayan for this useful post: | am1m, darkchild82, digitalnirvana, dragracer567, Herschey, Mu009, premsky, quickdraw, R.G, rajvardhanraje, Samurai, v1p3r |

| |

| | #1437 | |

| Senior - BHPian Join Date: Aug 2019 Location: BAH / MCT

Posts: 1,128

Thanked: 6,355 Times

| Re: Understanding Economics Quote:

The conventional wisdom since the 2000s was that the Chinese will slowly take over this role. Even within the US, this was generally accepted as a fact, especially after Obama was elected into office. However, the miscalculation was that everyone assumed that the Chinese would continue to grow forever - the notion that got seriously challenged post-covid when the Chinese economic growth stalled and is a shadow of its pre-covid times. We have to keep in mind that China is still not a ‘rich country’ and has a long way to go before it becomes a high-income economy. Structural issues in the economy, the inexplicable crackdowns on Chinese corporations by Uncle Xi and the horribly bad demographics that make Japan seem stable are real issues staring China in the eyes. At this point, it really is possible that the Chinese economy might never surpass the US economy in nominal terms. Not to say that the US is in a better situation - it is exhausted by two decades of war, it’s politics is dangerously polarised, safety is non-existent and trust in its leaders is at a historic low (something to reflect at the future of Indian democracy as well)! Offcourse, this was America in the 70s as well before it reinvented itself but we can’t really count on precedence for the future. And all this is while the US is still the most dynamic western economy, the rest are either dependent on natural resources (Canada and Australia) or are in perennial decline (most of Europe). What I do see happening is the world dividing into smaller fiefdoms where local landlords exercise power. A nice example is the Middle East where countries like Saudi Arabia and the UAE (supported by Israel) is increasingly not beholden to the US and shares power in a delicate balance with other regional powers like Turkey and Iran while playing US and China off eachother. India is also playing a crucial role here - infact there is even a Middle Eastern Quad now called I2U2 consisting of India, Israel, US and the UAE. Large countries are reclaiming their backyards with the prime example being the eye-watering investments that India is pouring into its neighbours to compete with Chinese money. Offcourse, fiefdoms are never stable and there is always a higher possibility of war as compared to being in a unipolar or bipolar world. This means, yes, the US dollar will almost surely decline but what would replace would be a basket of arrangements (Narayan sir hinted about this in the Ukraine war thread but I disagreed with him then  ) without an international standard such as the SWIFT system. Western systems would still be trusted more but most transactions might take place in a patchwork of bilateral arrangement. It’s hard to even imagine how crypto would get involved in this mix. ) without an international standard such as the SWIFT system. Western systems would still be trusted more but most transactions might take place in a patchwork of bilateral arrangement. It’s hard to even imagine how crypto would get involved in this mix. | |

| |  (20)

Thanks (20)

Thanks

|

| The following 20 BHPians Thank dragracer567 for this useful post: | ads11, am1m, DetonatoR, digitalnirvana, DigitalOne, maheshmenon, Mu009, ninjatalli, Old_Salt, R.G, rajvardhanraje, S1200, Sach_511, sainyamk95, Samurai, sri_tesla, V.Narayan, vamsi.kona, varunswnt, xsrahul |

| | #1438 | |||||||

| Distinguished - BHPian  Join Date: Aug 2014 Location: Delhi-NCR

Posts: 4,330

Thanked: 72,426 Times

| Re: Understanding Economics Quote:

Thank you@dragracer567. This is one of the most erudite, well crafted and balanced posts on geo-politics I have ever read on Team BHP. This quality of writing one gets to read in places such as the Foreign Affairs Journal of Washington which I devour each month. It is a joy discussing matters with you because unlike some you never go burrowing down a jingoistic rabbit hole. My thoughts follow on the points you have raised. Didn't think I'd let it pass did you :-) Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

All, As most know there are 3 roles the USD plays today - (i) the medium of denomination ie the unit in which traded goods are priced (ii) the medium of settling traded values - that's where SWIFT comes in; and (iii) a store of wealth - which is where all those US treasury bills go. For the first, most goods, even under bilateral non-USD settlement treaties, will continue being priced in USD even if settlements are in RMB, INR or EUR etc. For the second some bilateral move away from USD will occur and is emerging very steadily. That is not going to change even if another Ukraine kind of event takes place. My guess is, as stated earlier that in two decades about 50% to 60% will still be in USD - the USD will be first amongst equals. For the third the US will learn the hard way that you cannot keep sanctioning nations and expect them to fund your pile of debt. In years to come the act of freezing Russia's $300bn of national reserves that were kept in USD will be seen as an act of monumental folly driven by a deep arrogance by USA. It has not gone unnoticed by China, India, Brazil, Saudia. No one will be very vocal but actions will speak. USA is basically borrowing to repay old debts and to fund their deficits. Every major economy outside the White world, other than Japan & South Korea, is on this bandwagon of de-dollarization of trade. This will be an interesting space to watch next one year. | |||||||

| |  (12)

Thanks (12)

Thanks

|

| The following 12 BHPians Thank V.Narayan for this useful post: | am1m, digitalnirvana, DigitalOne, dragracer567, Mu009, ninjatalli, Old_Salt, premsky, rajvardhanraje, sainyamk95, Samurai, vamsi.kona |

| | #1439 |

| BHPian Join Date: Sep 2008 Location: Hyderabad

Posts: 280

Thanked: 573 Times

| Re: Understanding Economics One of my worries, not completely without evidence or history, is that as the USA sees more and more nations trying to move away from dollar, if not completely at least to some extent, they will not let it pass easily. The y can attribute a large part of their growth to their role in the two monetary systems that had put them at the centre of global forex, The Bretton Woods system and the petro dollar. Add to that the war ravaged Europe, USA was the primary attraction for many as it was the major power which was also democratic and had a free society. Now the current changes in international trade are very slowly chipping at that advantage of USD. The US has learnt from its many wars that it cannot take on any major nation head on. But the US agencies are as capable or even more capable in covert ways of bringing things to their side, be it corporations or nations. I have read of instances where CIA went to the extent of creating a social media platform to cause unrest in Venezuela. The advent of social media only makes it far more easy for them to mould opinions and cause unrest in places which they feel are a threat to the status quo. Their domestic situation is quite fragile but one thing that has been proven time and again is that when it is put as Us against Them, Americans tend to unite far more easily. So it is a very delicate balance nations such as India need to tread. Foreign policy never felt this important for us in the last 2 decades as we were pretty minor players in global space. The next decade or so is filled with huge opportunities and minefields for us to strengthen our status as an emerging power. Last edited by vamsi.kona : 5th April 2023 at 16:14. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank vamsi.kona for this useful post: | Herschey, rajvardhanraje, V.Narayan |

| | #1440 | |

| Senior - BHPian Join Date: Feb 2010 Location: -

Posts: 1,157

Thanked: 1,271 Times

| Re: Understanding Economics Quote:

This might be border rumour mongering but it seems China (along with Russia?) are working on launching a currency based on Gold. Fed printing dollars at slight wiff of trouble has made countries uneasy. Latest was being the SVB collapse. | |

| |  ()

Thanks ()

Thanks

|

|