News

Can the big German luxury EV makers protect their pricing power?

The BYD Seal is undercuts the BMW i5 M60 but still delivers the same 3.8 second 0-100 km/h time.

BHPian 84.monsoon recently shared this with other enthusiasts.

Can the Big German Luxury EV makers protect their pricing power with prices of mass-market EVs dropping and the Chinese EV makers bringing luxury EVs to the market?

European luxury brands enjoy immense pricing power in the luxury EV market. They are charging an arm and a leg (and even a head) for their EVs. The EQS and BMW i7 are priced atrociously high at well over 2 crores on the road. However, some strong headwinds are going to soon start impacting this pricing power - which was built up carefully, with stories of sustainability and technology sophistication over the years.

The media machine of the big German manufacturers is on overdrive to try and protect the pricing power for their EVs. The Mercedes India CEO recently wrote an article arguing how one should not compare an EV to a smartphone. The flimsily concealed reason behind his strongly argued article is that this kind of comparison will hurt the EV makers' pricing power. However much they try to drum up this version of the story, the reality is that EV prices will behave not very much differently than smartphone prices due to the rapid technological change in this industry, driven both by advances in battery technology and software.

Five strong headwinds are coming in fast, which will erode the pricing power of these luxury EV makers:

1. Mass market EV price drops set expectations of similar drops for luxury EVs

Prices of mass-market EVs are dropping fast. MG just announced a 15% price reduction on its most popular ZS EVs. Tata Motors followed with a 6 - 7% price reduction on its flagship Nexon EV. Mahindra recently launched the heavily updated XUV400 EV, with tons of additional features - at a price that is 10% lower than that of the facelift model. It is just a matter of time before consumers expect that EV prices for luxury brands will come down in a similar pattern to the rest of the EV market.

Luxury EV makers will fight tooth and nail against this expectation and perception so that they can continue to protect their pricing power. Today, there is a leading article in the Economic Times explaining why the prices of luxury EVs will not drop as the mass market ones have recently. I would be least surprised if the luxury EV makers are not a united force behind such press coverage.

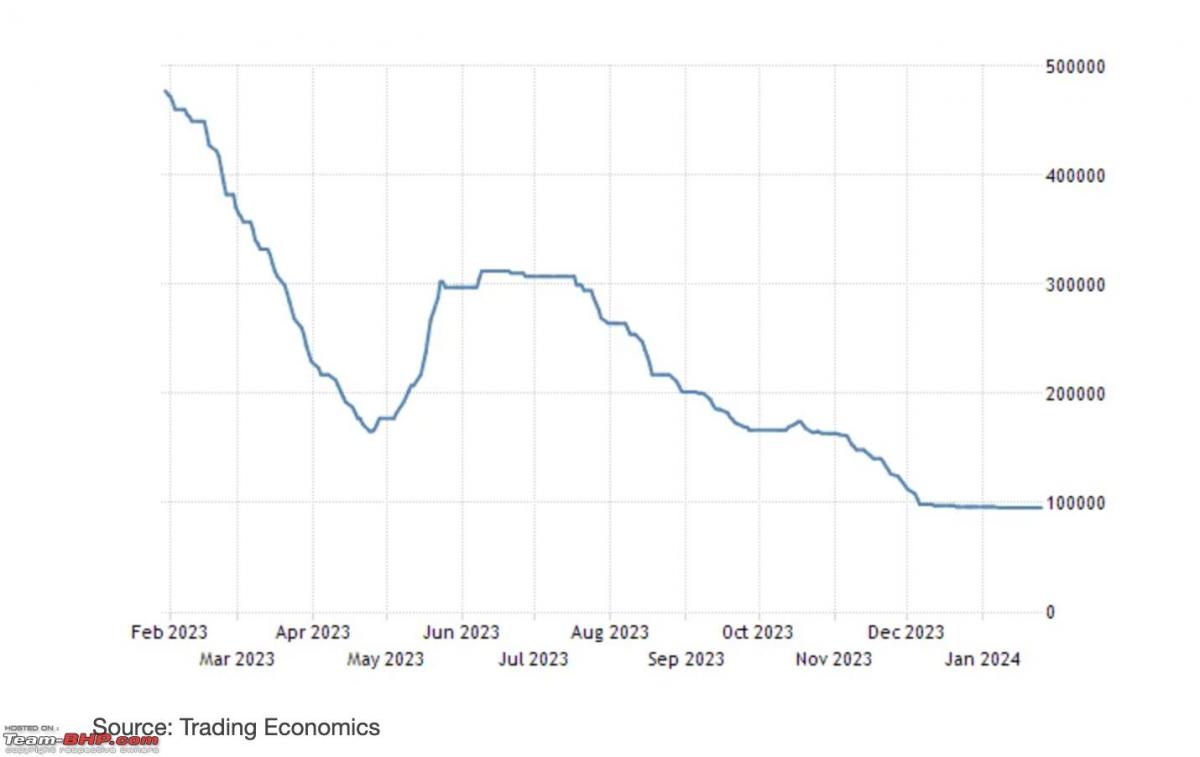

2. Teutonic drop in Lithium prices and Ongoing drop-in Lithium Battery Prices

Lithium prices have collapsed to just one-fifth of the price prevailing a year ago (See below for the Lithium price chart over the last 12 months). Lithium battery prices have also come down sharply. In the coming months, we are sure to see battery prices fall further as they start to reflect the steep fall in Lithium prices and tepid demand from the China market.

The cost of an EV is to a large extent driven by the cost of the battery. It is estimated approximately 40% of the vehicle cost of an average EV goes into the cost of the battery luxury. With rapid reduction in the cost of the battery, it is impossible to keep the price of the end product protected from the underlying economics forever. For Luxury car makers, it is not possible to differentiate very much in terms of the quality or life of the battery that goes into the EV, as Chinese manufacturers are actually ahead in battery technology compared to the Europeans. The pricing moat that the luxury car makers built in the ICE era by developing a higher level of engineering and performance into the engines is much harder to replicate with EVs.

3. The arrival of the Advanced Born Electric and Long Range EVs from the Indian majors.

If you need an EV that can do 500 km on a single charge today, you will be forced to look to the luxury German EV makers or the Korean twins (Hyundai/Kia). Very soon-sized EVs, such as Mahindra's XUV.E8 with an 80 KWHr battery will hit the market at a price point not much higher than that occupied by mid-size SUV EVs like the Kona and ZS. Tata will further develop its Acti. ev platform-based models at a rapid pace to bring out EVs with over 500 KM range.

As incremental costs per KWHr of battery capacity keep coming down, most new EV offerings will move rapidly to the highest practical battery capacity for the car size. To take a smartphone analogy, remember how, even 4-5 years ago, pricey iPhones used to come with 32GB storage and now all the Chinese low to mid-range phones costing as low as 10K, offer a minimum of 128 GB. So mid-size and higher SUVs will move to 80KWHr and smaller SUVs and sedans will move to 60KWHr. The MG4 launched in the UK has close to 80 KWHr battery on a large hatchback form factor. This will further narrow the differentiation enjoyed by the luxury EV makers with their larger batteries so far.

4. Rapid drop in prices of used EVs.

Earlier this week we saw the shocking reports of how used car prices of Tesla dropped to 50% of new car price in just 18 months. In the general used car market in the US, prices drop to 50% of the new ICE or Hybrid car price after 4+ years. India has not yet seen the real impact of this depreciation as the used EV market is shallow given the more recent development and commercialisation of EVs in this market.

This aspect of the dramatic depreciation of EVs has not yet landed in the average Indian buyer's calculations and decision process. Besides the fact that Teslas are harder to repair, the broader fact is that EVs are harder to repair in ways that make economic sense. Even mildly flooded EVs in the recent Chennai floods had to be written off, where we have experienced that it is possible to repair similarly affected ICE cars for 10-20% of the cost of the vehicle.

The depreciation in the used EV market will be dramatic, and this trend will be fully discovered only when a sufficient number of used EVs start flooding the market in the next 2-3 years. The real effect of this depreciation will have to be accounted for in the pricing of the new EVs as more of the buyers go through an EMI route, with the EMI being calculated based on the residual value of the cars.

5. Chinese competition in luxury EVs is coming hard and fast.

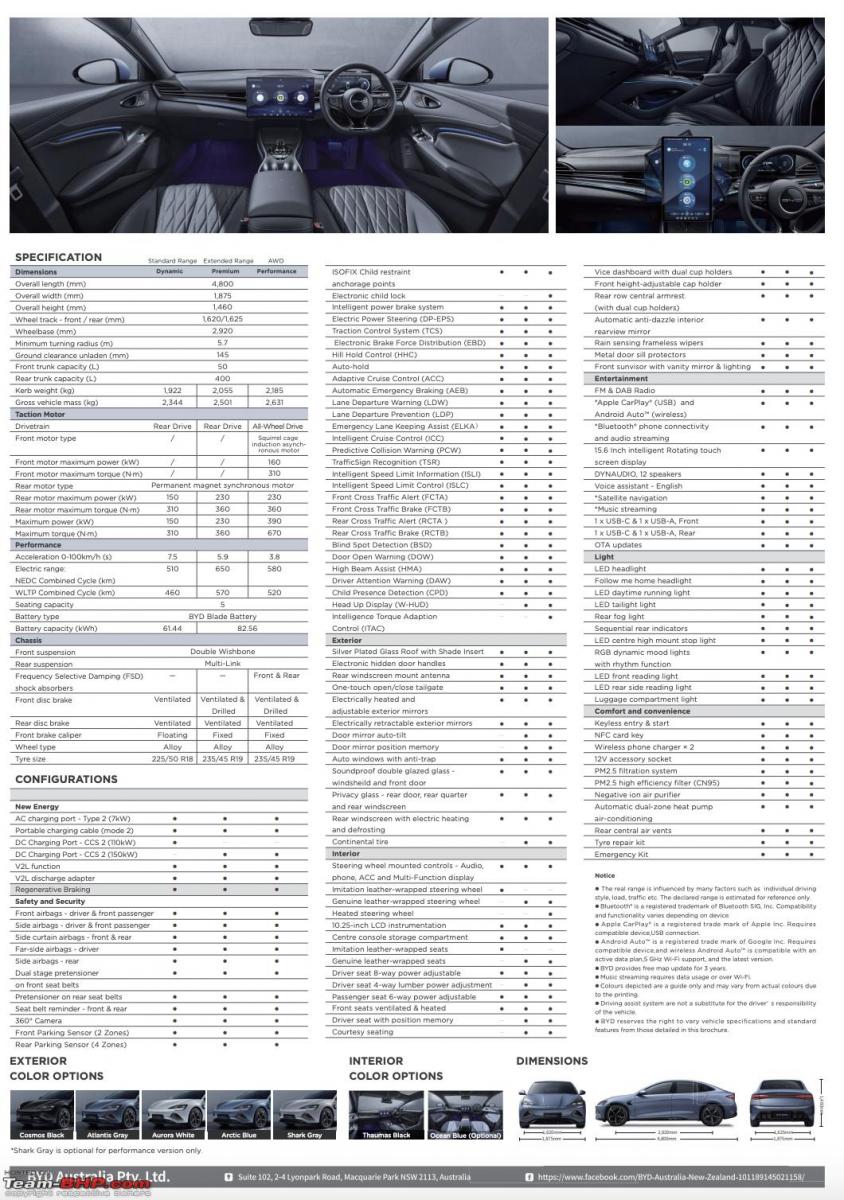

These companies such as BYD are no longer just competing on price and value but now starting to compete on engineering excellence, battery technology, luxury quotient, and even sheer power. An excellent example of this is the impending launch of the BYD Seal. It is going to give tough competition to established European luxury and performance EVs.

Take the BMW i5 M60 that is soon going to launch in India likely to be priced at 1.4 Crores. the BYD Seal has comparable acceleration and power figures to the i5 M60 (see attached comparison). We know the brands themselves are not comparable in the average buyer's mind, however, the cars themselves have specifications that are so evenly matched that comparison is inevitable.

The Seal will probably be priced around 35% of the i5 M60 (around 50 lakhs) and delivers the same 3.8 second 0-100 time. It has just as much battery capacity as well and an even higher range.

I think once all these market forces fully play out, European manufacturers will have to offer EVs at very different price points. Right now manufacturers like Mercedes and BMW are pocketing super-normal profits, riding a perception wave that their EVs have more sophisticated technology compared to their ICE cars and are more desirable due to the Green factor. Those manufacturing locally are sitting on 5% GST versus up to 48% GST for hybrids and ICE cars (and not passing on the benefits).

Market forces will soon start to play out in full force to force these manufacturers to drop prices. What we have seen in terms of price drops across MG and Tata in the last few days is just the tip of the iceberg, that will soon start hurting the pricing power of luxury EV makers too.

Here's what BHPian Hayek had to say on the matter:

Anyone buying an EV today is by definition an early adopter, and faces the risk of price decreases over time. My firm belief has been that commodity prices fall with time, and hence the long-term trend in Lithium prices is down. Of course, it is a commodity and so we will see spikes from time to time. But as battery technology develops, the prices of batteries will fall and hence EVs will not hold value the way ICE cars did.

But will that hurt luxury car makers? I think not. The fact is that the battery as a percentage of the cost of a mass-market product like a BYD or Hyundai is always going to be more than that of a premium product from a German luxury car maker. So the percentage drop in prices of luxury EVs will be less than that in a mass market car.

Further, while it is easy to produce insane acceleration with motors and batteries, suspension tuning, refinement and brand value that the Germans have built over the years cannot be competed away that easily. Even Lexus has not managed to take share in Europe (or India for that matter), and the Chinese are probably a couple of decades away from being able to compete in that space. I doubt too many people will pick a BYD over a Mercedes - VW and Renault however, they have much more to worry about.

Check out BHPian comments for more insights and information.