News

Competition in the 2 million rupee segment in India: A detailed report

Over the years, Rs. 20 Lakh segment has become one of the most competitive car segments. This is a very important segment, and as of now, the 2nd most, behind the Rs. 10 Lakh one.

BHPian Xpresstrainfast recently shared this with other enthusiasts:

Hello team-bhp. This is my first ever car analysis. Please excuse the quality of the post, since this is my first attempt. Hope you enjoy!

Introduction

Over the years, Rs. 20 Lakh segment has become one of the most competitive car segments. Just look at Tata and Hyundai for example. They are bringing four different powertrain options, lots of variants, and special editions of their Curvv and Creta respectively. Honda just survives for their City and Elevate. Vast majority of VAG sales comes from the India 2.0 products. Obviously, this is a very important segment for the Indian car scene, and as of now, the second most, behind the Rs. 10 Lakh one (IMHO). So, why don't I analyze: How exactly has it been for the carmaker's.

Defining a '20 Lakh Rupee car

First of all, we must understand what do we really mean by a car defined by its price point. Do not get confused: A car has a fixed price, but there are some debates:

#1 Ex-showroom vs On-road pricing

#2 Variant-by-variant pricing

#3 Stock vs Add-ons + Modifications

#4 New vs Used

#5 Exactly Rs. 20 Lakhs?

Ex-showroom vs On-road pricing

Different cities have different pricings, and we BHPians do not live in a single city. Due to this, for the sake of this analysis, I will take in account the Ex-showroom pricing

Variant-by-variant pricing

The most basic Innova Hycross cost around Rs. 20 Lakhs ex-showroom. So Does the super-basic variants of the Jeep Compass. Whereas the Tata Safari pricing starts @15 Lakhs. Kia asks 18 Lakhs for the fully loaded Syros Diesel. I feel that not many people actually buy these entry-level trims, and that it is mostly a marketing stunt by the manufacturers. I am going to include only the cars whose top-end or mid-variant cost Rs. 20 Lakhs. Within the Mahindra Born Electrics, only the Be6 will be included though (being classified as a C2 by AutoPunditz)

Overall cars from the C2 segment, and Carens, Thar Roxx from the utility segment will be included

Stock vs Add-ons + Modifications:

Not many owners keep their car 100% stock till the final day of ownership. Also, there is the money spent on Tax, FasTag, Fuel payment, service, showroom fitments, etc. It creates lots of confusions when we think more about this

So the car will be included in its ex-showroom pricing with no additions whatsoever.

New vs Used

I will do a separate analysis for used cars.

Exactly Rs. 20 Lakhs?

Obviously, no car is priced at exactly Rs. 20 Lakhs. Some car may be @19.99, another @19.49. So what is the limit to be included in the analysis? Since we already decided what car to take in account, this must erase the problem altogether, right? No. The XL6 is also classified under utility, like the Carens. The most expensive XL6 cost around Rs. 15 Lakhs, if I am not wrong. Let's say we take 17.5 to 22.5 Lakhs(i.e 20 lakhs, plus and minus 2.5 lakhs)

Observation

#1 For the entire time between march of 2024 and 2025, Creta was the most selling '20 Lakh Car'.

#2 Out of 1.16 million cars sold since the start of the year, 270,000 or rather 23% of the market consisted of C2+Thar+Carens.

#3 Citroen Basalt, though it is considered a C2, is more of a C1, as indicated by pricing, quality, powertrain, and features. Not even 200 units of this car have been dispatched since the start of the year, so it does not significantly hamper my analysis.

#4 Only 18,562 C2 sedans were sold since the start of the year. The Creta alone sold 18, 522 units in January 2025! The era of sedans is indeed gone.

I predict that in a few years time, the C2 segment sedan will vanish just like the D1 sedan did. If you think the C2 icon (Honda City) will last for ever, well, the D1 icon (Skoda Octavia) didn't.

#5 As if to put shame on Honda, the City (a product last updated in 2024, and in an entirely new generation since 2020) sold 2798 units, not far from the 2541 units of the Ciaz (a product that is on its deathbed).

#6 The MG Astor only sold 640 units since the start of the year. Dividing the

monthly sales of the Creta (in January), we get nearly 600. Possibly the Creta outsold what the Astor sold in a year, in a single day.

#7 Point #6 is an unfair comparison for two reasons: The Astor is an outdated product (2nd gen launched globally) and second, these are dispatch numbers, not actual deliveries. Still, I believe that this car is much better than what its sale numbers indicate about it (for layman, not enthusiast).

#8 Dark editions are on the rise! I don't like it though: Some cars look deadly in black, but this posses a visibility problem at night. Also, I feel that something 'black' brings bad omen (no offense, simply personal opinion).

Let's not go too off-topic.

#9 The larger XEV9e outsold the Be6 by a M-A-S-S-I-V-E margin. I do not understand this logic. Want more knowledgeable BHPians to shed light on this.

#10 GTO once said that one must not buy a product from M&M, Tata or the 'Germans', as soon as it is launched, but rather wait for a few years, for the niggles to settle down. Still, the feeling of getting a totally brand new car, that too a very futuristic, technologically advanced, and the bragging rights. Not generalizing, but more than 7000 people decided to get these Born Electrics already.

#11 36K+ units of the Grand Vitara and nearly 15,000 units of the Urban Cruiser Hyryder. The recent upgrade (AWD AT, 6 airbags standard, e-brake, etc) should be very, very interesting.

#12 The Honda Elevate met its 2-3K a month sales target only in March of this year. This product is simply not enough.

#13 Somehow, both the Skoda 2.0 cars (Slavia and Kushaq) are negatively affected by the Kylaq while the Volkswagen 2.0 (Virtus and Taigun) appear unaffected.

#14 Obviously, the Skoda-VW 2.0 products have started ageing. I believe that the company could make history repeat (The Polo and Vento have been updated countless times in 13 years with no all-new product!). Not sustainable!

#15 Hyundai is milking the 'CRETA' brand. First, it was a mere cosmetic job with the N-Line (not even a different exhaust). Now it is with the Electric. The Electric is a lot more disadvantaged compared to the Curvv.ev, however, the after-sales quality, Hyundai-esque fit and finish, rear seat space, and potential reliability will make it sell better.

#16 The XUV400 EV is a joke. I bet it sells better as a fleet than as a private vehicle. The market has changed a lot.

#17 The ZS EV has definitely lost the 'wow factor'. Competitors have gotten more modern. Even the BaaS scheme hasn't helped. I do not have any data on customer preferences for the ZS or any MG EV in particular (Baas vs Own Battery).

#18 If the Windsor is the best selling EV, then it is for a good reason. This car gives a tough fight to all the ICE platform-based EVs. The only disadvantage I see with it is its rear seat ride quality.

#19 I see a perfect opportunity for Renault-Nissan in this segment. If the Duster is truly coming back, it has a chance to succeed, provided the alliance isn't as lethargic with the Indian market as it is right now.

#20 Tata Curvv sales are decreasing. This is my guess- A lot of sales came from the EV- The 1.2 Petrol isn't the segment benchmark, the 1.5 Diesel DCA, though fantastic, didn't sell much either due to overall lack of demand for diesel or late delivery of Curvv Diesels, The rear seat space is far behind competition, and the premium over the Nexon isn't fully worth it for many customers. People became scared to put their hard-earned money on a brand-new Tata ev and decided that it was better to buy a Mahindra Be6 Pack One or an inferior Creta Electric

#21 The Kia Carens- despite being due for a facelift, stills sells in healthy numbers. This is also the first Kia in India that became popular in the fleet segment.

#22 The Kia Seltos-the gamechanger, however has stagnated. It is due for a new generation altogether. The current model is still relevant though. -17.5% YOY growth.

#23 The MG Hector- yet another gamechanger-has also stagnated. Much more than Kia did. It is considered a D1 thought it is still priced somewhere around Rs. 20 Lakhs.

#24 The Hyundai Alcazar is still a very boring product. Suddenly from December 2024 onwards, Alcazar sales went from 2k range to the 1k range.

#25 few companies seems to have intentionally shipped excess cars to dealership as a part of a marketing stunt. Hyundai is one of them.

#26 This is the main point of the post: 20 Lakh rupee cars have gradually started proving luxury cars to be overpriced. While they may not offer the same amount of quality, prestige, fit and finish, handling, they are improving. They offer a feature set + style+ perfect dimensions + powertrains that keep the common man more than happy. While you still shouldn't be trading your C-Class or 3-series for a Creta, Seltos, Thar Roxx, or Kushaq, The C2 segment has certainly improved a lot.

History of the 20 Lakh rupee car

We have seen two threads on gamechangers-in 2010 by GTO https://www.team-bhp.com/forum/india...-changers.html and another in 2025 https://www.team-bhp.com/forum/india...5-edition.html.

But first, lets define what we mean by Rs. 20 Lakhs. As we trace the history of a car's pricing, we can observe the effect of the Indian Rupee's depreciation. See, 15 years ago, you could get a maharaja-size Skoda Superb MT for Rs. 20 Lakhs.

Now, the same Skoda sells you a 4.2 meter long Kushaq for the same money! And no, its quality is not a match to the erstwhile Superb either.

This graph should give you an idea of just how much the Rupee depreciated

To avoid confusion, let's assume that we are talking about cars that were worth what they were in their time, what is now Rs. 20 Lakhs. In simple, C2 and mid-level utility cars. The C2 segment can be divided into two parts: SUV and Sedan. Lets start with SUV

SUV

To start of, I will first mention the Renault Duster

This machine came out in 2011, and created a revolution in a few ways:

#1 It introduced a whole new segment of monocoque SUVs

#2 It introduced Indians to a brand that had been a complete flop before

#3 Its ride quality simply blew competitors away.

#4 An SUV that could be cross-shoped with sedans (a continuation to #1)

Not long after, an AWD variant was added and gave the Duster a massive appeal. However, as time passed, the Duster begun to age fast. Renault facelifted the Duster in 2016, and this was a good move. However, with the Duster itself, Renault made three mistakes:

#1 launching a Nissan Terrano (rebadged Duster at a price higher than the original car, that too with no AWD= flop)

#2 Bringing the Captur (suposedly a Duster replacement. No AT and No AWD meant less popularity. It also looked very crossover-ish, unlike the Duster. This is also the car that is infamous among BHPians for its misleading advertisement showing the global model's achievements on an Indian TVC.

#3 Removing the 1.5 Diesel and the AWD in the later years of the car. These two were reason many people bought the Duster in the first place. Now, replacing it with a turbo-petrol, something nobody really felt the need for, was not really the best thing to do. This ultimately led to the car's fate.

In both a segment below and a segment above the Duster, unique gamechangers came to life:

In the segment below, it was the Ford Ecosport

This car was an extremely smart package for its time: It had a futuristic design + SUV-ish looks + decent space inside + fantastic powertrain options + ahead-of-its-time equipment list + Ford-esque handling and build quality, yet it was not more than 4 meters long. It created a whole new segment altogether- The Urban SUV!

In the segment above, it was the Mahindra XUV500

This car was Mahindra's first monocoque SUV and a gamechanger on its own. Its USP? A contemporary 7-seater with AWD that had an insanely VFM pricing.

For a few years, India's major automakers, Hyundai and Maruti Suzuki did not jump into this party. But this could not be for long.

Hyundai brought in the Creta.

This car was not particularly impressive in any way, but it had a typical-Hyundai quality, Hyundai badge, a neutral styling and it was 'just the right size' for middle class Indians. A very contemporary one too. The 2nd gen Creta was launched in 2020, with its sole drawback being safety and polarizing exterior details. It was facelifted in 2024, which IMHO, makes it look so beautiful, more so in the N-Line variant. An EV based on the Creta platform was launched in 2025.

What did Maruti bring? another neutral car= the forgotten yet legendary S-Cross

This car was impressive because it felt very European (handling and build quality) and it carried two powertrain options- one for the ordinary fellow, i.e 1.3 MJD (This thing is not called the national engine of India for no reason) and the other for the enthusiast- The 1.6 (a driver-oriented Maruti). This car was so premium for a Maruti that it had to introduce a separate dealership network= NEXA. However, Maruti made a few mistakes that later turned out to be major blunders. The S-Cross only came with dual airbags (no side and curtain airbags), was FWD (AWD from Europe not carried over), no AT, and no Gasoline. Its sales fell so much that after a point, Maruti had to reduce prices significantly and didn't help much either. This car was a flop.

Trivia: The S-Cross is the second generation of another flop Maruti, i.e the SX4.

The S-Cross was facelifted in 2017, and with it the 1.6 was removed from the lineup. The S-Cross was facelifted again in 2020, and its diesel was replaced by a lethargic gasoline engine. The only good thing that came with the update were the new touchscreen infotainment system and finally, an AT, albeit an old 4-speed unit. The S-Cross continued to fall behind was replaced by the Grand Vitara in 2022.

Meanwhile, the XUV500's price increased significantly and it was a another segment altogether. The Ecosport also formed another segment, and Maruti responded with a another opponent for it= Vitara Brezza, a massive, massive success. Hyundai responded in 2019 with the Venue. So, the definition of a car segment became more and more clear with time.

One gamechanger that cannot be ignored at all, is the Kia Seltos

This one was clearly making all direct competition worried-It had all sorts of powertrain options, had every feature that you could think of, felt very premium, and its styling was very, very handsome. The unsorted Tata Harrier launched around the same time, was no match for the Seltos-despite being a size bigger and having bigger engines. Kia's 1.4 T-GDI was very rev-happy and so was the 1.5 CRDi. The only drawback for the Seltos was its ride quality, and brand trust at launch. Kia had so much advantage from parent company, Hyundai's experience with the Indian market, and this allowed to do excellent market research, resulting in excellent product. This was also the car on which the 2nd gen Creta is based on. Later, the Seltos would see an addition to its list of flaws- Safety.

In 2020, G-NCAP tested the Seltos (in its specification without the optional side and curtain airbag) and it was rated 3-stars (out of a total of 5) with an unstable bodyshell. Then, a viral photo of a Seltos split in two pieces took things even more heated. A German man thought it was his time to take an advantage. There came the Skoda Kushaq.

Previewed by the Vision IN Concept, it was a fresh breath of European air in a sea of Chinese, Korean, and Indian cars. It was compact yet premium. Its build quality, though certainly not matching the expectation from a German car, was better than its competitors. Its feature list, though not as lengthy as the Koreans, was decent. Then, Skoda did what Tata did to its car in a lower segment cars=get a good safety rating, then brag about it. To add to it, the car had amazing handling and the engines-1.0 TSi and 1.5 TSi, were both excellent. An enthusiast pick for its price point it is. A few months later, the mechanically identical Volkswagen Taigun reached the market.

Kia decided to capture the MPV market. It realized a gap- The Marazzo wasn't selling, the Ertiga was not premium enough, and the Innova-too large/expensive. There was a room for a more modern monocoque MPV-the Carens.

Remember, the Grand Vitara-The successor to the S-Cross that I mentioned earlier? This car did not much to the market except the strong hybrid tech. After so long of bragging their SHVS, Maruti finally had a Toyota-sourced 'real hybrid' that was truly worth bragging. To show that it wasn't just a crossover but a real SUV, Maruti even brought their AllGrip Select AWD system to the Grand Vitara, albeit in a single mild hybrid MT variant. A rebadged Toyota Urban Cruiser Hyryder followed suit.

Honda, not wanting to get lost, created a half-hearted attempt-The Elevate. Honda had the opportunity to include the hybrid system from the City, making a perfect opponent for the Grand Vitara. Purely because of its lethargy, they could not even do that. This is a product powered by a fun-to-drive yet slow 1.5 iVtec from the City and is simply a good product. I dare say the Elevate is a boomer uncle's car.

The 3-door Mahindra Thar, launched in 2020, was certainly not a car that could exchange your Creta or Seltos for. It had many flaws for an daily drive. Exactly, four years later, Mahindra launched the 5-door Thar, an even more S-E-X-Y car. This car had a number of controversial aspects about=No Gasoline AWD (A lifestyle off-roader without AWD!), funky name (I can think of a better name than 'Roxx'), poorly done-up styling, white interiors, no keyless entry, not riding 'like a monocoque'. Yet the demand for this car is so much than some people had to wait a year to get it. This car is the definition of middle class aspiration. Inteha Ho Gai Intezaar Ki!

This is the car that I feel is the #1 hottest looking car in its segment, but it would not be my choice because of its after-sales quality: The Tata Curvv. While not in this post, check out the Curvv's rear end. It looks so damn C-O-O-L. The powertrain, safety, handling, interior ambience, and build quality of the car simply makes you forget that Its a Tata. I am not sure about fit and finish though.

Sedan

The modern premium sedan segment in India began with the Maruti 1000 in 1990s. This car could beat the Ambasadors and Padminis in every way, except power. Maruti solved the problem with the Esteem. Esteem continued to be on sale for a long time. When its modern alternative, the Baleno was introduced, Maruti decided to continue selling the Esteem alongside the Baleno in a lower segment. Eventually, the Esteem left the market for the Dzire in 2008.

The Honda City was one of those cars that eventually led to the Esteem's downfall. With its Vtec engine, sheer amount of technology, beautiful mod scope, and Honda reliability, it was a revolution. Currently in its fifth generation

The Hyundai Accent was also yet another modern sedan for the Indian car market. This one currently lives in the market as the third generation Hyundai Verna.

So many cars came and left the C2 sedan segment (Ciaz/SX4, Sunny, Fiesta, Linea, etc), but none of them came to dethrone the Honda City until the Vento. It was simply too competent.

Many years later, when sedans came to loose public interest, VAG revived with the Slavia and Virtus.

.

.

Check out BHPian comments for more insights and information.

News

Xiaomi SU7 outsells the Tesla Model 3 In China

Production of the SU7 started in April 2024 and 30,000 units were sold in the period of April, May, and June.

China is one of the largest markets for EVs and there are many manufacturers wanting a big slice of the pie. Chinese tech giant Xiaomi came into the automotive space with their first electric car, the SU7. In what is a major feat, the Xiaomi SUV 7 has outsold the Tesla Model 3 in China. This news is as per the sales data from the China Passenger Car Association (CPCA) between April 2024 and January 2025.

Production of the SU7 started in April 2024 and 30,000 units were sold in the period of April, May, and June. In April, it sold 7,058 against 5,065 units of the Model 3 in the same month.

The Tesla Model 3 ended the April-June period with 38,446 units, easily ahead of the SU7. In the July-September period, the Model 3 maintained its edge, with 52,052 units sales. In comparison, 39,790 SU7s were sold during the same three months. Xiaomi SU7 sales shot up in October, November, and December, beating the Model 3.

Where Tesla managed to sell 52,241 Model 3s during these 3 months, Xiaomi sold 69,697 SU7s. This included 20,726 in October, 23,156 in November, and 25,815 in December. Strong demand for the Xiaomi continues into 2025 and 22,897 were sold in January. In January, Tesla sold just 8,009 Model 3s.

Official figures from the China Passenger Car Association show that Xiaomi delivered 162,384 SU7s between April 2024 and January 2025. Tesla on the other hand delivered 152,748 Model 3s during the same period.

Xiaomi is now set to launch its second EV, the YU7, which will be a direct rival to the Tesla Model Y.

Xiaomi had showcased the SU7 in India in August last year.

In recent developments, Tesla is also slated to make an entry into India soon.

Source: Carscoops

News

Effect of registration waiver on strong hybrid car sales in UP

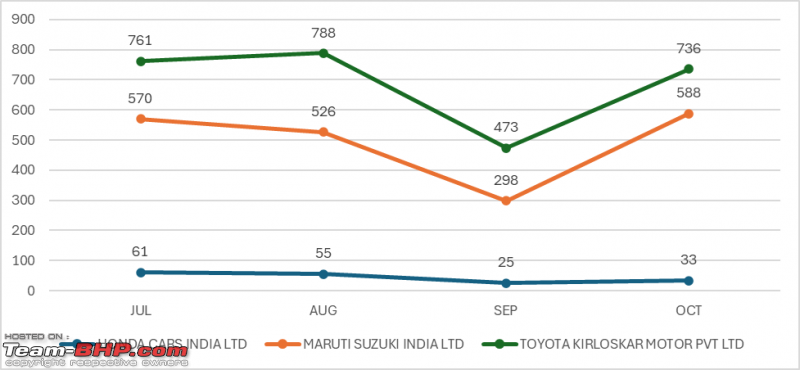

We have the sales data of the three brands (Honda, Maruti and Toyota) which sell strong hybrid cars.

BHPian ferrarirules recently shared this with other enthusiasts:

Curious case of Strong Hybrid cars not selling in high numbers even after registration waiver in UP

I have been tracking the impact of registration waiver on the adoption of strong hybrid cars in Uttar Pradesh. The orders were passed in July 2024 so a considerable 3 months including the festival month of October have passed but the sales of strong hybrid are not skyrocketing.

Let's see the data for Uttar Pradesh of the three brands (Honda, Maruti, Toyota) which sell strong hybrid cars.

Sales trend of Strong Hybrids in UP for the last 4 months

Sales trend of Mild Hybrids in UP for the last 4 months

*Data for only Honda is non-hybrid cars as Honda doesn't have mild hybrid tech

Data Source - Vahan Dashboard

I tried to analyze the why and it lies in the pricing of the strong hybrid cars being way more than their non-strong hybrid counterparts. Strong hybrid cars even get a 2% GST cess benefit. Despite all this, the ex-showroom price of strong hybrid cars is more than the on-road price of non-strong hybrid cars.

Example

- Toyota Hyryder V Hybrid is Rs.19,99,000 ex-showroom and V AT Neodrive is Rs.19,85,257 on-road Noida

- Maruti Suzuki Grand Vitara Alpha Plus Hybrid is Rs.19,93,000 and Alpha Smart Hybrid is Rs.19,44,819 on-road Noida

Conclusion

Based on the above evidence, providing a registration tax waiver on strong hybrid cars is not helping the adoption. The manufacturers really need to look at the pricing of strong hybrids if they want to drive adoption.

Check out BHPian comments for more insights and information.

News

Understanding Sales Numbers of Mahindra Scorpio N and Scorpio Classic

This does seem to indicate that Scorpio N has been a success in terms of sales. Then why Mahindra still produces the Classic?

BHPian scorpi0N recently shared this with other enthusiasts:

Trying to Decode Sales Numbers for Scorpio N

So, for some reason Mahindra doesn't disclose the sales data for Scorpio and Scorpio N separately. Take for instance the recent car sales data for September 2024, one can see the numbers for Scorpio but not for Scorpio N and Classic.

I tried to do some back calculations based on an update shared by Mahindra on their official instagram page in February, which indicated that by February 1, 2024 there were 1 lakh Scorpio N on the street.

The delivery of Scorpio N started in September, 2022. This means that in 17 months (September 2022 to January 2024), a total of 1 lakh Scorpio N were sold.

During this same time (based on monthly car sales data released on teambhp), a total of 1.05 lakh XUV 700 and 83k Thars were sold. The total sale of Scorpio during this time was 1.66 lakh which means 66k Scorpio Classics were sold. The breakup along with estimated monthly average is as below.

This does seem to indicate that Scorpio N has been a success in terms of sales. Then why Mahindra still produces the Classic? Just for record, I think that Mahindra Classic is a phenomenal vehicle! Anyway, if Mahindra had to move to a second generation Scorpio then why not move completely?

One can note that based on estimates, Scorpio Classic sales have been robust! Who is buying these vehicles? Now, this is just my guess, but I think Mahindra has a captive Scorpio Classic client base in many government organisations. I have noted that a significant portion, if not the entire, of the Mumbai RTO fleet, BMC fleet and many Navy cars in Mumbai are Scorpios (Classic and old generation Scorpios). Also for many politicians, who would want to travel with their bodyguards, Scorpio Classic with its sideways back seats is more practical perhaps. I guess Mahindra doesn't want to disturb this captive client base and, hence, is continuing the production of Scorpio Classic!

Check out BHPian comments for more insights and information.

News

Indian Automobile Sector over the last 10 years: Sales trends analysed

I thought why not analyze this data to bring out some meaningful trends and see how Indian automobile sector has shaped in the last 10 years from 2014 to 2024.

BHPian ferrarirules recently shared this with other enthusiasts:

Preface -Teambhp has a lot of data captured over the years. Monthly dispatches by all the manufacturers selling cars in India is one of the important data points available. So I thought why not analyze this data to bring out some meaningful trends and see how Indian automobile sector has shaped in the last 10 years from 2014 to 2024 (2024 - Q1-Q3).

Points of Analysis- I have analyzed the following points

- 10 years market share trend for each manufacturer

- 10 years market share trend based on the origin of each manufacturer

- Yearly rank of each manufacturer

10 years market share trend for each manufacturer

- Maruti's market share has reduced from 51.7% peak to 41%. Lack of safety, lesser features and innovation as compared to other brands seem to be the reasons for the fall.

- Hyundai's market share has reduced from 17.5% to 14.5%. This is a due to competition bringing cars which are equally good but cheaper and Hyundai's high reliance on Creta (their star product).

- Tata and Mahindra have increased market share from 5% to 13% and 7.5% to 12% respectively. The reason are for this are simple - competitively priced, safety forward, feature rich products. Most of the products are targeting the SUV craze.

- Toyota has had a flat market share of 4.5% to 5% for most of the last 10 years but in last two year their market share has jumped to near 7%. All thanks to re-badged Maruti cars.

- Kia has not been around for last 10 years. After a peak market share of 6.73% in 2022, their market share is decreasing slowly and has come down to 6%. The reason can be attributed to lack of expanding product line.

- Honda market share has come down from 7% to 1.6% over the last 10 years. Reason - We have a thread dedicated for the same, bad decision after bad decisions.

- Renault - Another player which had a peak market share of 4.5% which has reduced down to 1%. Reason can be simply attributed to lack of product pipeline.

- MG - It has been in the market for 5 years and the market share is limited to around 1.3%. A lot of it was to do with lack of investment with JSW JV this year, that issue is solved. They will be the one's to keep an eye on in the coming years.

- Volkswagen and Skoda have had a combined market share of 2% all through the last 10 years. Reason for the same have been many. Also their product pipeline is slow. Their might be some turn around round the corner as Skoda launches Kylaq.

- Nissan, Citroen and Jeep for them lesser said is better. Sub 1% percent market share for last 10 years and no signs of a change.

10 years market share trend based on the origin of each manufacturer

- Japanese manufacturers started with a market share of whopping 60%+ which has now reduced down to 50%. The slide has somewhat been arrested by Maruti and Toyota joining hands in mid 2020. Maruti has 80%+ share in the 50% market share.

- Korean manufacturers had a peak market share of 23% when Kia came to the market but since then the market share has slowly declined to 20%. Kia is losing to Toyota on dispatches this year.

- Indian manufacturers started with a measly 13% market share and now their market share has increased to 25%. They understood the consumer sentiment and came with products which were bang on for the market demand.

- European manufacturers had a peak market share of near 7% but that has dwindled to 3% over the year. All due to lack of product vision for the market they are in.

- Chinese manufacturers have been limited to 1.3% market due to geopolitical reasons.

- US manufacturers - GM, Chevrolet and Ford have all left India for good. Just didn't have the patience to understand the Indian consumer.

1. Data for 2024 is till Sep-2024. The numbers for 2024 will change as the last quarter completes

News

Top 10 best-selling cars in India - November 2024

The top 3 positions are occupied by Maruti, Hyundai & Tata (Baleno, Creta & Punch).

The list of the top 10 best-selling cars in India in November 2024 consists of models from Maruti, Hyundai, Tata & Mahindra.

The top 3 positions are occupied by Maruti, Hyundai & Tata (Baleno, Creta & Punch). The Maruti Ertiga sits in the 5th spot, while the 6th, 7th, 8th & 9th positions have been secured by the Brezza Fronx, Swift & WagonR, respectively.

The Mahindra Scorpio is in 10th place, while the Tata Nexon is in the 4th position.

The top 10 cars sold in November 2024:

- Maruti Baleno

- Hyundai Creta

- Tata Punch

- Tata Nexon

- Maruti Ertiga

- Maruti Brezza

- Maruti Fronx

- Maruti Swift

- Maruti WagonR

- Mahindra Scorpio

News

Top 10 best-selling cars in India - October 2024

The top 3 positions are occupied by Maruti & Hyundai (Ertiga, Swift & Creta).

The list of the top 10 best-selling cars in India in October 2024 consists of models from Maruti, Hyundai, Tata & Mahindra.

The top 3 positions are occupied by Maruti & Hyundai (Ertiga, Swift & Creta). The Maruti Brezza sits in the 4th spot, while the 5th, 6th and 10th positions have been secured by the Fronx, Baleno & Grand Vitara, respectively.

The Mahindra Scorpio is in 8th place, while the Tata Punch & Nexon are in 7th & 9th position, respectively.

The top 10 cars sold in October 2024:

- Maruti Ertiga - 18,785

- Maruti Swift - 17,539

- Hyundai Creta - 17,497

- Maruti Brezza - 16,565

- Maruti Fronx - 16,419

- Maruti Baleno - 16,082

- Tata Punch - 15,740

- Mahindra Scorpio - 15,677

- Tata Nexon - 14,759

- Maruti Grand Vitara - 14,083

News

Top 10 best-selling cars in India - September 2024

The top 3 positions are occupied by Maruti & Hyundai (Ertiga, Swift & Creta).

The list of the top 10 best-selling cars in India in September 2024 consists of models from Hyundai, Maruti, Tata & Mahindra.

The top 3 positions are occupied by Maruti & Hyundai (Ertiga, Swift & Creta). The Maruti Brezza sits in the 4th spot, while the 6th, 7th, 9th and 10th positions have been secured by the Baleno, Fronx, WagonR & Eeco respectively.

The Mahindra Scorpio is in 5th place, while the Tata Punch is in 8th position.

The top 10 cars sold in September 2024:

- Maruti Ertiga - 17,441

- Maruti Swift - 16,241

- Hyundai Creta - 15,902

- Maruti Brezza - 15,322

- Mahindra Scorpio - 14,438

- Maruti Baleno - 14,292

- Maruti Fronx - 13,874

- Tata Punch - 13,711

- Maruti WagonR - 13,339

- Maruti Eeco - 11,908

News

Electric vehicle sales down by 9%; lowest in last 19 months

Luxury EV sales dropped by 14% in September 2024 compared to the previous year.

Electric vehicle sales in India tanked by 9% in September 2024, falling to a 19-month low of 5,733 units.

According to the sales data released by the Vahan website, EV sales peaked in March with 9,661 units. Since then, sales have been steadily slowing down. 6,630 EVs were sold in August, 5% down on the previous year.

Tata Motors, which has been at the forefront when it comes to electric vehicle sales, registered an 18% decline over the previous year. The carmaker sold 3,530 EVs in September 2024, compared to 4,320 units last year. Its market share also dropped from 68% to 61%.

MG registered a growth of 7% in its EV sales last month. The carmaker sold 955 units in September 2024, compared to 894 units in the previous year. However, sales were down 32% compared to August 2024. The brand now has a market share of 16.65%.

Mahindra also registered strong growth despite having just one EV in its product line-up. The carmaker sold 443 XUV400s in September 2024, registering a growth of 23% YoY and 33% MoM. The company’s market share stands at 7.72%.

BYD sales were down 27% MoM in September. The Chinese EV maker sold 161 units compared to 221 units in August 2024. Citroen had its best-ever month with 386 units sold in September 2024, while Hyundai recorded its worst EV sales in the past 9 months, with just 26 Ioniq 5 EVs sold in the month of September.

Luxury EV sales dropped by 14% in September 2024 compared to the previous year. 209 units were sold down from 245 units in September 2023. However, cumulative sales for the first 9 months show a growth of 20% YoY.

Source: Autocar Pro

News

Sold my S-Cross after 1.1L km: Why I decided to upgrade to Skoda Kodiaq

The Kodiaq is an absolute steal when compared to the entry level prices of cars from the BIG 3 namely: Mercedes, BMW and Audi.

BHPian Keynote recently shared this with other enthusiasts:

An important update on ownership and purchase of New Car

So at the begining of this year, I started to think of getting a new car. The only excuse for an upgrade was the need for automatic transmission. If my Scross 1.6 had the automatic transmission, i probably would not have

bothered with an upgrade as the car was kept in excellent condition and I've thoroughly enjoyed each and every drive in it. Please note I never saw a single check engine light error or any other error for that matter in the last 8 years when I had the car and it was finally sold on 9th September 2024 after driving for 110916 KMs. Wishing the new owner a troublefree ownership and only good memories with the car ahead

Odometer reading while handing over the Scross 1.6 to New Owner

Quote from BHPian rahul143:

@keynote, if I may ask, which car are you getting next? Being a proud owner of S-Cross yourself, it’ll be informative to know which car did you choose. Thanks in advance.

Sorry about the delay Rahul, but I hope the below information helps.

My requirement was very simple - it has to be an automatic and should be a bigger and better car than my Scross 1.6 (ie. read as spacious 5 seater and performance).

Budget was set for 50 lakhs initially but was reluctantly okay to extend it upto 65 lakhs max if the car meets my simple requirements. But trust me it wasn't that easy.

Although many of my friends, fellow Scross 1.6 owners and aquaintances have mentioned about how difficult it is to find a replacement for Scross 1.6 (unless one is ready to shell out 45-50 lakhs), you realise only after you go through it in real time.

Since I've gotten used to the punchy diesel and the addictive torque of Scross 1.6 for the last 8 yrs, I was initially leaning towards diesel automatics only. But as the time progressed, i was okay with Petrol automatics too.

Although I was not very keen on Electric / Hybrid Vehicles, because of the budget in hand, eventually ended up test driving cars from multiple segments. After going through multiple posts of various cars in team bhp I short listed below cars for test drives if we were to purchase a new one.

Test drive list of Diesel Automatics and approximate OTR prices in Bangalore for top end models

2021 Mahindra XUV700 AX7L with optional AWD as AX5 did not have top end - ~32 to 34 lakhs

2022 4th Gen Hyundai Tuscon - ~46 lakhs

2023 New generation BMW - X1 - ~65 lakhs

2024 Mercedes-Benz GLA Facelift - 220 D - ~68 lakhs

Test drive list of EVS / Hybrids (when road tax did not exist for EVs in Karnataka until Mid of March 2024)

BYD Atto3 - ~36 lakhs

Ioniq 5 - ~49.50 lakhs

Toyota Camry - ~58 Lakhs

Test drive list of Petrol Automatics and approximate OTR prices in Bangalore for top end models

2021 Volkswagen Tiguan Facelift - ~45 lakhs

2022 Audi Q3 - ~68 lakhs

2022 Skoda Kodiaq Facelift - ~53 lakhs

In order to not offend any current or future owners, I'll skip sharing the not so good things of the cars that we test drove from the above list. It is in the best interest as no one should be discouraged / influenced by others decisions.

After all these test drives, there were only 2 cars that brought BIG smile and Joy to us. It was the 2024 Mercedes Benz GLA facelift 220 D and 2022 Skoda Kodiaq Facelift in L&K variant and in the end we picked

Skoda Kodiaq L&K as this car is quite an all rounder and is absolute value for money. It is more car per money and with the Skoda's online discounts on 24th of each month, it made the deal even sweeter for us. At 46.50 lakhs on road Bangalore, it is an absolute steal when compared to the entry level prices of cars from the BIG 3 namely - Mercedes , BMW and AUDI

Last picture taken as New owner drove away the Scross 1.6

And just like the Scross 1.6, Skoda Kodiaq is also one of those cars that punches above its weight . (search for the relavant thread by GTO in tbhp and you will know what i mean)

And finally a picture of them together.

Check out BHPian comments for more insights and information.

Pages

.jpg)