| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  2,729,551 views |

| | #5446 |

| BHPian Join Date: Dec 2009 Location: Bengaluru

Posts: 565

Thanked: 957 Times

| Re: The Credit Card Thread |

| |  ()

Thanks ()

Thanks

|

| |

| | #5447 | ||||

| BHPian | Re: The Credit Card Thread Quote:

- Axis Vistara Signature or SBI Vistara Prime - 90%+ Similar - The Target annual spends would be around 4.5 Lac Spends in a Year on this card - Will get you 4 Premium Economy & 2 Economy Vistara Domestic Tickets - HDFC Regalia - Good for Purchases via Smartbuy (Online & Offline) due to the 5X Reward Multiplier & has 3X on Train Tickets also. Translates to 6.6% for Purchases via Smartbuy & 4% for booking Train Tickets. Both percentages in terms of travel redemptions (Flights / Hotels) Quote:

No, holding multiple CCs does not damage your CIBIL Score. Defaulting on payment damages it. Quote:

Quote:

Yes. 110% Sure. No Exceptions in SCB Ultimate Last edited by tejas08 : 6th June 2022 at 09:20. Reason: Additional Quote & Response added | ||||

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks tejas08 for this useful post: | moloised |

| | #5448 | |

| Newbie Join Date: Jan 2022 Location: Bangalore

Posts: 0

Thanked: 8 Times

| Re: The Credit Card Thread Quote:

| |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks moloised for this useful post: | tejas08 |

| | #5449 |

| BHPian Join Date: May 2016 Location: NCR/UK-05

Posts: 49

Thanked: 194 Times

| Re: The Credit Card Thread

I second that. SCB Ultimate does provide redemption points for fuel purchases, though its not entirely 3.3% as you get approx. 1% charged for Fuel transaction, like any other CC. IMHO, I find this card best in terms of value for it provides 1point=1Rs value in a host of vouchers. Plus you get 5K points against 5K fees, so technically all you pay is GST of 900. I've taken the Infinia Metal last November, and have been trying to get it into habit. It did give decent reward point with Smartbuy multiplier, but I have few concerns, if you or someone can help out: 1. The cancellation of flight on Smartbuy are not refunded yet, been more than two months. Spicejet, Easemytrip, both say they refunded from their end, and it's smartbuy who needs to return. No concierge or Customer care number pciks up. 2. Smartbuy portal is not the most user friendly like MMT for flight and hotel booking, and is pricier for same flights or hotels if checked from other portals. 3. I'm not sure how to redeem points directly for flight/hotel redemption apart from few gyftr voucher I bought for Flipkart, Croma, BMS etc. Any other more lucrative method to utilise points, please do enlighten. 4. No use of Club Marriott membership along with the card. It's no help while booking hotels or getting upgrades, as Bonvoy doesn't recognize Club Marriott. Any experience with this? Any other way Infinia users usually maximise their spends and rewards in a better manner, please do share. I use SCB Ultimate mastercard, which I like most for the return value. Vistara Infinite which I use to spend 7.5L (most viable as next cap for free ticket is 12L), which gives me 3 business class tickets and two upgrade vouchers, plus approx 20K Club Vistara points which can book about 4-5 economy tickets every year depending on leg. Third one is Infinia Metal, where I need to spend 10L to get it free for next year. But I'm still exploring if it's better value than SCB, as I feel bounded to use Smartbuy to get the best value. I wont get a fourth, so any option to replace one of these with any AMEX card. I'm always curious and want to try it for once. Last edited by Turbanator : 7th June 2022 at 03:33. Reason: Quoted posts trimmed. |

| |  ()

Thanks ()

Thanks

|

| | #5450 |

| BHPian Join Date: Nov 2019 Location: Toronto

Posts: 693

Thanked: 2,643 Times

| Re: The Credit Card Thread |

| |  ()

Thanks ()

Thanks

|

| | #5451 | |

| BANNED Join Date: Feb 2022 Location: Pune

Posts: 47

Thanked: 56 Times

| Re: The Credit Card Thread Quote:

There are some banks which tries to manipulate (or maybe system not updated) to show zero outstanding however their terms and conditions are clearly laid out to clear statement dues (or at least minimum due i.e. trap amount). Whenever in such case, always make the payment first and then contact the card issuer asking for excess amount to be refunded to your bank account, they comply as the amount is over and above your credit limit. | |

| |  ()

Thanks ()

Thanks

|

| | #5452 |

| BHPian Join Date: Mar 2022 Location: Gurgaon

Posts: 59

Thanked: 281 Times

| Re: The Credit Card Thread So glad I found this thread but so hard to find for what I need due to the ~400 pages of posts  I have never had a credit card before but I am planning to get one for my planned upcoming travel abroad. I found that HDFC Infinia has some of the best features for me personally (lounge access, 4 points per 150 spent, 1rp=1point, apple discounts, no late payment charges, 1 plus 1 on ITC hotels, 2% markup on forex) But the 12500 + 18% GST? Is that worth it? If anyone is kind enough to shed some light on this, while I use the search the thread to figure this out. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks akshaysehgal for this useful post: | dheer4 |

| | #5453 | ||

| BHPian Join Date: May 2022 Location: Washington, DC

Posts: 56

Thanked: 331 Times

| Re: The Credit Card Thread Quote:

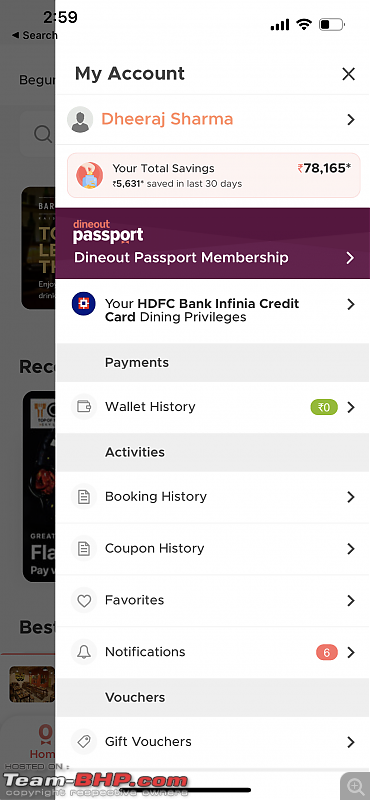

1. In the same boat, have cancellations worth 1L pending to come through. There is a separate concierge platform for Infinia and Diners Black exclusively for smartbuy.( CC concierge and Smartbuy concierge are different.) Smartbuy concierge is open 24/7 and I just had a word with them today regarding my cancellation. The number to reach them is. : 1800 118 887 The website you can go is : https://offers.smartbuy.hdfcbank.com/infinia 2. Go to smartbuy portal, then go to Privileges. In that, you have a separate Infinia portal. This can be used to redeem reward points at the rate of 1re/pt. But you can only pay 70% of the bill using reward points. Still, this is a very amazing feature. I've handled the Infinia for over 4 years till date and booked flights and hotels worth well over 25 Lakhs, though MMT and all show a cheaper rate at first, when you go to checkout, the taxes and markup almost are similar to what the smartly platform is offering. Recently, I booked a Flight + Hotel through smartbuy to Singapore and the other websites were a bit expensive considering the exchange rates they charge.(But smartbuy has 80% selection of hotels/Flights compared to other websites.) I usually use momondo.in to check the average rates and then go to smartbuy to see if they are good. Amazon spends gives back around 16.6% in reward points and Flipkart gets around 10% back. To maximise spends, anything over 1000 Rs bought online is gone through the smartbuy platform and then routed to amazon.( I bought a MacBook Air M1 for effectively 54K after point rebate and discounts last December.(I got 10X rewards in this offer.)) 3.The maximum value so far is Flight booking/ Hotel booking at 1re/pt. The others average out at 0.30re/pt to 0.50re/pt. 4. I've never received the club Marriott membership as I've been using the card for almost 5-6 years from now. AFAIK new cards get them but its pretty much useless. 5. If you are an individual who dines out frequently, Dineout offers free Gourmet passport membership on Infinia cards. Gourmet passport usually gives 15-25% discount on the entire bill in select restaurants and HDFC offers 15% on top of that until 1000 rs. Massive savings IMO. Have saved well over 75,000 Rs doing this. 6. Get add on's for all your family members. If you have a family of 4, who have PAN Cards, Everyone can get an infinia at no cost and added benefit is every add on member gets Infinite Priority Pass on their name.(Boon if you travel frequently.) Please feel free to ask anything if at all. Happy to help a fellow BHPian. I basically have a PhD in maximising infinia rewards by now  . .Quote:

Small calculation: 10 Flights at average of 15,000 for a return ticket. 15,000*10 = 1,50,000 5 Reward points for 150 rs Translates to 3.33 reward points for every 100 rs. at 10x rate of reward points, it is 33.3% back. This means, in 1,50,00 Rs that you spend, you get back 33.3% ~ 50,000 back. International lounges are expensive and a visit would cost around 30-50$ based on the lounge. Priority pass is exceptional and has unlimited visits. But the smartbuy platform has a few cons as well. It is difficult to navigate after the latest update. The hotel booking site shows exorbitant prices at first, but when you go to book it the price is somewhat palatable. (For example, if you try and book a hotel for 4 days, at first it shows 12,000 Rs for a night but when you go ahead it comes to 24,000 or an average like that. I guess this is due to massive difference in one night compared to another. And if you book 2 rooms, Both the rooms cost are added when you see in the first page.) And if you spend around 10L annually, the fee is waived off. Last edited by Turbanator : 7th June 2022 at 03:32. Reason: Back to back posts merged. Please use multiquote or edit function. | ||

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank dheer4 for this useful post: | aadya, aastiksaluja, akshaysehgal, Jedi.Knight, tejas08, zurura023 |

| | #5454 | |

| BHPian Join Date: Apr 2008 Location: Pune

Posts: 54

Thanked: 37 Times

| Re: The Credit Card Thread Quote:

Thanks. Last edited by Jedi.Knight : 7th June 2022 at 09:48. | |

| |  ()

Thanks ()

Thanks

|

| | #5455 | |||||

| BHPian | Re: The Credit Card Thread Quote:

Amex card are probably one of the most versatile cards in terms of Reward Redemption Options. At the same time, Amex cards are best used in combination of two or three Amex Cards to combine reward points earned. Sadly Amex is under RBI Ban. Quote:

Quote:

First - You can get more than 1 Re per Point Value on Infinia via the Airmiles Route but thats if you are a person who looks forward to luxury experiences. Here's the post regarding Singapore Airlines Business Class Travel using Infinia Points. A value of close to 2 Re per Infinia Point on this booking. https://www.team-bhp.com/forum/shift...ml#post5327283 (The Credit Card Thread) Second - All kinds of gift vouchers @ 1:1. But its borderline unethical hack as its against the system/ redemption options set by HDFC for Infinia users. P.S - As much as I want to, I cannot share that hack. Its a ticking time-bomb with a potential to cause a massive devaluation of Infinia. Quote:

Quote:

These vouchers u can redeem at 1:1 ratio. Last edited by tejas08 : 7th June 2022 at 11:41. | |||||

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank tejas08 for this useful post: | aastiksaluja, Jedi.Knight, mav2000, whencut86 |

| | #5456 |

| BHPian Join Date: Apr 2012 Location: MAS,BLR,PUN

Posts: 238

Thanked: 1,017 Times

| Re: The Credit Card Thread |

| |  ()

Thanks ()

Thanks

|

| |

| | #5457 |

| BHPian Join Date: Apr 2006 Location: Kolkata

Posts: 383

Thanked: 620 Times

| Re: The Credit Card Thread I used to have two credit cards in the past, say about 4-5 years back. I was a co-applicant in a loan which my family business had and defaulted, ultimately settled in a court settlement. Although I was not involved in running-repaying or settlement of the loan, this dragged down my credit score terribly. But, it did not bother me much since I had stopped using a credit card at all about 5 year back and had given up both my HDFC & SCB cards. 3 years ago I had availed a Home Loan from SBI and it was approved in 2 hours flat (probably on basis of my salary) but credit score also should have played a role. I had been doing international travel pre-pandemic for work, and I used to get a prepaid forex card from my employer for most of my expenses. Now international travel has ceased for more than 2 years, and we are looking to resume travelling out of India starting this June. I have somewhat of a bad luck when it comes to transit airports and situations have made me wait long hours at these hubs in the past. I now started exploring credit cards which my colleagues often flash to enter into premium international lounges. I hold a coral debit card from ICICI which I use often in domestic airport lounges, but this wont work for access to International lounges. For this reason, I was exploring and even applied an HDFC Regalia card which was instantly declined citing CIBIL score issues  . After this, someone advised me to check out smaller newer banks, I tried IDFC for one of their premium cards which had international lounge access, but almost instantly got rejected from them too. I checked my CIBIL score which showed a score of 690 despite my disciplined pre-closure of my car loan about 9 months back and disciplined EMI payment towards my Home Loan. Dejected, I felt sad and stopped looking for a credit card. . After this, someone advised me to check out smaller newer banks, I tried IDFC for one of their premium cards which had international lounge access, but almost instantly got rejected from them too. I checked my CIBIL score which showed a score of 690 despite my disciplined pre-closure of my car loan about 9 months back and disciplined EMI payment towards my Home Loan. Dejected, I felt sad and stopped looking for a credit card. I got a call from my bank (where I save money) ICICI, and the agent told me I had been rejected a credit card from HDFC, do I want to apply with ICICI? I said I do not want, since I was more than sure of rejection. Now, this lady proposed me to get a card against an FD. She said you can make an FD of even 10k and you will get a card with limit of 100k. I did not believe in her, but at the same time, wanted to see. So I decided to make an FD right then for 30k and I got a credit card (ICICI Coral) immediately with a meagure limit of 27k. I called up the lady to complain about this limit where she had promised me a minimum limit of 100k. Anyways, I am using this card for as tiny bit possible since such a low limit is actually of no use to me. And it has been very long I have completely shifted away from credit cards. Now, is there any way other than the FD route to get a decent international lounge access credit card? I guess even if I use and repay this card bills in time, it wont get upgraded to a card which comes with international lounge access. Any idea from experienced CC users here, what can be done? Or is it advisable to buy a priority pass instead of the credit card business all together? |

| |  ()

Thanks ()

Thanks

|

| | #5458 | |

| BHPian | Re: The Credit Card Thread Quote:

Regarding International Lounge Coral Credit card has a direct upgrade to MMT Signature Card which has International Lounge access with Dreamfolks membership. You can try for that. You will get another card that shares limit with your coral credit card. Just call customer care and enquire if you can get an upgrade to it. Its a LTF card with joining fee. But you get vouchers and MMT cash worth your joining fee. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks blackbandit for this useful post: | arpanjha |

| | #5459 | |

| BHPian | Re: The Credit Card Thread Quote:

By the way, I dont see any Apple Vouchers as well. I see Apple products, but the Iphone 13 is more than double the number of points Vs. cash. Last edited by mav2000 : 7th June 2022 at 19:33. | |

| |  ()

Thanks ()

Thanks

|

| | #5460 | |

| BHPian Join Date: May 2022 Location: Washington, DC

Posts: 56

Thanked: 331 Times

| Re: The Credit Card Thread Quote:

I usually don't buy any apple products through the Smartbuy platform as the rates are high. If you wait around for sales like the Big billion or Amazon's Great Indian Sales, They run a 10x reward point promo on the HDFC infinia at least twice in a year. The max limit being 33,000 last time I checked and the transaction has to be above 50k INR. You'll be able to buy products at a very good rate if you factor in the points you'd get. I've never bought Vouchers using the Infinia so I can't comment on the Apple Vouchers. Go to Infinia site, and select the destination. Whenever you're in the checkout page, you have a slider which would allow you to select how many points you'd like to redeem for that transaction. | |

| |  ()

Thanks ()

Thanks

|

|