Quote:

Originally Posted by Shreyas_H  Looking for some expert advise on replacing my HDFC Diner's Club Black card.

Diner's club black while being a good card has acceptance issues in a lot of places. I am looking to replace it with a better card that will be fuss free.

Main requirements are good deals on travel, airfare, hotels and of course the usual lounge access, concierge etc.

Options considered so far - - HDFC Infinia

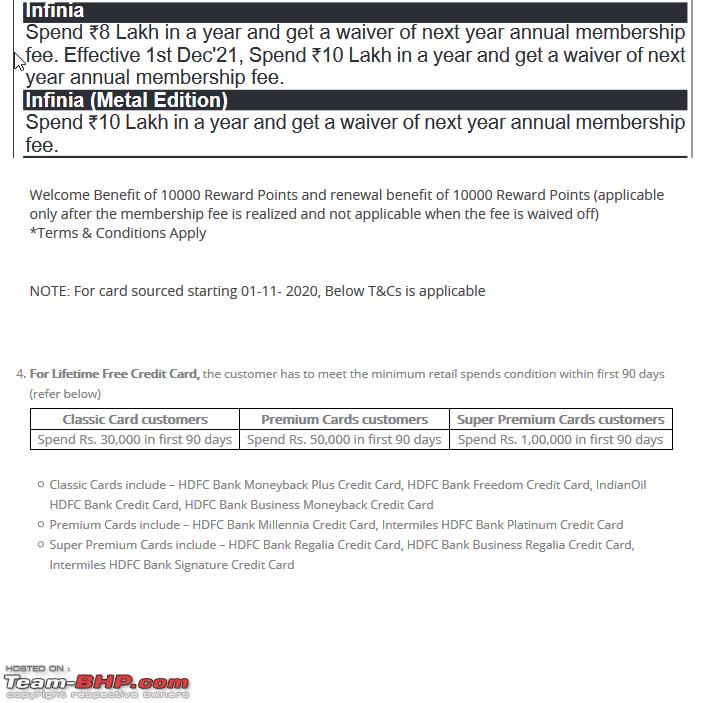

Seems like a logical upgrade, seems to have most things I need and I have a good relation with HDFC. Only thing is how flexible are they to waive off the annual charges. What spend would they realistically expect? I spent around 5 lacs on the Diner's club last year and they were happy to waive off the annual charges. - American Express Platinum

Getting a few mixed views on this. The site says the annual charges are 60,000 Rs! Am I reading this correctly? The offerings on this card seem good but might be a bit excessive for my needs.

|

Have both cards, can definitely provide some insights on those.

Wake me up in deep sleep a 100 times and ask me if I should take the Infinia for Rs. 10,000 Annual fee and I will Yes every time.

Couple of things though, the annual fee increases to 12,500 when the Metal Infinia gets launched. So get the Infinia before that and you will have the fee of Rs. 10,000 for the next three years. The criteria for upgrade is 8 Lacs Credit Limit on Existing HDFC Credit Card. If you have that, send an email to Grievance Redressal Team asking for upgrade.

HDFC will not waive of annual charges. They give 10,000 Reward Points instead. If you know how to use DCB well, you already know that Infinia is worth a lot more than Rs. 10,000. Have earned 3.6 Lacs Reward Points in less than 30 Months between DCB & Infinia (DCB upgrade to Infinia)

As for the Amex Platinum Charge Card, Amex is currently under RBI Ban. So you cant get one anyhow till the ban is lifted.

How good is the Amex Platinum Charge Card:

Its a Lifestyle Card. It is not in everybody's capacity to reap good rewards out of that card. But if u think you can do it, its a crazy card. Paid 60,000 + Taxes for the 1st year of its ownership (which ends on 27th October) and have earned tangible benefits of 2.4 Lacs. You can check the below tweet for the details:

https://twitter.com/tejasghongadi/st...62086274449408

You can good value out of this card, if you travel decently or can play with Airmiles & Hotel Loyalty Points using Amex MR points. If you are looking for cashbacks and discounts, this wont be the card for you.

Quote:

Originally Posted by AZT  Any Visa Infinite card will have you covered when it comes to foreign lounge access. Axis Vistara Infinite is good for travel and currently they have an offer where you can get first year free if you spend 1.2 lakh in 3 months. This offer is till October end. You can see the below link - https://www.cardexpert.in/axis-premi...signup-offers/

If you are not keen on paying, you can try for the IDFC Wealth card which is again Visa Infinite. Above 20,000 spend there is a 2.5% statement cashback and below 20,000 it is 1% so this is also a good card.

HDFC Infinia has a higher version coming called Galaxia which probably will have better benefits than existing Infinia so if you're fine paying the fee you can wait for that. |

Axis Vistara Infinite is overrated frankly. Axis Vistara Signature is better unless somebody wants to travel Business Class even in Domestic Flights. At Rs. 3000 Annual Fee, you get 4 Premium Economy Tickets + 12,000 CV (Two Economy Tickets equivalent) Points at 4.5 Lacs Spends.

2.5% is reward rate is actually very low for high spenders on credit cards. There are cards which easily give 7-8% after offsetting the annual fee. This is on travel redemption of course. If somebody wants to focus only on cashbacks / Statement credit, then the best combination to use is ICICI Amazon Pay + Axis Ace

HDFC Galaxia is still a while away. The Annual fee is expected to be 20K+ & the fee waiver also around 20+ Lacs. The Launch date isnt clear and the criteria for card upgrade too isnt clear. Same as Infinia, this too will be Invite only for the first couple of years.

Quote:

Originally Posted by Guite  On 7th October I booked a hotel through Agoda.com, for stay on 15th and 16th Oct. I choose a slightly higher tariff to avail free cancellation, in case there is change in plan.

Please note that credit card details were provided during booking but no payment made.

Yesterday, 13th October the hotel attempted to debit an amount slightly more than half of the roof tarrif as shown in booking confirmation. I am not supposed to pay until I reach the hotel. In case of no show, they were to debit entire booking amount from my card.

Luckily for me I had misplaced the card and blocked it. This special previledge that hotels enjoy (PIN or OTP not required, they can just charge your card based on the detail you have already provided) is a bit dangerous. If they were successful in charging my card, and I cancel my booking (which I intend to, based on this experience), getting refund could possibly be a big hassle. |

Amex helps a lot in these situations. I always use my Amex to make such transactions. In case of any dispute, Amex works on the Cardholders side. The amount will be refunded to you and they will take up with the merchant for necessary clarifications.

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(8)

Thanks

(8)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks