| | #106 |

| BANNED Join Date: Jan 2006 Location: Cochin

Posts: 2,195

Thanked: 268 Times

| |

| |

| |

| | #107 |

| BHPian Join Date: Nov 2009 Location: Drivers seat

Posts: 844

Thanked: 369 Times

| |

| |

| | #108 |

|

Posts: n/a

| |

| | #109 |

| Senior - BHPian | |

| |

| | #110 |

| Senior - BHPian Join Date: Oct 2009 Location: Bangalore

Posts: 1,097

Thanked: 375 Times

| |

| |

| | #111 |

|

Posts: n/a

| |

| | #112 |

| BHPian Join Date: Apr 2009 Location: Seattle

Posts: 585

Thanked: 81 Times

| |

| |

| | #113 |

| Senior - BHPian | |

| |

| | #114 |

| Senior - BHPian | |

| |

| | #115 |

| Senior - BHPian | |

| |

| | #116 |

| BHPian Join Date: Nov 2009 Location: Drivers seat

Posts: 844

Thanked: 369 Times

| |

| |

| |

| | #117 |

| Senior - BHPian | |

| |

| | #118 |

| BHPian Join Date: May 2008 Location: Bengaluru

Posts: 422

Thanked: 1,906 Times

| |

| |

| | #119 |

| Team-BHP Support  | |

| |

| | #120 |

| Senior - BHPian Join Date: Jun 2006 Location: Bangalore

Posts: 1,155

Thanked: 1,113 Times

| |

| |

|

Most Viewed

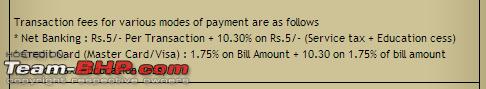

Everywhere, I get discount for online payments, but in Chennai, one has to pay more for online payments.

Everywhere, I get discount for online payments, but in Chennai, one has to pay more for online payments.